Bitcoin crosses $63K, but BTC’s next move remains uncertain

- Whales began to hedge their bets as BTC’s costs surged.

- Bitcoin’s retail hype gave the impression to be in a lull.

Bitcoin’s [BTC] meteoric rise catapulted it past the $60,000 threshold, triggering waves of pleasure and hypothesis.

Nevertheless, beneath the floor of this surge lay a nuanced narrative dominated by institutional maneuvers and a notable absence of retail participation.

AMBCrypto’s examination of BTC confirmed a swift surge as costs touched $63,000, solely to retrace barely to $62,725.01 throughout the final 24 hours.

Whales go risk-free

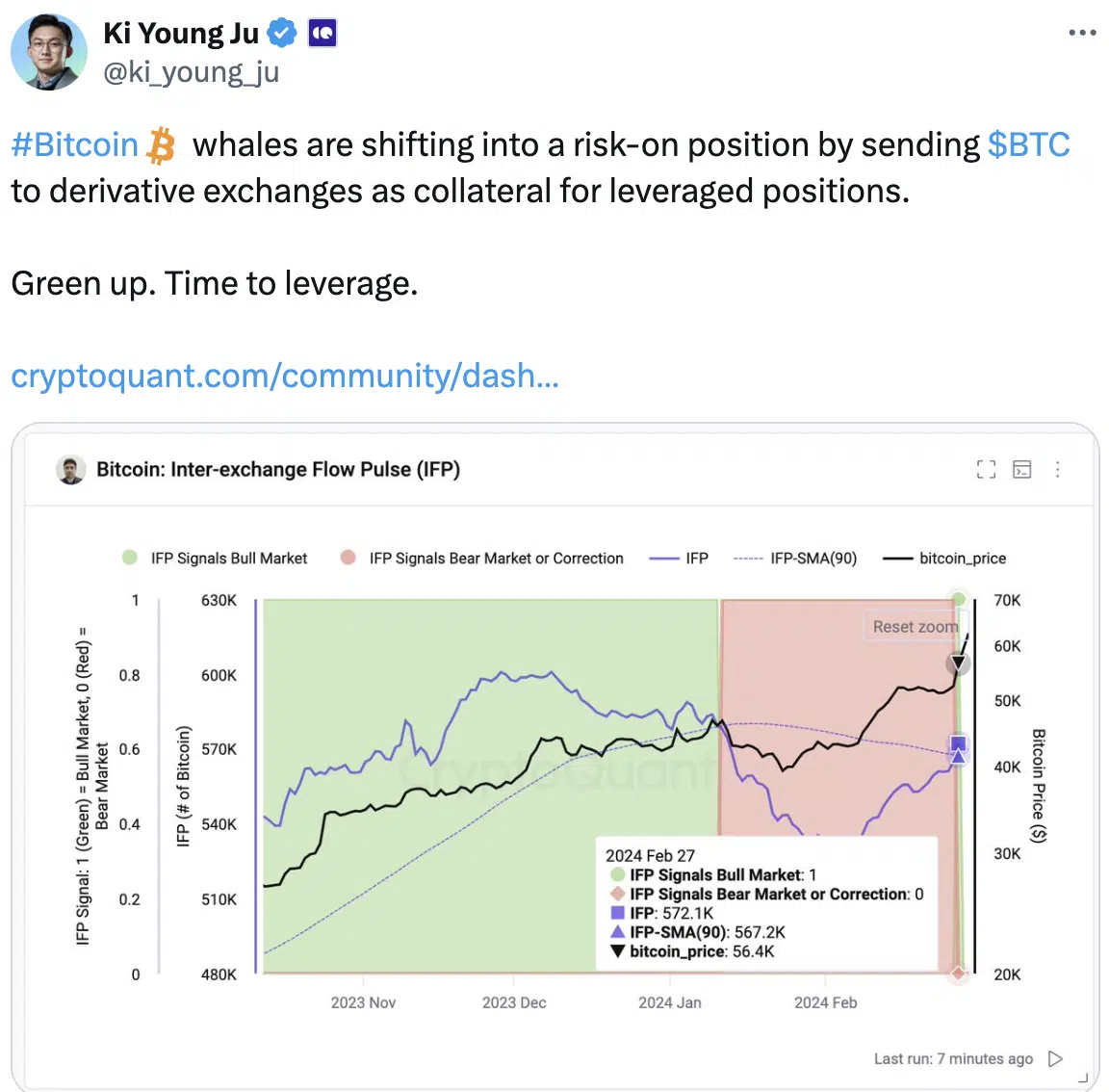

As BTC eclipsed $60,000, the driving power behind this surge wasn’t solely natural market dynamics. Latest knowledge pointed to a strategic transfer by massive Bitcoin holders, generally referred to as “whales.”

These entities have been exhibiting a heightened danger tolerance, pivoting towards spinoff exchanges.

By transferring Bitcoin to those platforms as collateral for leveraged trades, whales sign a shift towards riskier market methods.

Surprisingly, the keenness from retail buyers, usually a potent power in driving cryptocurrency rallies, gave the impression to be waning.

The present surge in BTC’s value was predominantly propelled by institutional curiosity and strategic strikes by whales.

If whales begin to decelerate their accumulation and if their bullish stance takes a again seat, the worth of BTC might stagnate at present ranges.

Retail buyers may have to take a position extra in BTC for its value to go additional up north.

Trying on the state of the holders

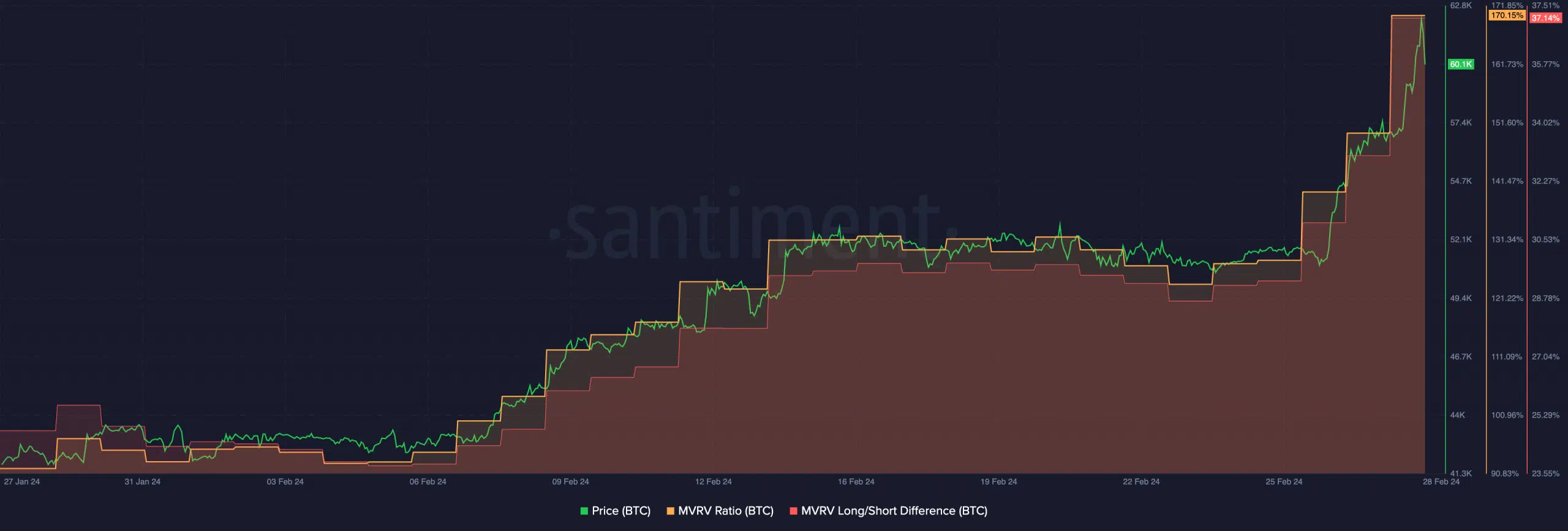

An element which will cease retail buyers from accumulating BTC can be their profitability.

The MVRV (Market-Worth-to-Realized-Worth) ratio for BTC surged considerably over the previous couple of days.

The rising MVRV ratio signifies {that a} important proportion of Bitcoin addresses have been holding worthwhile positions. A few of these holders had not seen profitability since 2021.

On account of this, many retail buyers might need to promote their holdings and e-book their income.

Including one other layer to the evaluation is the Lengthy/Quick distinction surrounding BTC. The increasing distinction suggests the next prevalence of long-term addresses in comparison with short-term addresses.

How a lot are 1,10,100 BTCs price in the present day?

Lengthy-term holders usually exhibit a extra resilient stance, being much less more likely to promote in response to short-term market fluctuations.

Solely time will inform whether or not buyers can proceed and maintain on to their BTC as its value displays risky actions.