Bitcoin: Despite 2024 bull run, the market feels unusually calm – Why?

- Bitcoin hits new highs in 2024, however retail-driven hype is notably absent from the rally

- Institutional flows dominate Bitcoin markets, shifting conduct from speculative spikes to regular, structured development

Bitcoin [BTC] is flying excessive — however the crowd isn’t cheering. Regardless of reaching new all-time highs in 2024, the market feels unusually subdued.

Gone are the feverish pumps, memecoin frenzies, and speculative retail waves that when outlined bull cycles. On-chain information backs up the vibe shift: short-term holders, usually a proxy for retail hypothesis, are largely absent.

However this isn’t an indication of weak spot. It’s the beginning of one thing extra structured, institutional, and presumably extra sustainable.

From straightforward cash to intentional markets

The euphoria of 2020-2021 was pushed by a novel mixture of things: near-zero rates of interest, large stimulus, and plentiful liquidity. Retail buyers surged into the market, fueling a robust risk-on sentiment.

At present, the macroeconomic panorama has shifted dramatically.

Rates of interest stay excessive, quantitative tightening continues, and capital has turn into extra selective. The absence of straightforward liquidity is reworking how cash flows inside crypto markets.

Moreover, the post-ETF period has introduced institutional buyers to the forefront as key capital drivers. Their involvement provides scale but in addition introduces a extra cautious strategy.

The result’s a extra measured market—much less pushed by hypothesis and more and more outlined by construction relatively than velocity.

The psychology of a tamed bull market

Crypto as soon as thrived on chaos—manic rallies, TikTok-fueled trades, and sudden crashes outlined its motion.

Nevertheless, 2024 presents a distinct narrative. Information means that Quick-Time period Holders (STHs) are largely absent, and the market’s tempo displays that shift. With out retail’s emotional swings, worth motion feels extra restrained, nearly calculated.

Establishments now dominate the market, changing hype-driven trades with structured methods. They allocate funds in tranches, rebalance portfolios, and give attention to long-term publicity relatively than speculative momentum.

This shift is redefining crypto’s conduct—transferring from FOMO-driven surges to risk-managed development. Persistence, not panic, is the prevailing strategy.

The bull market isn’t gone; it’s simply carrying a go well with and advancing with quiet precision.

What the numbers say

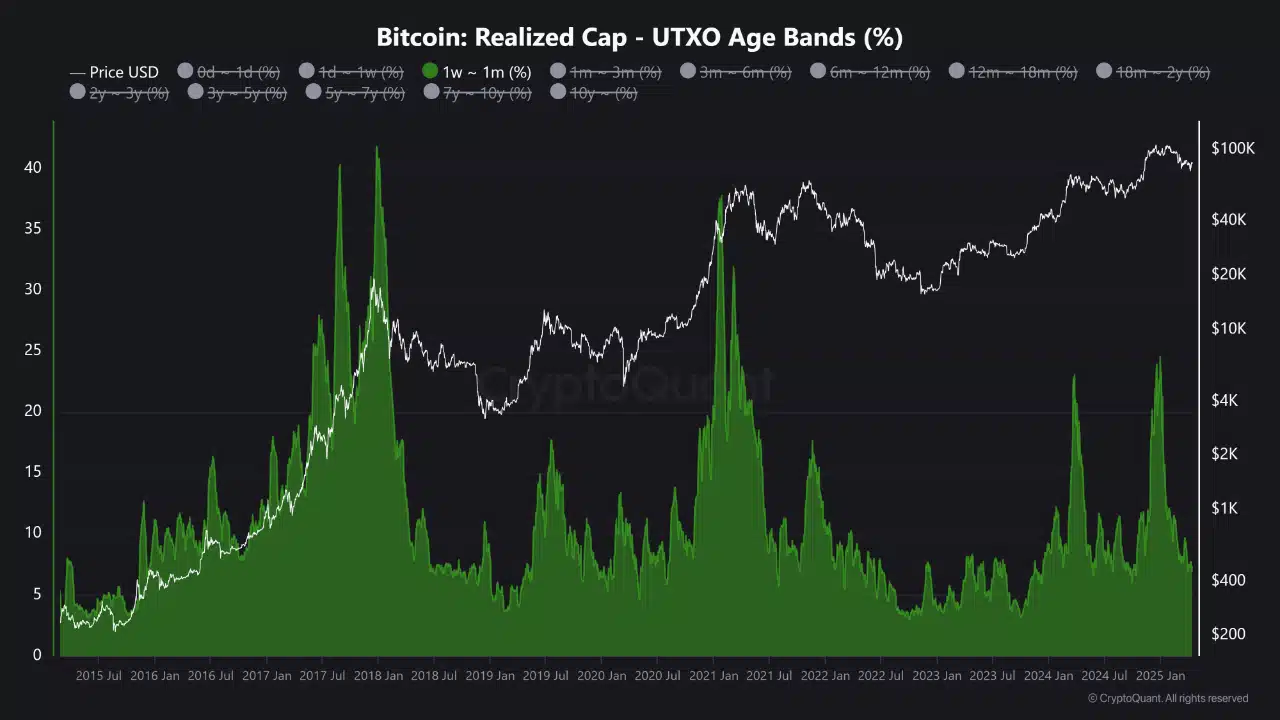

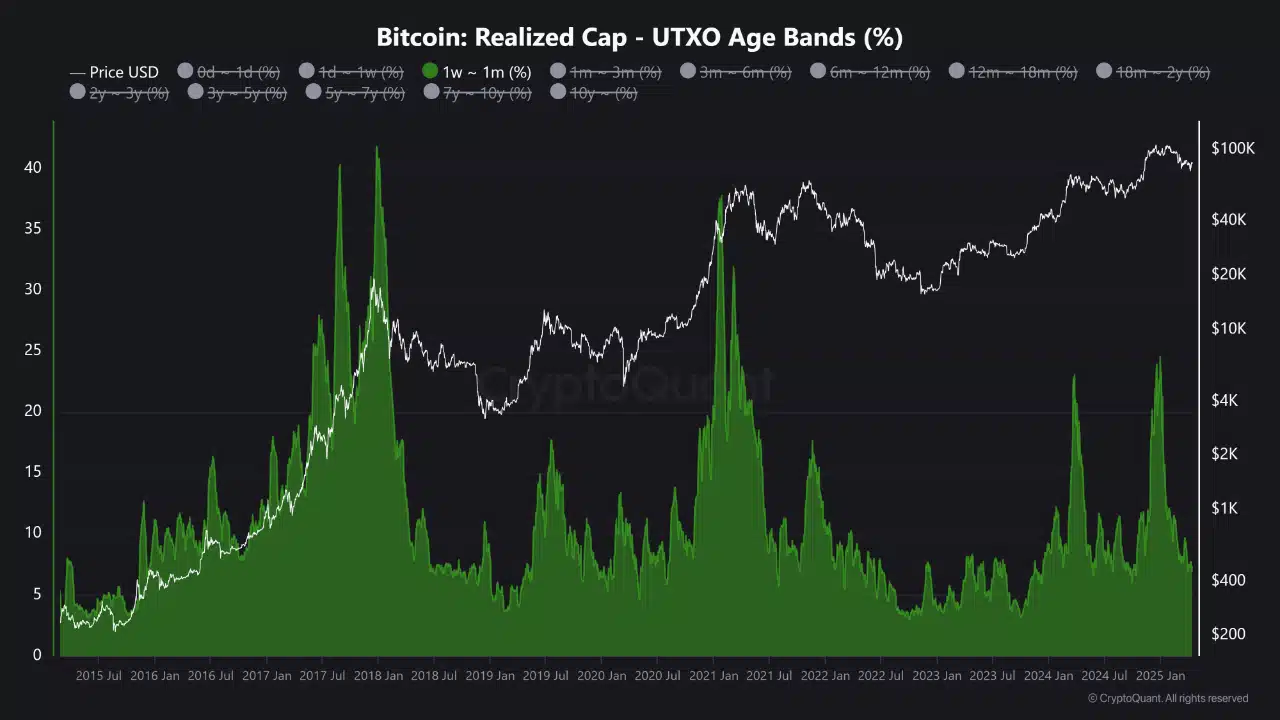

The data gives clear affirmation of the market’s muted tone. Traditionally, spikes within the 1-week to 1-month UTXO age band have coincided with euphoric retail participation close to cycle tops — 2017, 2021, early 2024.

Supply: CryptoQuant

However the newest peak in Bitcoin’s worth noticed solely a modest uptick on this band, suggesting new speculative capital didn’t flood in. As a substitute, the realized cap stays largely composed of older cash held by long-term members.

Volatility could also be modest, however so is the mania. And that may simply be the healthiest sign of all.