Bitcoin continues to fall, virtual currency transaction fee problem emerges

Macroeconomics and monetary markets

Within the US NY inventory market on the eighth, the Dow Jones Industrial Common fell 55 {dollars} (0.2%) from the day prior to this, and the Nasdaq Index closed at 21.5 factors (0.2%) larger than the earlier weekend.

connection:Nasdaq rises barely forward of CPI, Buffett is bullish on Japanese shares | ninth Monetary Tankan

connection:Inventory funding really helpful for cryptocurrency buyers, consultant cryptocurrency shares of Japan and america “10 alternatives”

Digital forex market

Within the crypto asset (digital forex) market, Bitcoin fell 2.3% from the day prior to this to $ 27,616.

BTC/USD every day

With the discharge of indicators such because the CPI (US Client Value Index) on the tenth and the US Producer Value Index (PPI) on the eleventh, market adjustment promoting took priority.

Among the many main alts with the very best market capitalization, XRP, Dogecoin (DOGE), Polygon (MATIC), and Solana (SOL) are all 5-10% weaker than the earlier week.

Most lately, funds have been flowing into memecoins led by Pepe Token (PEPE), and as of the seventh, PEPE’s every day buying and selling quantity was $2.37 billion, greater than thrice that of XRP, the fourth place.

In the event you take away the stables $PEPE continues to be #3 in every day quantity at 2.37 billion behind #Bitcoin and #Ethereum $XRP is #4 with .71 billion pic.twitter.com/DSLqwbhFtG

—Massive Dawg (@thecryptodawg) May 7, 2023

The chapter submitting of Bittrex, a long-established crypto asset (digital forex) alternate in america, additionally contributed to the deterioration of market sentiment. Filed for Chapter 11 chapter in federal courtroom in Delaware. Whole debt is between $500 million and $1 billion.

Bittrex was sued by the U.S. SEC (Securities and Trade Fee) for violating securities legal guidelines in April this yr, and the worldwide model of Bittrex International will proceed to supply companies to clients outdoors the U.S.

connection:Cryptocurrency alternate Bittrex recordsdata for chapter within the US

Concerning the drop within the Bitcoin and altcoin markets, there may be additionally the view that rising Bitcoin transaction charges and transaction congestion led main cryptocurrency (digital forex) exchanges reminiscent of Binance to droop remittances, triggering risk-averse promoting. be.

BREAKING: #Binance outflow information confirms largest withdrawal in it’s historical past, over 162,000 $BTC has left the alternate, valued at over $4.6 Billion.

Are Whales/Insiders leaping ships? pic.twitter.com/QSXYAEvHkt

— WhaleWire (@WhaleWire) May 7, 2023

The variety of pending excellent transactions in mempool reached the equal of half one million as of yesterday.

Then again, with the speedy unfold of Bitcoin NFT (non-fungible token) known as Ordinals Protocol (Inscriptions) and “BRC-20 (Bitcoin Request for Remark)” token, miner earnings have elevated considerably. there may be

The market capitalization of the BRC-20 token has reached an estimated $1.6 billion, however many consultants are sounding the alarm as a result of it’s an experimental system.

On the seventh, the transaction price of some miners briefly reached 6.7 BTC, exceeding the block reward quantity.

BITCOIN TX FEES > BLOCK SUBSIDY pic.twitter.com/BQ64pHtAsg

— pourteaux (不说中文 arc) (@pourteaux) May 7, 2023

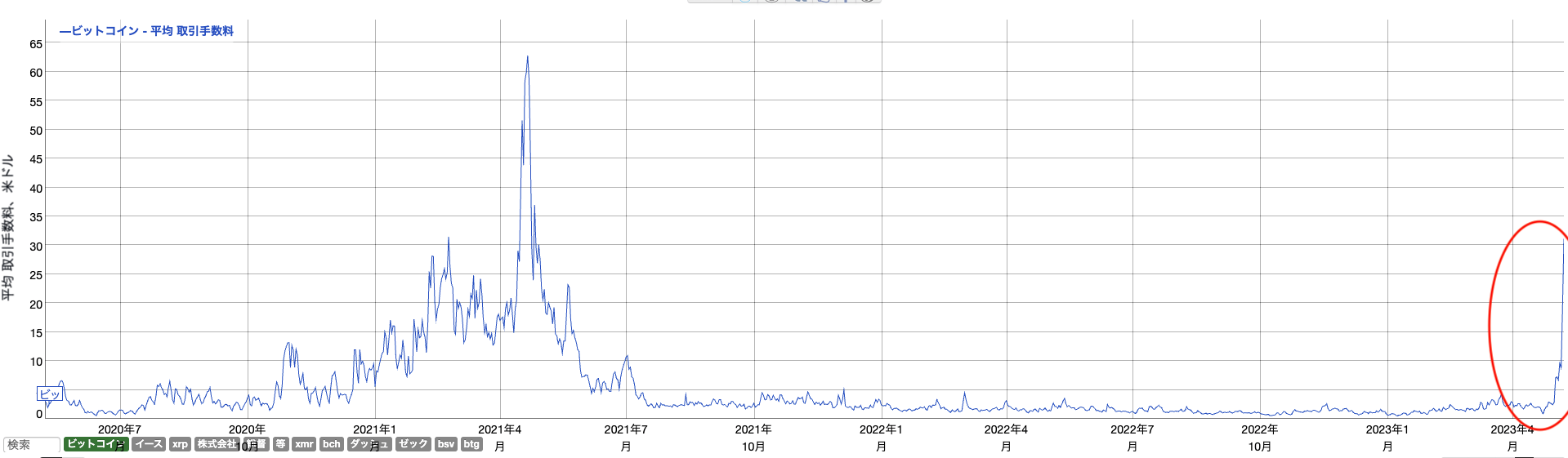

In line with information from BitInfoCharts, the typical transaction price on the Bitcoin community has soared to the $20-30 vary (3,000-4,000 yen), the very best degree since Could 2021. Till final week, the typical Bitcoin transaction price was round 1/10.

bitinfo charts

connection:Countdown to the subsequent Bitcoin half-life lower than a yr away, market traits and professional predictions?

Concerning the current surge in Ethereum transaction charges (Fuel), some level out that the Meme Coin increase is profiting from the revitalization of “MEV (Miner Extractable Worth)”.

With a purpose to maximize the revenue of arbitrage (arbitrage buying and selling), it makes use of front-running and sandwich assaults that interrupt the execution order of different merchants’ shopping for and promoting orders on the decentralized alternate.

Issues have resurfaced, with the contract value being at an obstacle and rising the slippage and rising fuel prices.

A MEV bot is consuming your lunch.

jaredfromsubway.eth MEV bot is the highest fuel ETH spender within the final 24H, spending 455ETH ($950k) and utilizing 7% of complete fuel of the community

Within the final 2 months it spent greater than 3.720ETH ($7M) in fuel charges and carried out greater than 180k transactions pic.twitter.com/IGMJY7skkq

— sealaunch.xyz (@SeaLaunch_) April 18, 2023

connection:Contributing to the development of Ethereum’s fuel value rise, the precise state of affairs of the analysis and growth group Flashbots

connection:Bitcoin remittance clogging turns into severe, Ethereum basis sells ETH

Click on right here for an inventory of market experiences revealed prior to now

[Recruitment]Recruitment of latest personnel as a consequence of Web3 enterprise growth

Japan’s largest cryptocurrency media CoinPost is on the lookout for full-time staff and interns because it expands its Web3 enterprise.

1. Media Enterprise (Editorial Division)

2. Advertising operations

3. Convention administration and launch work

4. Open Place (college students welcome)Particulars https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual forex info site-[app delivery](@coin_post) February 14, 2023