Bitcoin ETF inflows remain dominant, Ethereum ETFs not far behind – What’s next?

- Ethereum, Bitcoin ETF traits have been optimistic all via the previous week.

- BTC has dropped barely from its ATH of $100,000, whereas ETH additionally fell under its $4,000 value stage.

The Bitcoin [BTC] and Ethereum [ETH] ETFs had an eventful week, with each reaching important milestones as their costs rallied.

Whereas Bitcoin ETFs reached an all-time excessive in web property, Ethereum ETFs set a brand new report for weekly inflows, signaling heightened institutional curiosity within the crypto market.

Bitcoin ETF hits new all-time excessive

The Bitcoin ETF market skilled outstanding progress final week, coinciding with Bitcoin’s value surge to a brand new all-time excessive.

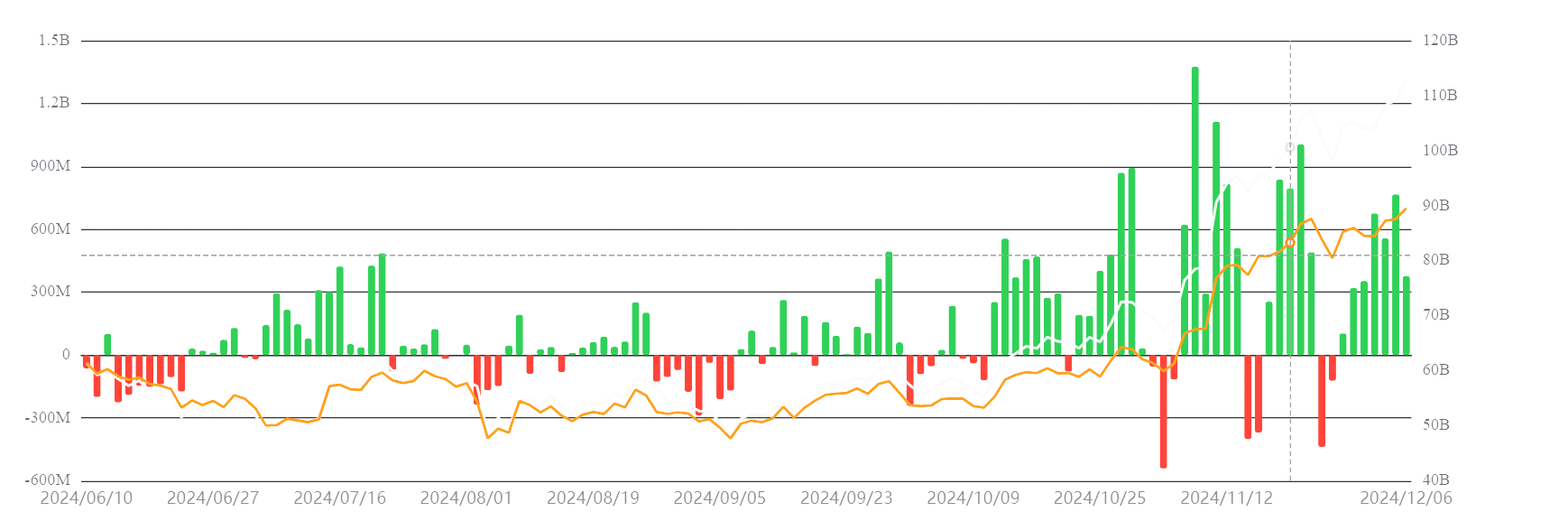

Information from SosoValue revealed that Bitcoin ETFs held a report web asset of $112.74 billion at press time, accounting for five.62% of Bitcoin’s complete market capitalization.

Supply: SosoValue

Internet inflows for the previous week totaled $2.73 billion, with optimistic flows recorded on all days. BlackRock’s IBIT, the world’s largest BTC ETF, attracted the lion’s share of those inflows, receiving over $2.6 billion.

This reinforces BlackRock’s dominant place within the ETF house and highlights the rising institutional urge for food for BTC publicity.

Ethereum ETF breaks weekly web influx information

Ethereum ETFs mirrored Bitcoin’s success, reaching a milestone of their very own.

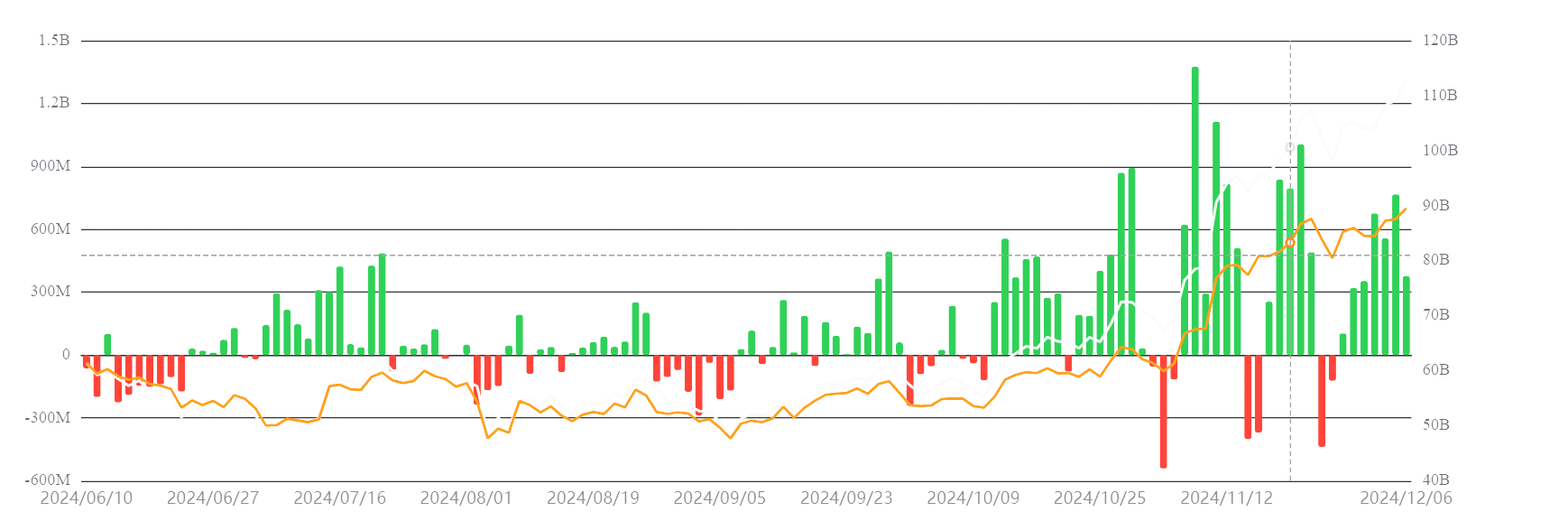

Weekly web inflows hit $836.69 million, the very best in Ethereum ETF historical past, pushing the entire property underneath administration to a report $13.6 billion.

For the primary time since their approval, Ethereum ETFs recorded two consecutive weeks of optimistic web inflows, a big shift in investor sentiment.

Supply: SosoValue

On the fifth of December, Ethereum ETFs set one other report, registering $428.44 million in day by day web inflows, the very best ever for the asset class.

These inflows display a rising confidence in Ethereum’s potential as a long-term funding, pushed by its increasing utility in DeFi and sensible contracts.

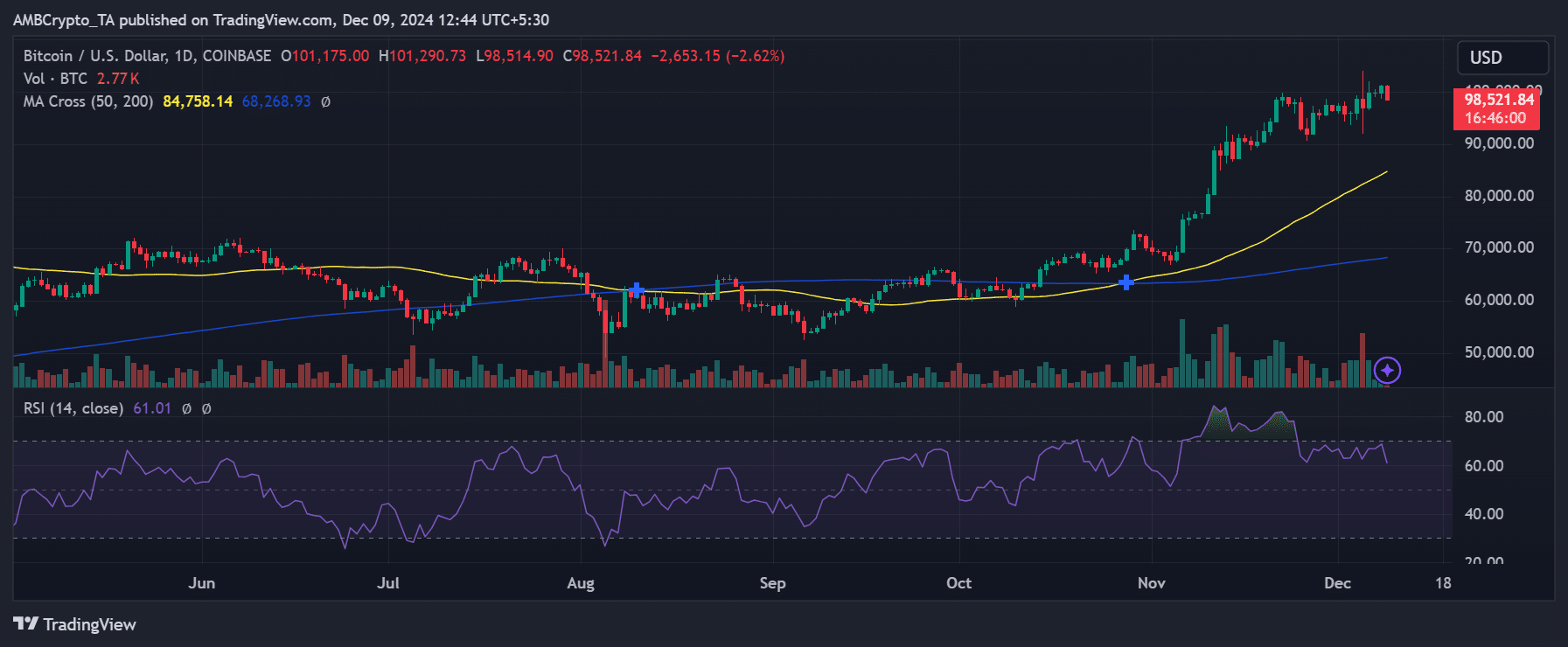

Bitcoin value consolidates after historic rally

Bitcoin’s value was $98,521 at press time, reflecting a wholesome consolidation part after its sharp rally previous the $100,000 mark.

The 50-day transferring common has crossed above the 200-day transferring common, forming a golden cross—a robust bullish indicator.

With an RSI of 61, Bitcoin maintains room for additional upward motion whereas remaining in a steady buying and selling vary.

Supply: TradingView

With their record-breaking $112.74 billion in web property, Bitcoin ETFs underscore the asset’s continued dominance in institutional portfolios.

Traders nonetheless view Bitcoin as a dependable retailer of worth, at the same time as Ethereum good points consideration for its progress potential.

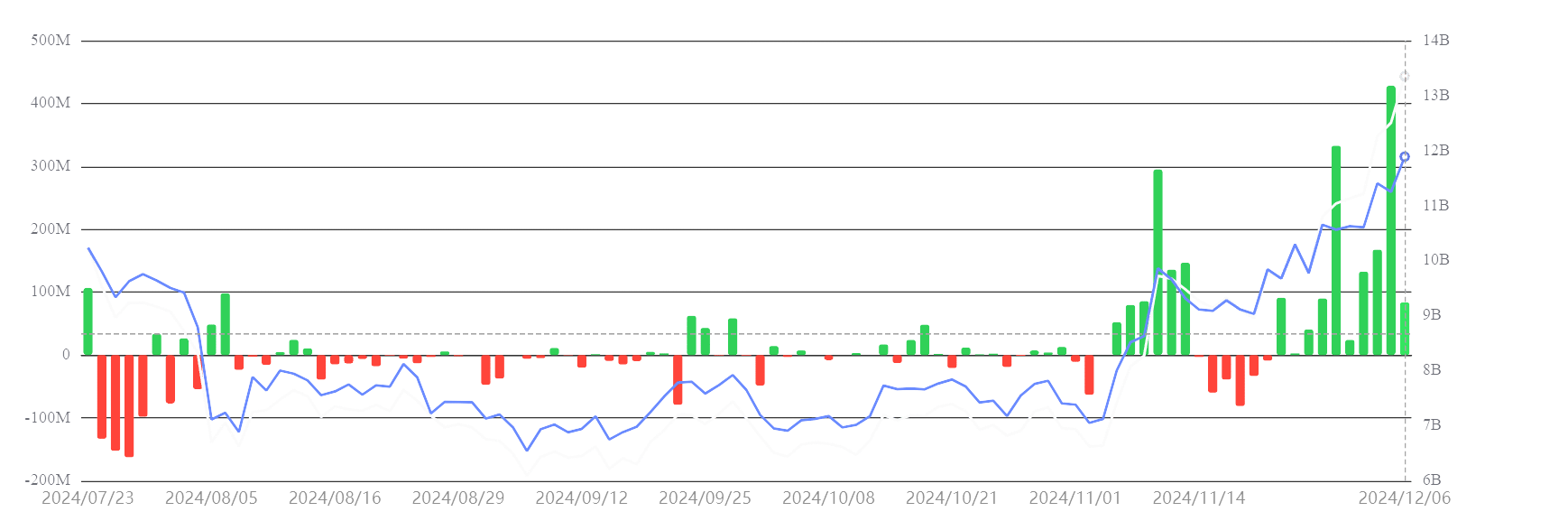

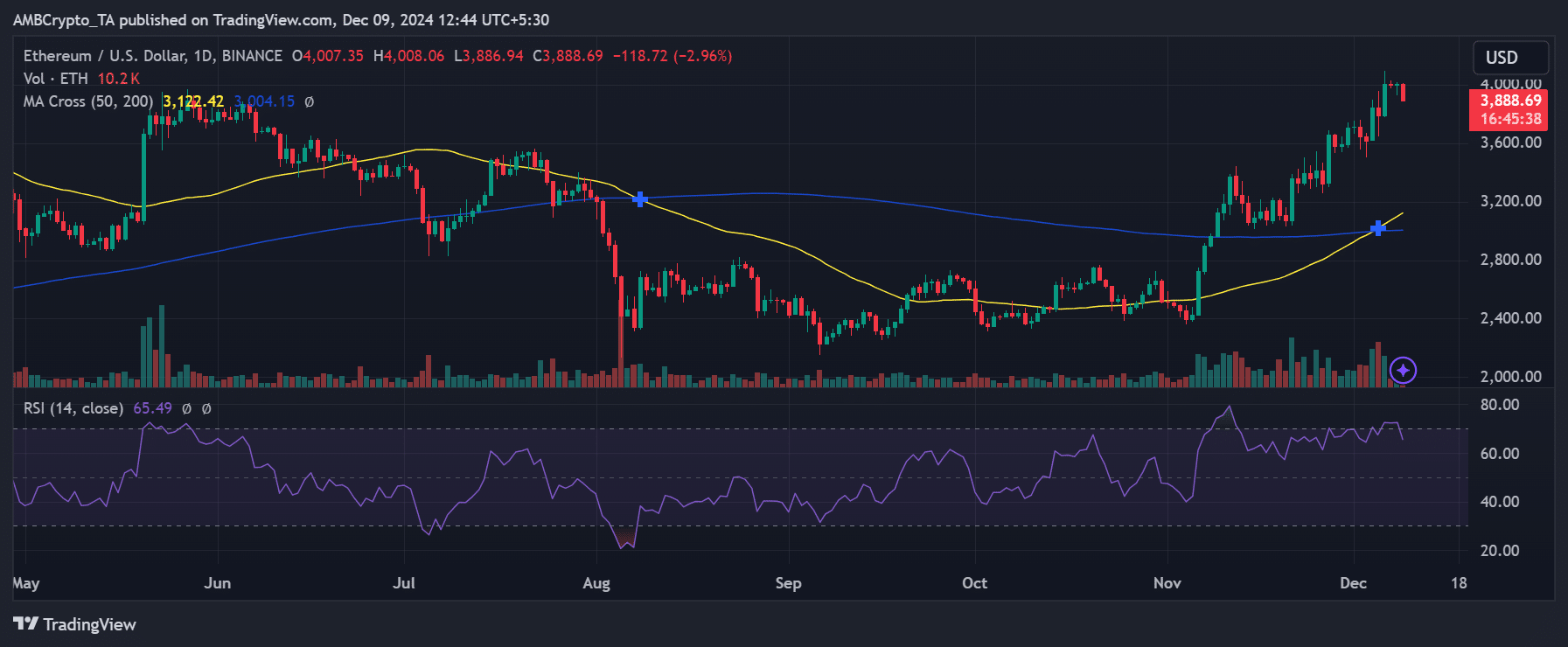

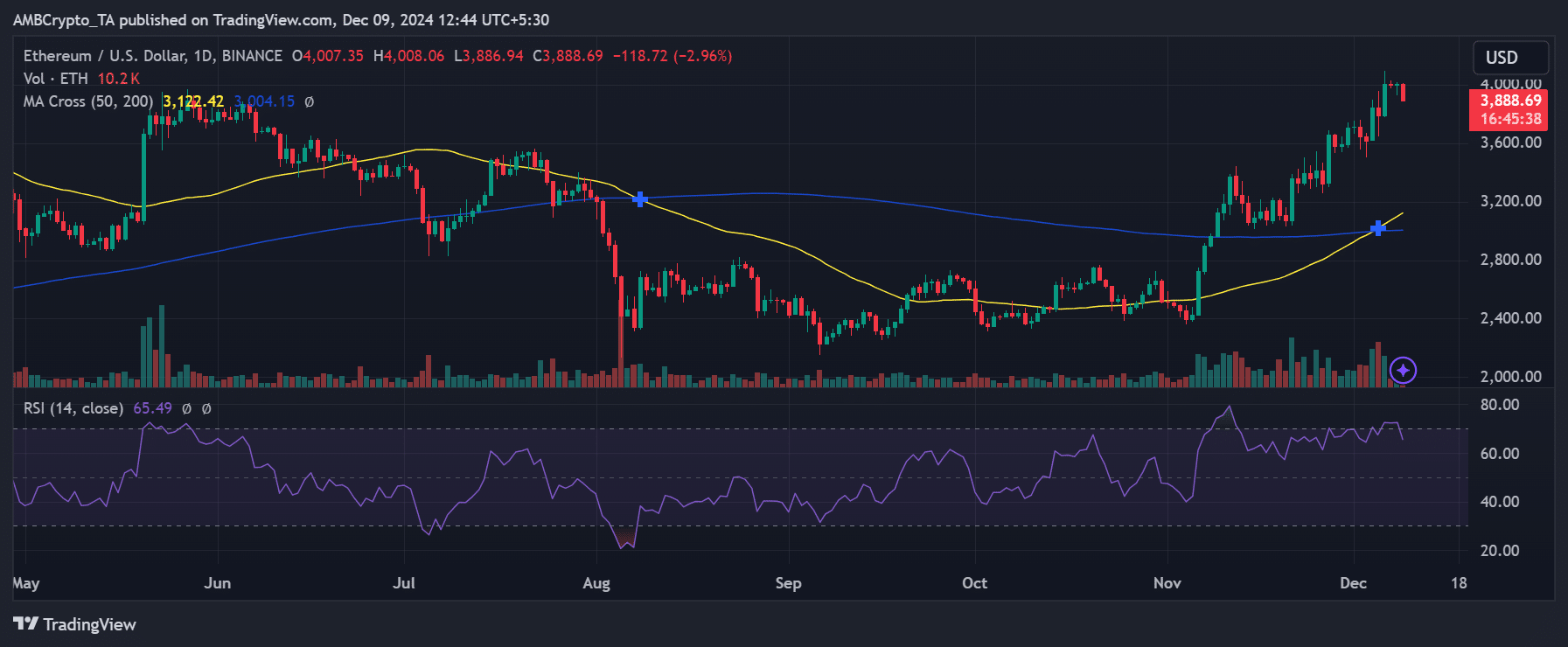

Ethereum’s value momentum aligns with ETF progress

Ethereum’s value, at $3,888, has seen a slight pullback after not too long ago crossing the $4,000 mark. Nevertheless, its bullish technical indicators remained intact.

The golden cross between the 50-day and 200-day transferring averages pointed to additional upside potential. In the meantime, an RSI of 65 prompt Ethereum was nearing overbought ranges however nonetheless has room for progress.

Supply: TradingView

The report inflows into Ethereum ETFs aligned with this value momentum, reflecting institutional confidence in Ethereum’s long-term prospects.

These inflows may catalyze sustained value appreciation, additional solidifying Ethereum’s place because the main different to Bitcoin.

Bitcoin and Ethereum ETFs are breaking information, pushed by rising institutional demand and powerful value momentum.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Whereas Bitcoin retains its dominance as a retailer of worth, Ethereum’s explosive weekly inflows spotlight its rising function as a dynamic progress asset.

These developments mark a pivotal second for the cryptocurrency ETF market, underscoring the growing integration of digital property into conventional monetary portfolios.