Is Nvidia the next MicroStrategy? Why Bitcoin could be its next big bet!

- Bitcoin as an institutional asset for Nvidia makes full sense for 2 key causes

- Its model positioning as a forward-thinking asset is about to boost if this occurs

Crypto Twitter is abuzz with speculation that Nvidia could also be contemplating a strategic allocation of Bitcoin [BTC] to its company treasury.

In keeping with AMBCrypto, this thesis isn’t far-fetched although. In actual fact, key macro and market dynamics prompt this could possibly be a calculated transfer to diversify steadiness sheet publicity and hedge towards fiat depreciation.

If confirmed, such an allocation may act as a major bullish catalyst for Bitcoin. In actual fact, it has the potential to draw extra institutional traders into the market.

Strategic sense behind Bitcoin’s position in Nvidia’s treasury

The U.S. economic system is just midway by means of Trump’s re-election cycle and but, prime public firm shares have fallen by over 20% in Q1. Nvidia, ranked among the many prime three public corporations with a market cap of $2.72 trillion, isn’t any exception.

At press time, its inventory valuations had been down 24.44% from its Q1 opening of $138. Nonetheless, this might simply be the start of a bigger decline.

Supply: TradingView (NVDA)

As a tech large deeply invested in Synthetic Intelligence (AI), Nvidia is squarely positioned on the intersection of the U.S.-China commerce battle. This exposes the corporate to potential geopolitical dangers that would additional stress its inventory value.

Furthermore, with rising inflation eroding the buying energy of the united statesDollar, Nvidia may face increased operational prices, notably for elements and provide chain logistics.

Given these macroeconomic pressures, it’s no shock that extra publicly traded corporations are turning to Bitcoin to hedge towards these dangers.

In actual fact, Metaplanet recently issued 3.6 billion JPY in 0% strange bonds to accumulate further Bitcoin. It’s positioning itself as a part of the rising pattern of corporations including crypto belongings to their company reserves.

Proof is within the numbers

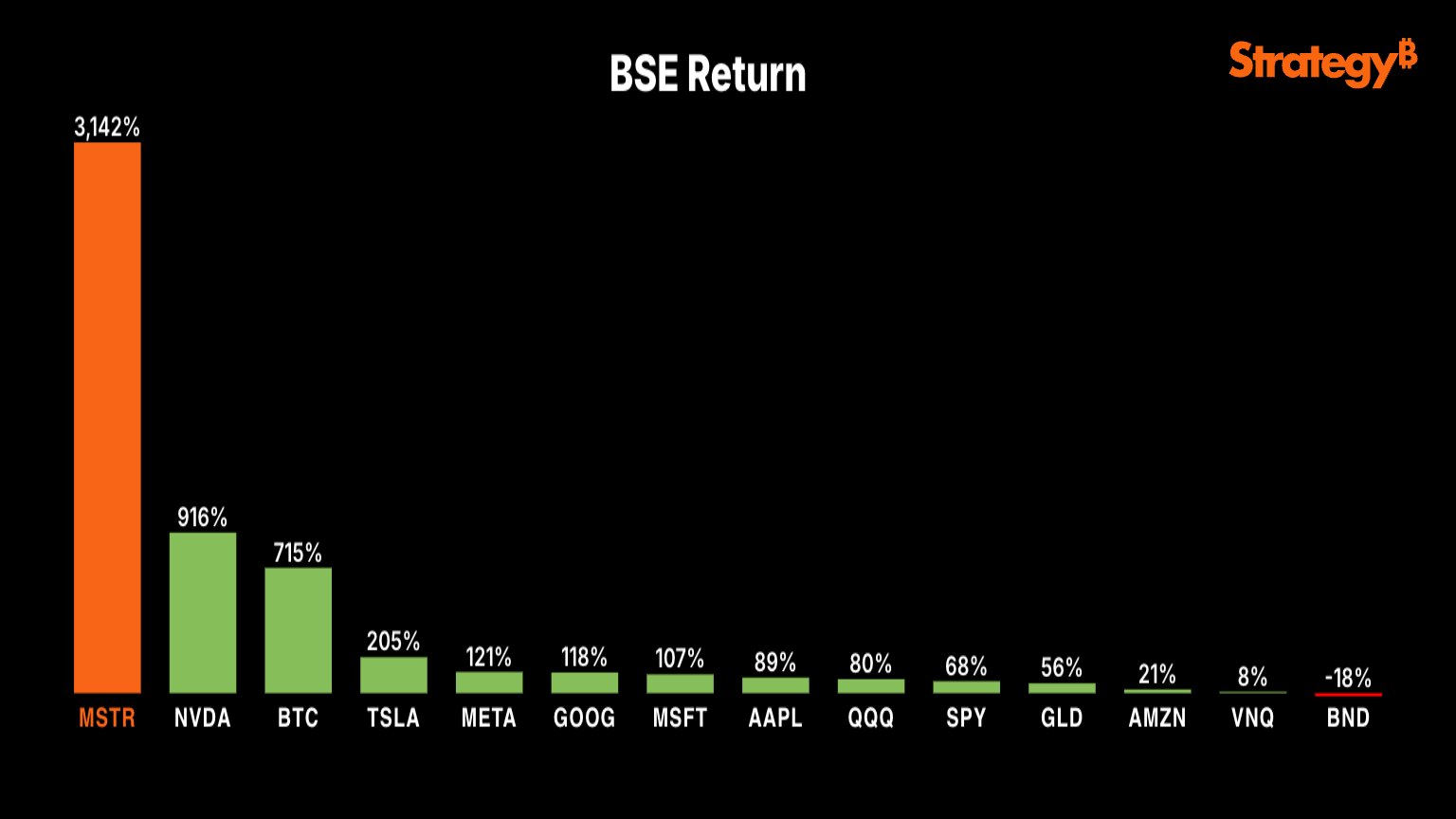

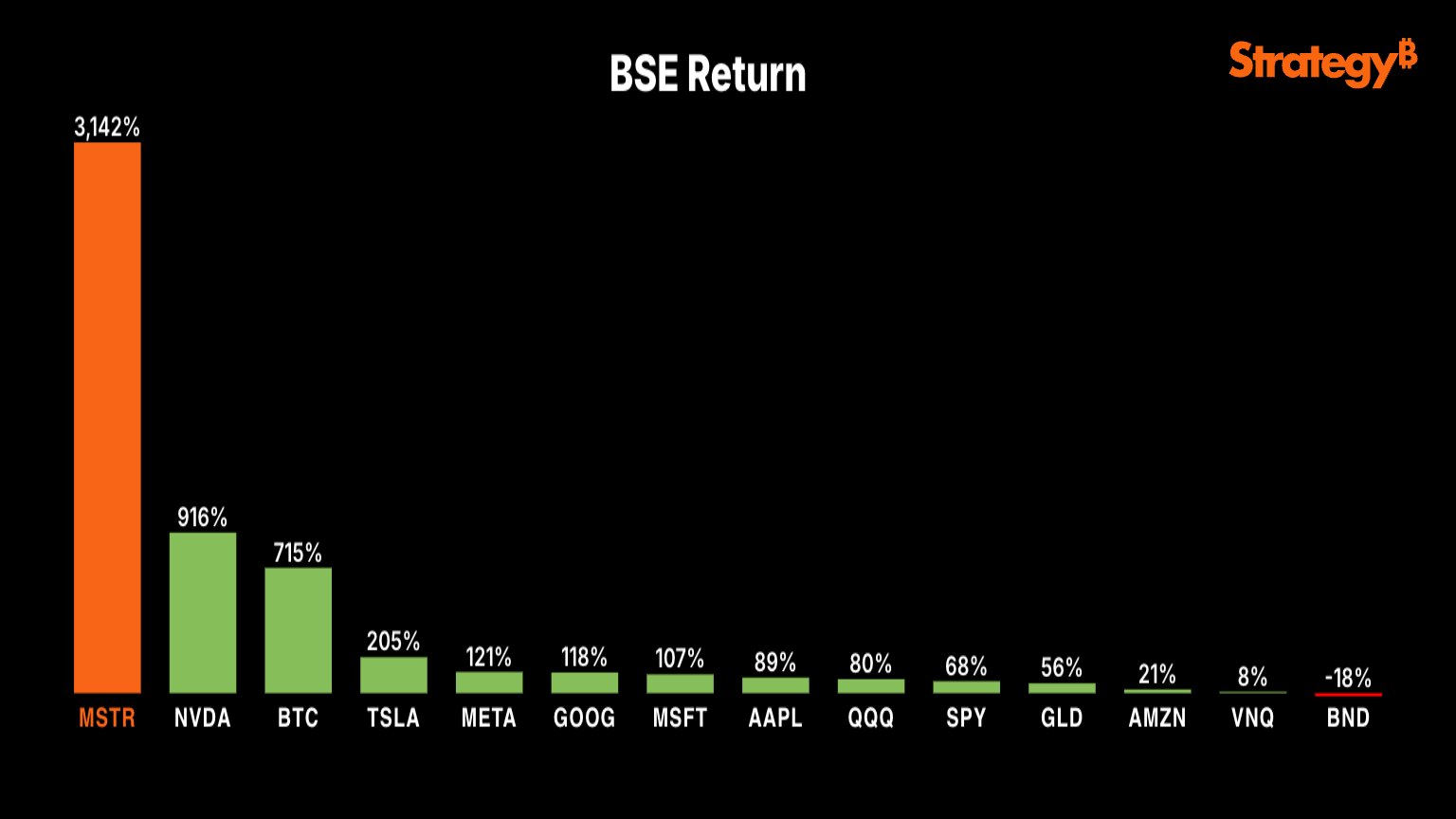

MicroStrategy’s [MSTR] inventory has seen a staggering 3,000% return over the previous 5 years, largely pushed by its Bitcoin publicity. It has considerably outperformed most tech equities. This has translated to an annualized development price of 600%.

As compared, Nvidia’s inventory posted returns of “simply” 916%. Despite the fact that it trails MicroStrategy by a major margin.

Supply: X

This stark divergence highlights the outsized affect of Bitcoin on MicroStrategy’s efficiency.

Bitcoin’s surge from $10,000 in 2020 to $96,172 at press time, reflecting a year-to-date value acquire of 715%, additional substantiates its position as a essential driver of portfolio returns for companies like MicroStrategy.

With outcomes like these, it’s no marvel that different huge gamers may quickly leap on the bandwagon. And guess what? Nvidia seems prefer it’s subsequent in line to make that daring transfer!