Bitcoin correlation with stocks and bonds rises in August – why?

- Bitcoin’s correlation with U.S. shares and bonds has elevated this month.

- This has been resulting from a rise in institutional traders’ publicity to the crypto asset.

Within the final two weeks, the correlation between Bitcoin [BTC] and U.S. equities and investment-grade bond costs has elevated to 40% and 33%, respectively, analysis agency Kaiko discovered.

📈BTC correlation with U.S. equities and funding grade bonds costs has risen to 40% and 33% respectively in August. 👀🤔 pic.twitter.com/MK2tKI08uI

— Kaiko (@KaikoData) August 15, 2023

This means that, on common, when the costs of U.S. shares transfer, there’s an inclination for BTC’s value to maneuver in an identical route about 40% of the time.

Equally, a 30% correlation between the king coin and investment-grade bond suggests a average statistical connection. It means modifications in bond costs may coincide with modifications in BTC’s costs round 33% of the time.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Avengers, assemble!

Usually, the correlation between BTC and these conventional monetary belongings improve as institutional traders intensify their accumulation of or publicity to the main crypto asset. An evaluation of their conduct within the final month confirmed an increase in curiosity amongst this cohort of traders.

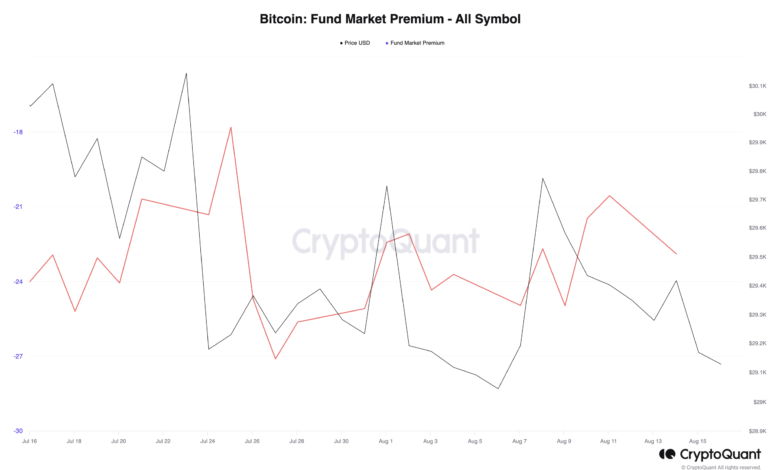

A consideration of BTC’s Fund market premium metric revealed an uptick in investor eagerness over the previous 30 days to place their cash in funding belongings (BTC belief) that derive their value from the coin’s value actions.

Fund Market Premium refers back to the distinction between the market value of a fund and its Internet Asset Worth (NAV). A Fund Market Premium can happen when traders are keen to pay extra for a fund than its NAV.

This might be resulting from a number of elements, such because the fund’s efficiency, funding technique, or total market sentiment.

BTC’s Fund Market Premium tracks institutional traders’ curiosity in BTC belief. Knowledge from CryptoQuant confirmed a development on this metric, suggesting that regardless of the slender value actions of BTC, traders have remained steadfast of their convictions.

Supply: CryptoQuant

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

Coinbase is lacking in motion

Though Coinbase is the most important U.S.-based cryptocurrency change, most institutional traders’ exercise within the area previously month didn’t happen on the platform.

A take a look at Bitcoin’s Coinbase Premium Index (CPI) revealed a gentle decline into the damaging territory in the course of the interval below assessment, knowledge from CryptoQuant confirmed.

The CPI is a metric that measures the distinction between the worth of an asset on Coinbase and its value on Binance. When an asset’s CPI worth is constructive, it signifies robust shopping for stress amongst institutional traders on Coinbase.

Conversely, when the CPI metric returns a damaging worth, much less accumulation exercise takes place on Coinbase.

A month in the past, BTC’s CPI was 0.05. At press time, it was noticed at -0.10.

Supply: CryptoQuant