Bitcoin dominance hits 63% – Time to rethink your altcoin strategy?

- Bitcoin dominance was displaying indicators of cooling off after breaching a key resistance zone.

- Are different belongings primed for a resurgence in investor portfolios?

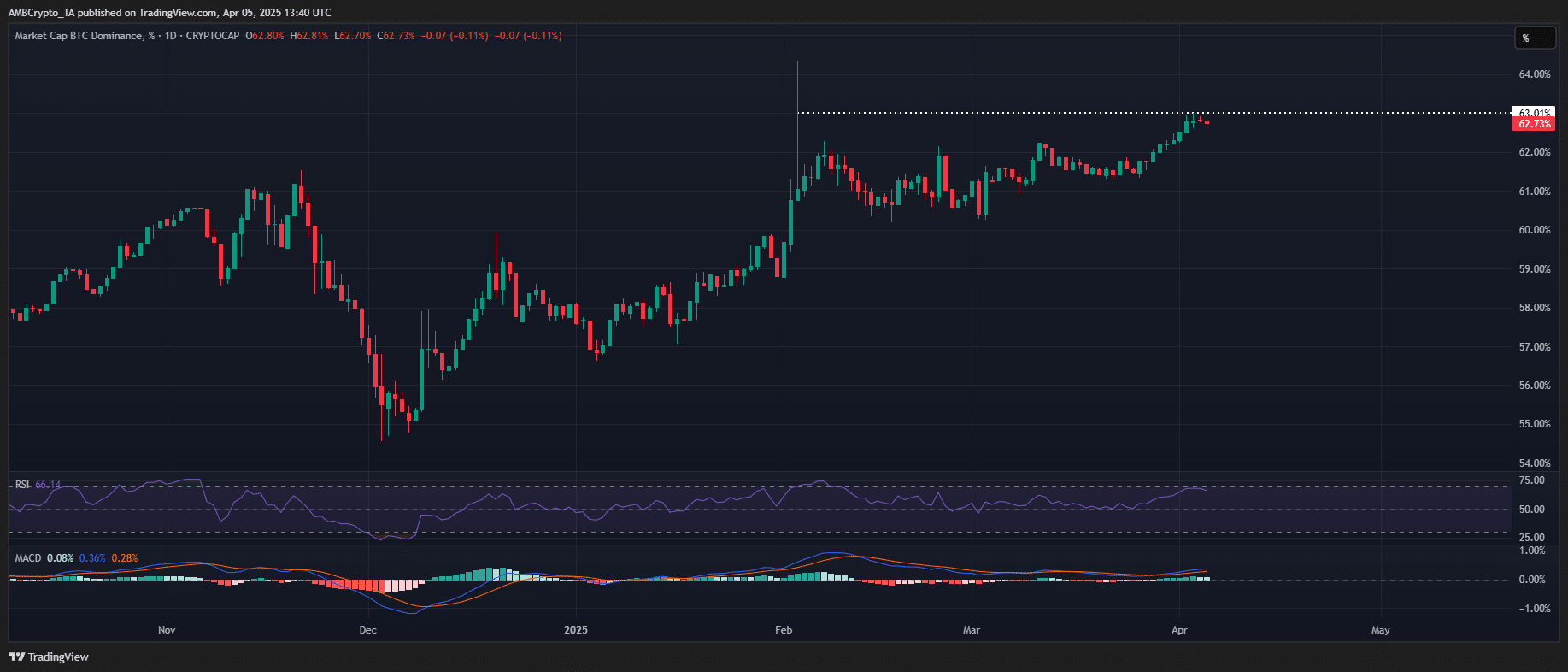

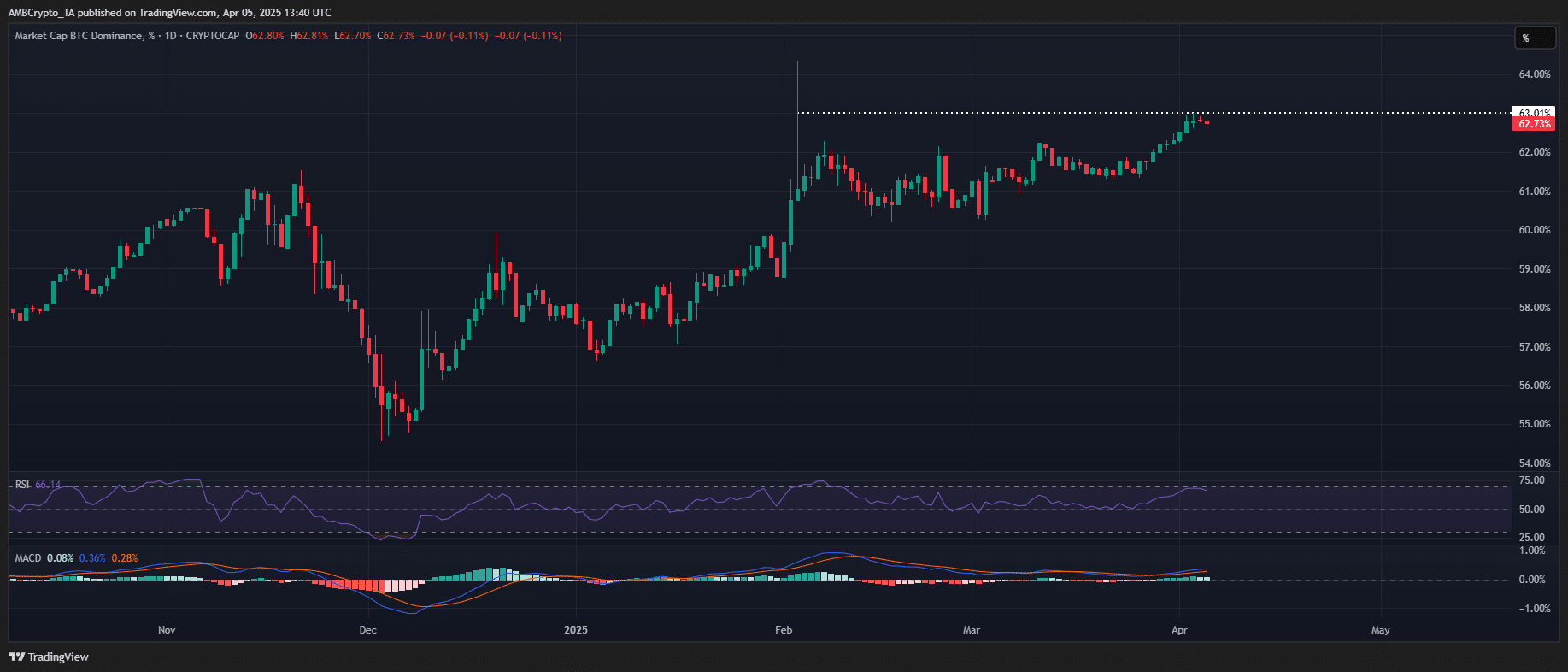

After a powerful rally, Bitcoin dominance [BTC.D] has began to point out indicators of exhaustion.

At press time, the Relative Energy Index (RSI) was deeply overbought, rising the chance of a corrective retracement, whereas the MACD bearish crossover signaled a momentum shift as BTC.D assessments the important thing 63% resistance stage.

Traditionally, such technical situations have preceded capital rotations into risk-on belongings, suggesting a possible altcoin resurgence if BTC.D begins to unwind.

Supply: TradingView (BTC.D)

Nonetheless, affirmation of a neighborhood prime stays elusive. Whereas Bitcoin has demonstrated structural resilience amid macro headwinds, high-cap altcoins stay extremely unstable with failed assist retests.

Solana [SOL] serves as a main instance – Regardless of its eight-month low, the asset has twice reclaimed $115 in March. But, it has failed to determine a agency assist base, leaving it structurally weak and prone to additional distribution cascades.

The identical sample extends to most altcoins, reinforcing a fragile market construction. Consequently, diminishing the chance of a sustained capital rotation regardless of BTC.D’s overheated technicals.

Altcoins poised to decouple from Bitcoin dominance

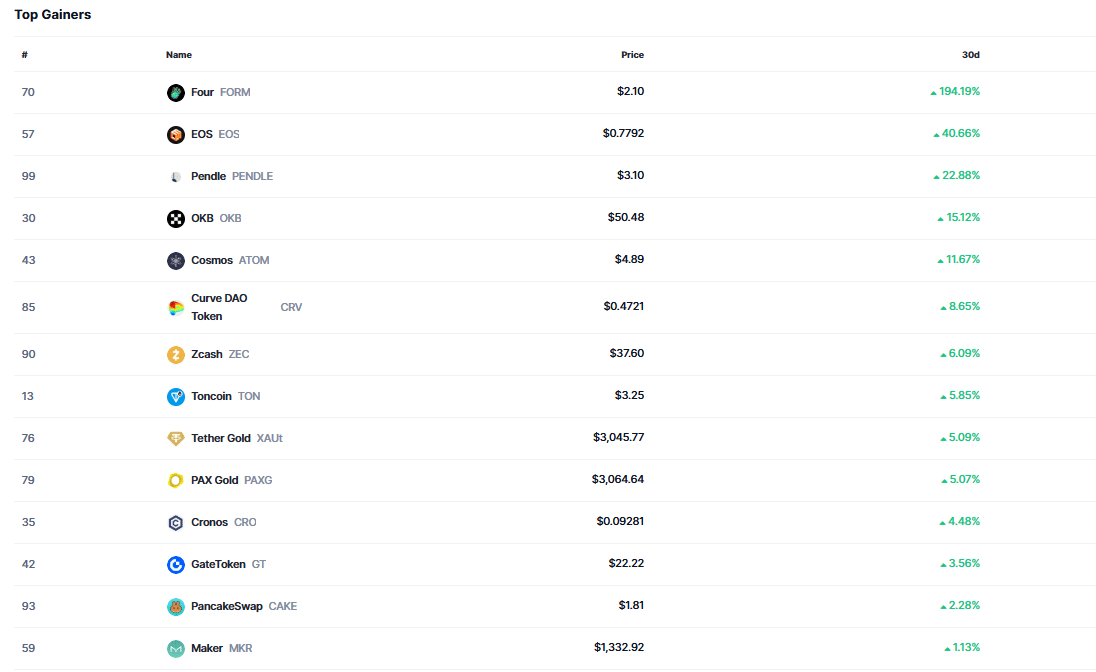

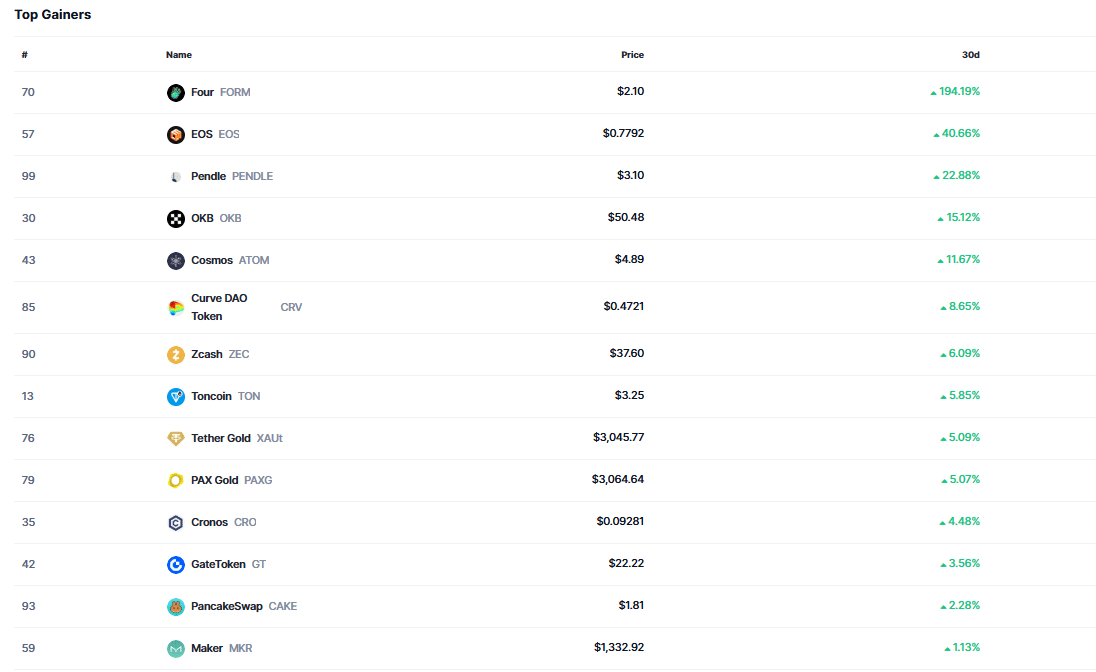

CoinMarketCap’s monthly gainers chart underscores a decisive capital rotation into low and mid-cap altcoins.

Topping the leaderboard is 4 [FORM], a low-cap asset that has posted a 194.19% rally to $2.10, signaling heightened speculative curiosity and liquidity inflow.

Mid-cap belongings akin to EOS [EOS], OKB [OKB], and Cosmos [ATOM] have additionally posted notable beneficial properties, every sustaining a market capitalization above $1 billion, signaling broader market participation past Bitcoin’s dominance.

Supply: CoinMarketCap

In distinction, high-cap altcoins proceed to face distribution strain. Regardless of some buying and selling at sub-$1 ranges, their demand has waned as BTC dominance peaks.

Notably, no high-cap asset has made it onto the highest gainers’ listing, with Cardano [ADA] main the draw back, registering a steep 30% month-to-month drawdown.

As leaders throughout the altcoin market, their failure to determine bullish momentum disrupts capital rotation dynamics.

This structural divergence underscores why, regardless of Bitcoin dominance flashing overbought situations, a sustained altcoin season stays unbelievable.