Bitcoin crosses $71K, but now there’s a massive cause of worry

- BTC was up by greater than 1.8% within the final 24 hours.

- A metric identified that BTC may be overvalued.

After days of volatility and uncertainty, Bitcoin [BTC] recovered and went past the $70k. A serious motive behind its value decline for the reason that 2nd of April was enormous revenue realizations, amounting to over $2.7 billion.

Nonetheless, BTC confirmed why it was King for a motive, recovering quickly and buying and selling at $71,178.80 at press time, having risen 2.39% within the final 24 hours, per CoinMarketCap.

Bitcoin is recovering

IT Tech, an creator and analyst at CryptoQuant, lately posted an analysis highlighting the components that helped BTC get better swiftly.

As per the evaluation, an element behind the value enchancment was a drop in promoting strain as short-term holders have stopped realizing losses on the value correction.

Bitcoin has at all times had a powerful correlation with Tether [USDT]. Within the current previous, new USDTs have been minted, which might have additionally contributed to BTC’s restoration above $70k.

Furthermore, there was an enormous BTC influx to the buildup addresses, and their reserves hit an all-time excessive. All of those incidents mixed lend BTC a serving to hand, permitting it to push its value up.

Will the development final?

Since BTC managed to push its value above $71k, AMBCrypto checked CryptoQuant’s data to see whether or not it could witness a value correction anytime quickly.

We discovered that purchasing strain on BTC was excessive, as its web deposit on exchanges was low in comparison with the final seven-day common.

Its Coinbase Premium was additionally inexperienced, which means that purchasing sentiment was dominant amongst US buyers.

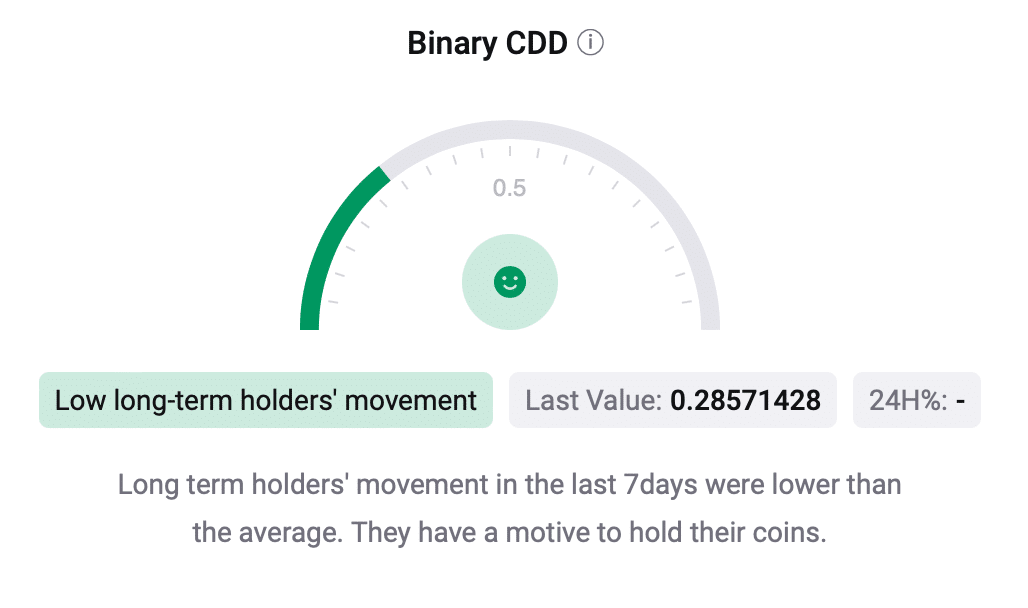

Lengthy-term holders’ actions within the final seven days have been decrease than common, signaling that they have been keen to carry their property.

Supply: CryptoQuant

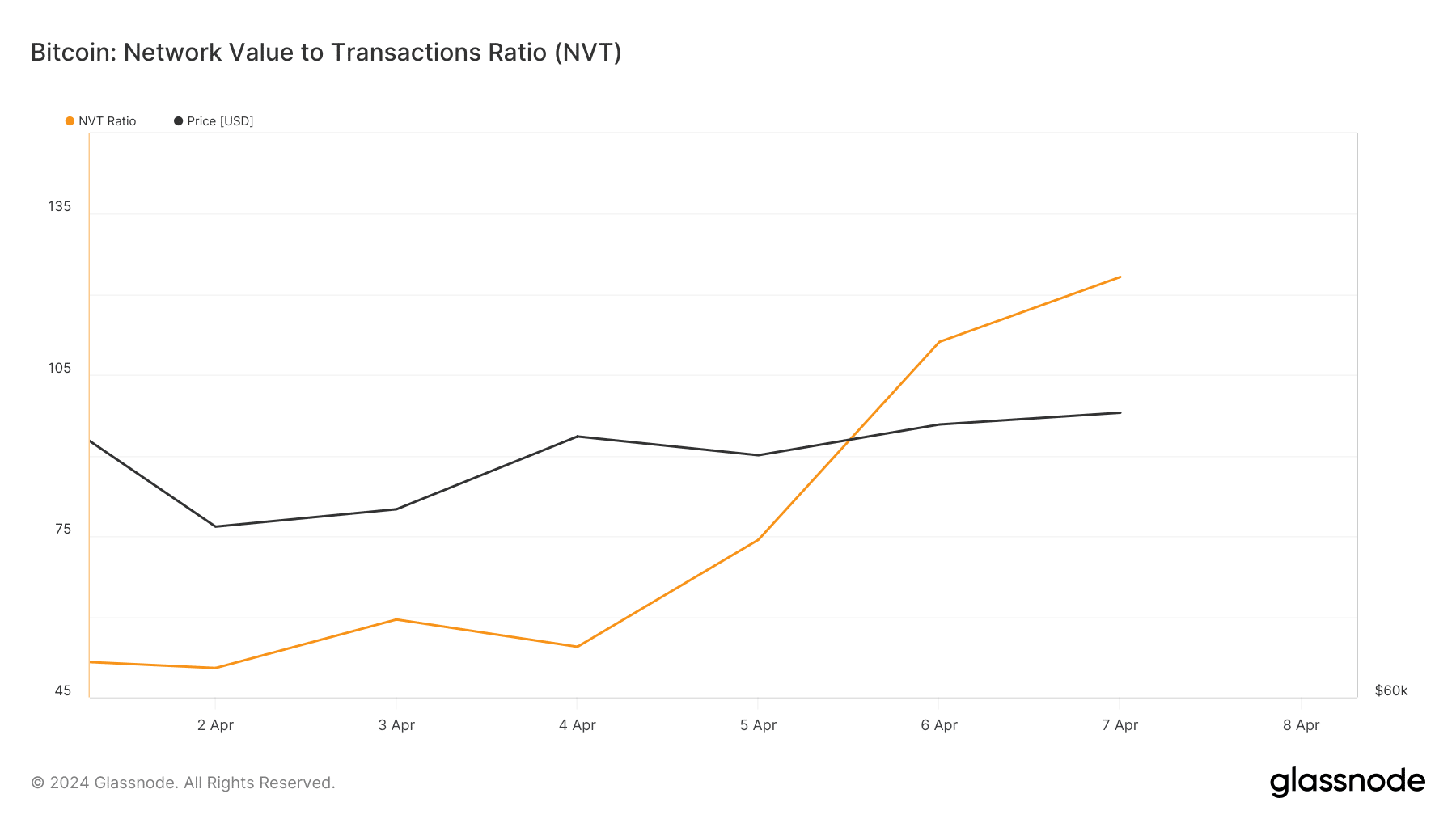

Although the aforementioned metrics appeared optimistic, AMBCrypto’s have a look at Glassnode’s knowledge revealed a bearish sign. Bitcoin’s Community Worth to Transactions Ratio registered a pointy uptick.

An increase within the metric implies that an asset is overvalued, hinting at a value drop.

Supply: Glassnode

Learn Bitcoin’s [BTC] Value Prediction 2024-25

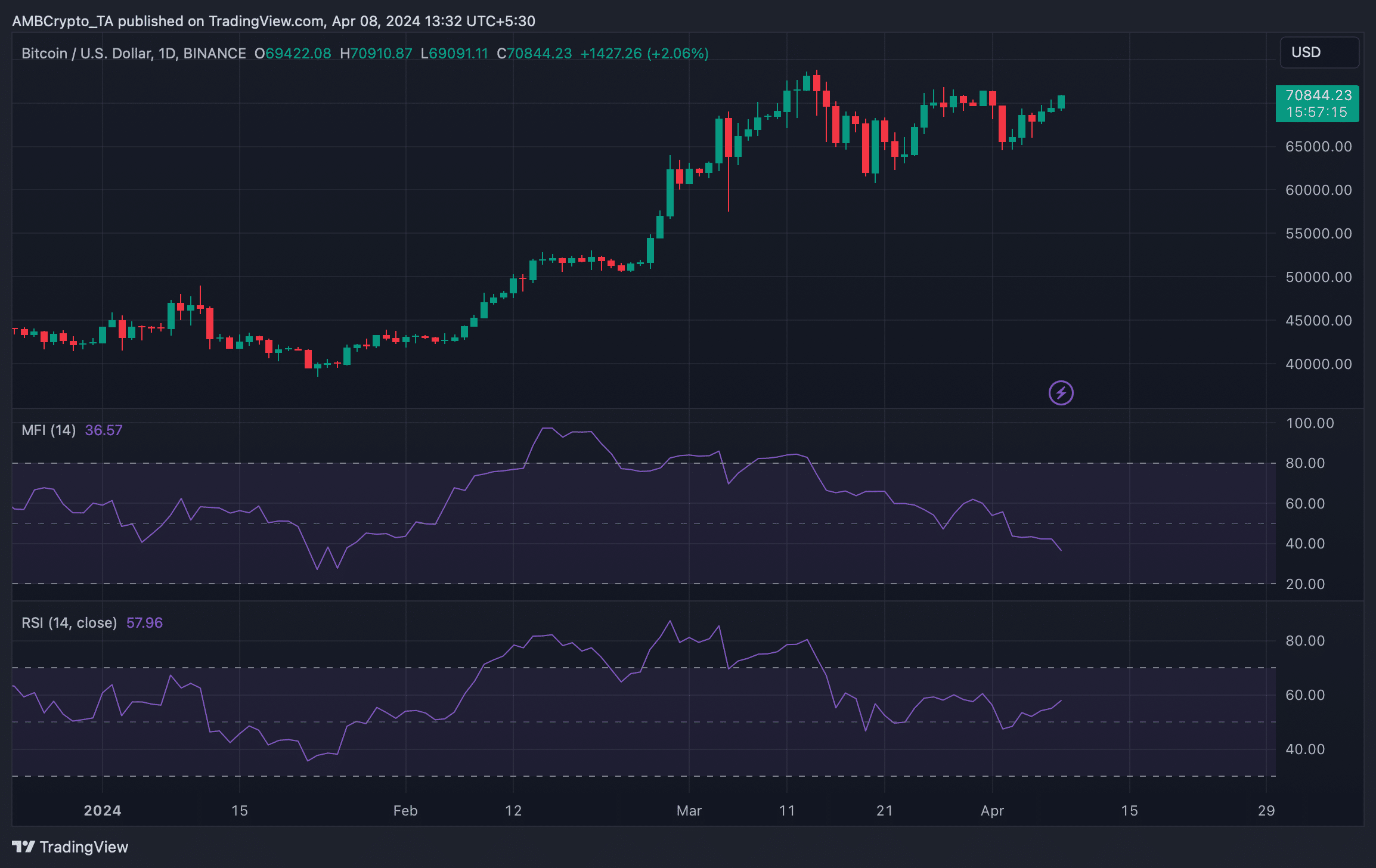

The king coin’s Cash Move Index (MFI) additionally supported the bears because it registered a pointy downtick.

Nonetheless, the Relative Energy Index (RSI) appeared bullish and indicated that BTC’s value would possibly proceed to rise within the coming days.

Supply: TradingView