Bitcoin Emerges As the King Of Assets,10X Growth Over Gold During US Banking Crisis

Regardless of the unstable value motion of Bitcoin (BTC), the world’s largest cryptocurrency has outperformed each different asset, together with gold. Though it’s buying and selling beneath its psychological milestone of $30,000 at $29,000, Bitcoin is anticipated to develop additional in 2023, because it acts as a secure haven for buyers amidst the US banking disaster.

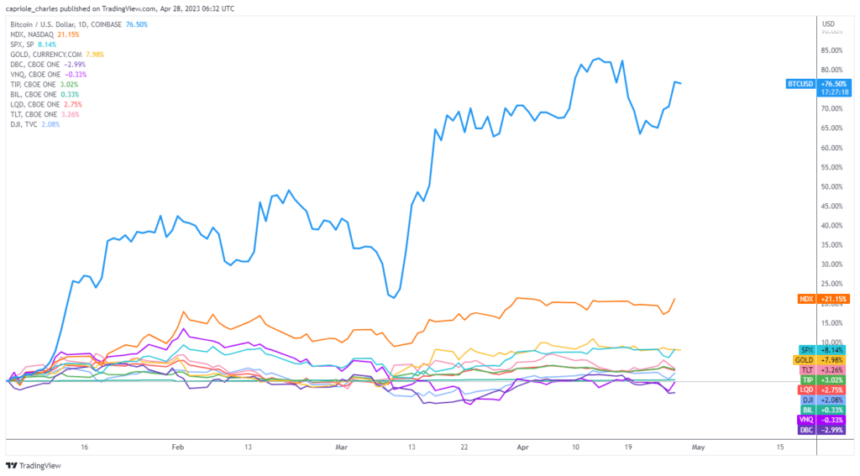

Bitcoin Reigns Supreme Because the Finest-Performing Asset

Capriole Funding, which offers analysis and evaluation on cryptocurrencies, has reported that the present market cycle favors laborious property like gold, as indicated by the 200-week Gold-to-Shares ratio. This traditional indicator highlights when the market favors safe-haven property like gold over riskier fairness property. Each gold and Bitcoin have generated a few of their finest returns throughout these phases.

Because the market continues to favor laborious property, Bitcoin has emerged as the popular secure haven for wealth amidst the US banking disaster and fiat foreign money weak spot. Throughout this era of excessive correlation, Bitcoin has outperformed gold by 10X in 2023, making it the best-performing asset of the yr amongst main asset courses.

The sturdy optimistic correlation between Bitcoin and Gold has additionally elevated considerably, making them enticing choices for buyers trying to diversify their portfolios and hedge towards financial uncertainty. With unsustainable tightening, banking crises, and de-dollarization looming, the market is popping to those safe-haven property to guard their wealth.

In response to the report by Capriole Funding, the present Bitcoin rally in 2023 is believed to be natural and spot pushed. The report highlights a key metric exhibiting complete futures Open Curiosity as a ratio of the full Bitcoin and USDT market cap.

This metric offers perception into the market’s leverage and reveals that the crypto market leverage peaked with the FTX fraud in November 2022. Since then, this ratio has been on a one-way downtrend, regardless of Bitcoin’s value rallying over 80% from $16,000 to $30,000. This means that there was little hypothesis out there this yr.

The report means that till this ratio spikes or Bitcoin dominance peaks, the foundations for sustainable value appreciation stay in place. Which means that the present rally is pushed by natural demand somewhat than hypothesis, which is a optimistic signal for the long-term development of the cryptocurrency market.

Moreover, the report means that the lower in leverage signifies a wholesome market much less weak to sudden value drops. It’s because a excessive stage of leverage can typically result in market instability, inflicting sharp value swings and doubtlessly leading to a market crash.

BTC’s $30-32K Dilemma

In response to the report, Bitcoin is buying and selling inside the largest technical resistance block on the chart since $20,000. This area, which ranges from $30,000 to $32,000, represents the underside of the 2021 vary and the breakdown level into the bear market that started in 2022.

Moreover, it’s a main weekly order block stage and Fibonacci extension stage from the prior cycle. $30,000 can be a significant spherical quantity stage, representing a 50% improve from the 2017 cycle all-time-high of $20,000, and $32,000 marks a 100% appreciation in Bitcoin for the reason that FTX Fraud backside at $16,000.

Whereas Bitcoin has proven outstanding resilience in current months, you will need to notice that previous efficiency isn’t an indicator of future outcomes. Nevertheless, in accordance with Capriole’s report, if Bitcoin manages to shut above $32,000 weekly, it wouldn’t be shocking to see a brand new pattern carry its value into the $40,000 mark.

Featured picture from Unsplash, chart from TradingView.com