Bitcoin decouples from stocks—Is BTC poised for new ATH?

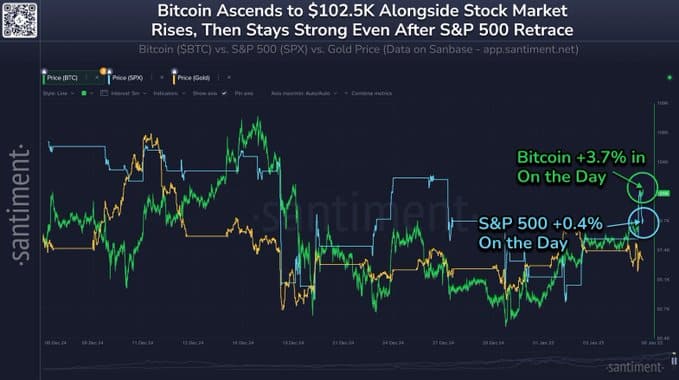

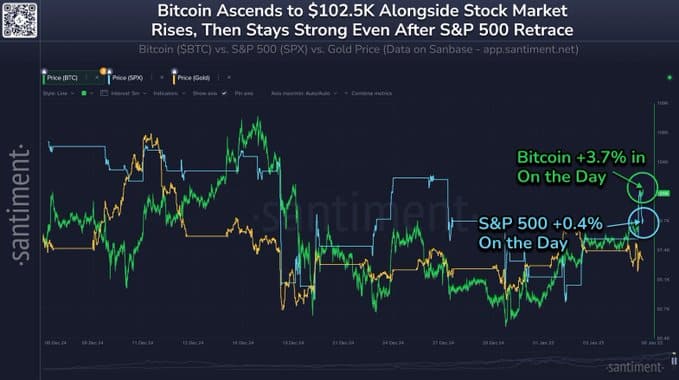

- Bitcoin outpaced the S&P 500 with a 3.7% acquire, exhibiting indicators of diminished inventory market correlation.

- Robust help at $95K-$98K and minimal resistance above $ 104K positioned BTC for potential new highs.

Bitcoin [BTC] confirmed early indicators of decoupling from equities, surging forward of the S&P 500. As of press time, Bitcoin was priced at $100,839, with a 1.39% enhance over the previous 24 hours and a 7.16% rise within the final seven days.

This marks an essential shift, as analysts recommend that diminished correlation to conventional markets may sign the beginning of a brand new bull market.

Bitcoin decouples from S&P 500

In accordance with Santiment, Bitcoin has begun to outperform the S&P 500 in January 2025. Whereas Bitcoin posted a 3.7% acquire in a single day, the S&P 500 recorded a modest 0.4% enhance, signaling divergence. Santiment on X (previously Twitter) acknowledged,

“For many of the previous three years, cryptocurrency has been perceived as a ‘high-leveraged tech inventory,’ however present information means that BTC might break free from inventory market fluctuations.”

Supply: Santiment

Traditionally, crypto markets have skilled their strongest bull runs after they have a low correlation with equities. Analysts consider that if Bitcoin can maintain its momentum and function independently of macroeconomic elements, it may pave the best way for brand new all-time highs in 2025.

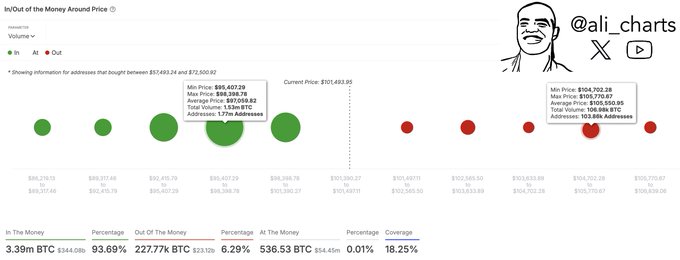

Robust help and minimal resistance ranges

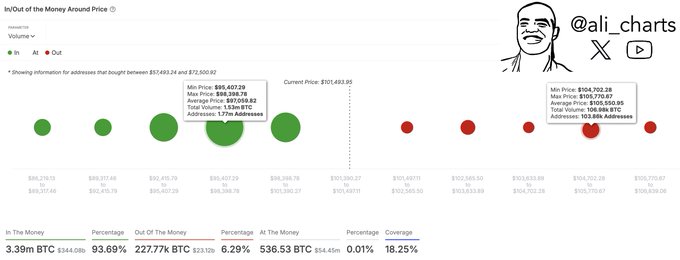

Crypto analyst Ali noted that Bitcoin is properly above a essential help zone between $95,400 and $98,400, the place 1.77 million addresses bought 1.53 million BTC. This cluster of consumers represents a powerful demand zone that would stop important value declines.

On the upside, Bitcoin faces minimal resistance, with solely 107,000 BTC held by 102,168 addresses between $104,700 and $105,770. Analysts anticipate additional upward motion if BTC breaks by way of this gentle resistance zone, as promoting stress stays restricted at greater ranges.

Supply: X

This constructive ratio displays sturdy market sentiment, as most holders are assured in Bitcoin’s trajectory.

Rising Open Curiosity and market exercise

Knowledge from Coinglass shows a rise in Bitcoin Futures Open Curiosity, now at $64.96 billion, up 2.20% each day. Open Curiosity(OI) has been steadily climbing since mid-2024, aligning with Bitcoin’s value rally and reflecting heightened speculative exercise.

Moreover, buying and selling quantity surged by 49.82% to $86.96 billion, and choices quantity jumped 76.78% to $3.54 billion, indicating rising dealer engagement.

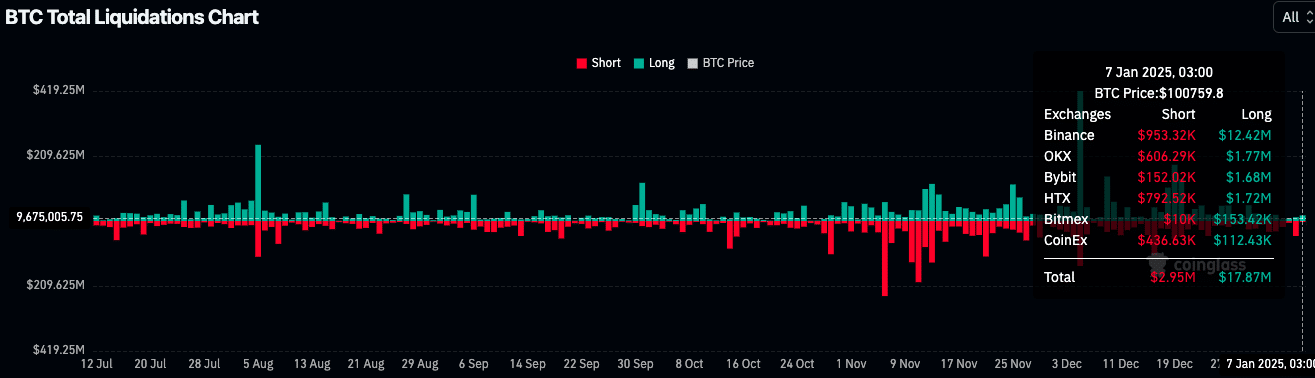

Nonetheless, rising OI and leveraged positions can enhance the chance of volatility. The BTC Whole Liquidations Chart recorded $17.87 million in lengthy liquidations and $2.95 million in brief liquidations previously session.

Supply: Coinglass

Learn Bitcoin’s [BTC] Value Prediction 2025–2026

This imbalance means that overleveraged longs have been worn out throughout minor value corrections.

With a powerful help base and minimal resistance forward, analysts consider Bitcoin is well-positioned to check new all-time highs if it continues to decouple from conventional markets.