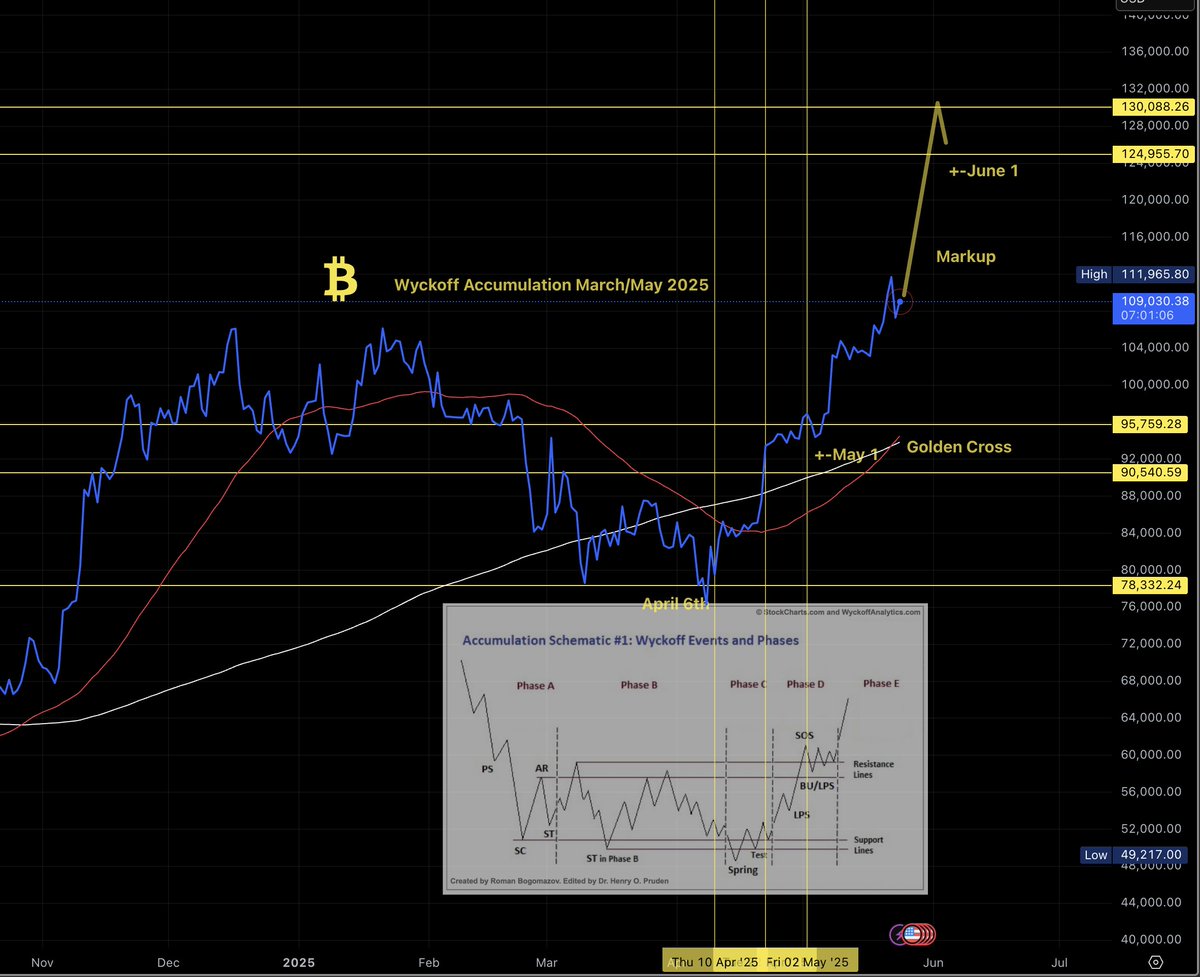

Bitcoin enters ‘Wyckoff Phase E’ – Mapping BTC’s path to $125K and beyond

- Bitcoin enters Wyckoff Section E with a ‘golden cross,’ setting sights on $125K short-term.

- Analyst eyes $260K by August–September, citing shrinking withdrawal exercise as a key driver.

Bitcoin [BTC] formally entered Section E of the Wyckoff Accumulation mannequin—usually marked by a breakout and powerful upward continuation.

One key technical affirmation was witnessed on the twenty fourth of Could, when the 50-day Transferring Common (MA) crossed over the 200-day MA, forming the favourite ‘golden cross’ on the each day chart.

The chart sample is historically thought-about a bullish long-term sign. It often signifies a shift in sentiment.

Naturally, many merchants have now set their sights on the $125K mark—the primary main resistance inside this markup section.

Supply: X

The true query stays—what occurs past that?

U.S. Senate crypto payments may provoke the following market section

From a extremely regarded market analyst’s tweet, the following cycle for Bitcoin may both be a distribution section or a re-accumulation section.

The likeliest, in his view, is re-accumulation, notably with the U.S. Senate set to vote on key crypto laws quickly.

In fact, regulatory occasions inject volatility. However they might additionally help institutional confidence, particularly if authorized readability emerges round digital asset classifications.

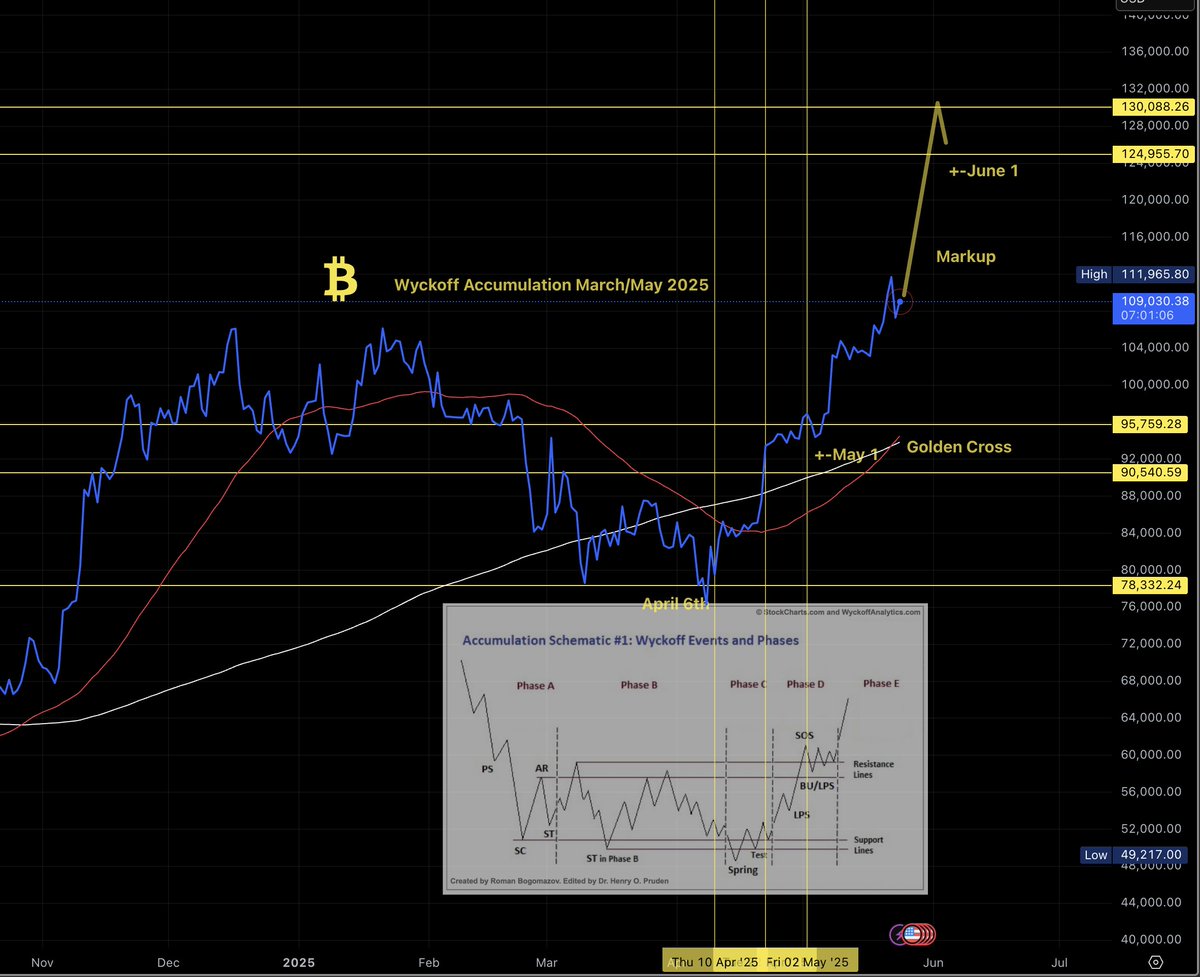

Addresses withdrawing Bitcoin are declining

On-chain metrics add gas to the present rally.

The declining variety of Alternate Withdrawing Transactions—a key indicator monitoring how typically BTC is moved to non-public wallets, steered promoting stress could also be dwindling.

Choosing up on the decline, the ensuing fade in promoting stress might act as a stealthy bullish driver, decreasing overhead resistance and powering value momentum.

This sample aligns with the analyst’s projection of a distribution transfer close to $260K by August or September, assuming market provide stays constrained.

Supply: CryptoQuant

Insurance policies and value motion to observe

With Bitcoin firmly in Wyckoff Section E and backed by a ‘golden cross,’ near-term momentum is agency.

Macro circumstances like regulation and on-chain developments will, nevertheless, dictate what occurs subsequent.

If the market goes by, re-accumulation or distribution will probably be contingent on investor sentiment and the destiny of laws on the pending Bitcoin payments.