Bitcoin – Dump the FUD as BTC’s price is still on course for $85,000!

- Rising calls to promote BTC might gasoline a rebound in the direction of $68,600

- An necessary metric revealed that the coin has not but hit the height of this cycle

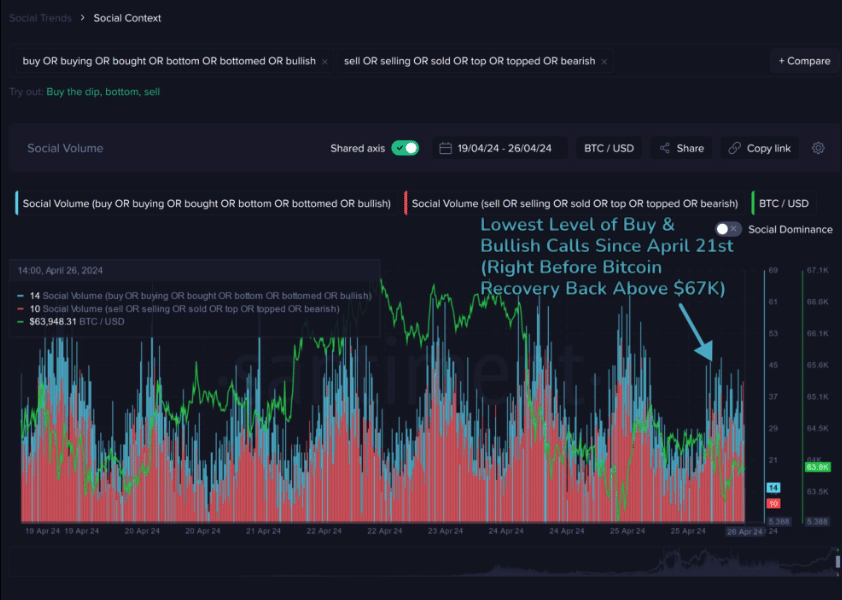

In an fascinating flip of occasions, Bitcoin’s [BTC] fall under $63,400 has fueled a lot Concern, Uncertainty, and Doubt [FUD] out there. This assertion might be supported by merchants’ sentiment over the past 12-24 hours.

Utilizing Santiment’s on-chain social instrument, AMBCrypto seen that the calls to promote had been far more than the ‘purchase the dip’ screams. Just a few weeks in the past, that was not the case. This, as a result of any slight dip within the cryptocurrency’s worth triggered a wave of bullish calls round that point.

Is worry the facility supply for a hike?

Nonetheless, this example will not be completely dangerous for Bitcoin as a peak in FUD may set off a bounce on the charts. In actual fact, one thing related occurred lately, particularly on 21 April.

On that day, BTC depreciated and fell to $64,531, with many merchants opining {that a} additional decline was imminent. Opposite to these expectations, nevertheless, Bitcoin swung upwards and hit $67,169.

Supply: Santiment

With that in place, it’s potential to see a repeat of that state of affairs if bears proceed to share their sentiment publicly. Nonetheless, additionally it is necessary to take a look at the likelihood from a metric-driven PoV.

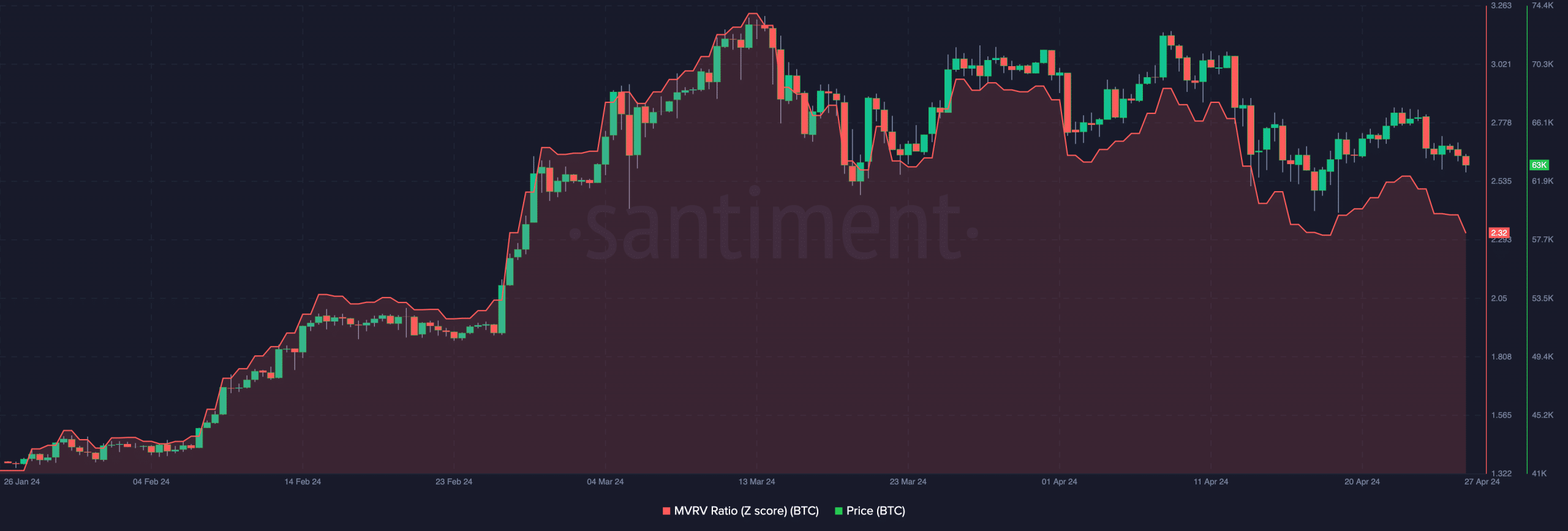

To begin off, AMBCrypto appeared on the Market Worth to Realized Worth (MVRV) Z Rating. For the uninitiated, the MVRV Z Rating can spot the bottoms and tops of a cryptocurrency. It might probably additionally inform if an asset is overvalued or undervalued.

On the time of writing, Bitcoin’s MVRV Z Rating was 2.32. Wanting on the chart under, we will see that since March, the value has recovered each single time the metric fell under 2.60.

Supply: Santiment

Nonetheless, there’s a probability that BTC may drop to decrease than $62,400 if bears retain management of the value. If that’s the case, the revival could possibly be higher, and a hike to $68,600 could possibly be subsequent.

BTC appears to be like sound for the latter half

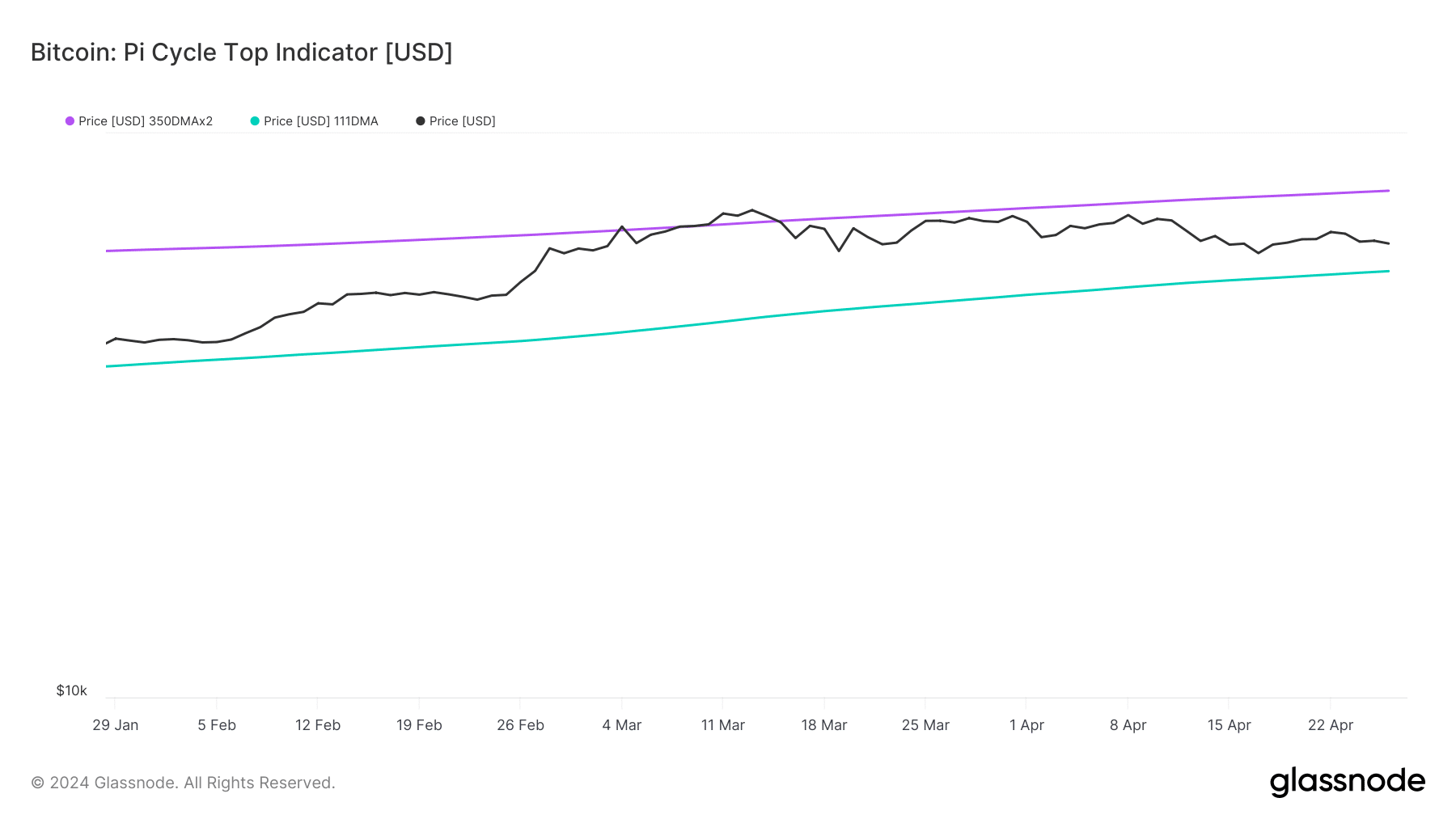

One other metric AMBCrypto evaluated was the Pi Cycle Prime indicator. Traditionally, this metric has been instrumental in figuring out when BTC is overheated or in any other case. On the indicator, you’d discover two strains — A inexperienced one and a purple one. The inexperienced line represents the 111-day Easy Shifting Common (SMA) whereas the purple signifies the 350-day MA.

Typically, Bitcoin closes in on the highest when the 111SMA reaches the identical spot or crosses above the 350SMA. Nonetheless, at press time, that was not the state of affairs because the inexperienced line remained under the purple line.

Supply: Glassnode

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

The state of this metric appeared nice for Bitcoin bulls not just for the brief time period. however for many of this cycle.

Ought to the Pi Cycle Prime maintain its place within the coming months, BTC could rally. And, a goal of $80,000 to $85,000 could possibly be potential too.