Bitcoin ETF inflows surge to $235.2 mln – Returning investor interest?

- Bitcoin ETF inflows see renewed vigor, led by Constancy’s FBTC and BlackRock’s IBIT.

- Ethereum ETFs expertise no new inflows, with declining buying and selling quantity on the seventh of October.

Regardless of a sluggish begin to October for spot Bitcoin [BTC] ETFs, the market is exhibiting indicators of enchancment.

In keeping with Farside Investors, BTC ETFs noticed notable inflows on the seventh of October, amounting to $235.2 million, marking two consecutive days of optimistic capital motion.

Constancy’s leads Bitcoin ETF

Main the surge was Constancy’s FBTC ETF, which recorded the best inflows, drawing in $103.7 million.

Moreover, BlackRock’s IBIT, the most important spot Bitcoin ETF by belongings, recorded a strong $97.9 million in inflows, rebounding from zero exercise seen on the 4th of October.

As anticipated, Bitwise’s BITB gained $13.1 million, Ark and 21Shares’ ARKB attracted $12.6 million, VanEck’s HODL acquired $5.4 million, and Invesco’s BTCO captured $2.5 million.

Nonetheless, Grayscale’s GBTC and 6 different ETFs recorded no new flows on the seventh of October.

That being mentioned, the collective buying and selling quantity throughout all 12 ETFs reached $1.22 billion, exhibiting a gentle improve from $1.19 billion on the 4th of October and $1.13 billion on the third of October.

Balchunas had already anticipated this

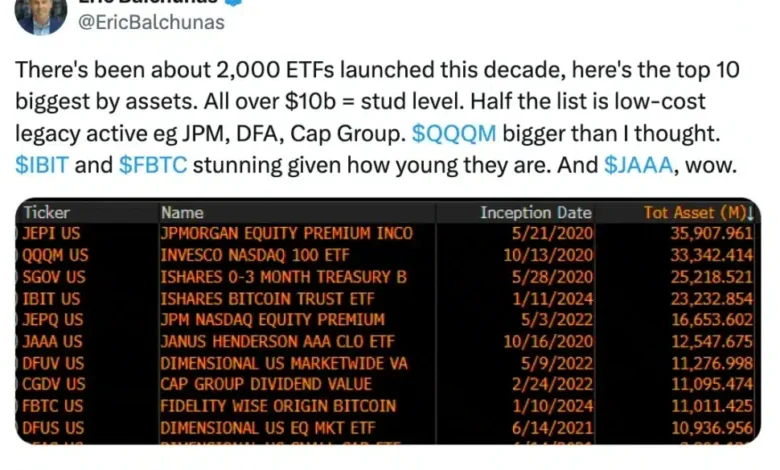

Remarking on the identical, Bloomberg senior ETF analyst Eric Balchunas lately spotlighted IBIT and FBTC as two standout BTC ETFs of the last decade.

He famous their spectacular rise to “stud degree” standing, every amassing over $10 billion in Property Underneath Administration (AUM).

Balchunas emphasised,

Supply: Eric Balchunas/X

Bitcoin’s worth exhibits bearish momentum

Unexpectedly, as Bitcoin ETFs seize elevated investor consideration, BTC’s worth has proven some indicators of battle.

Currently trading round $62,497 after a 0.48% drop prior to now 24 hours, the cryptocurrency stays shy of its latest $66,000 peak.

These developments coincided with a big authorized determination, because the U.S. Supreme Court docket lately declined to listen to an attraction regarding the possession of 69,370 Bitcoin initially seized from the Silk Street darkish internet market.

Ethereum ETF analyzed

Not like BTC ETFs, U.S. spot Ethereum [ETH] ETFs skilled a pause in exercise on the seventh of October, following $7.39 million in inflows final recorded on the 4th October and a $3.2 million in outflows on the third of October.

Alongside this quiet interval, buying and selling quantity throughout 9 ETH ETFs declined, reaching $118.43 million from the 4th of October’s $148.01 million.

In the meantime, on the worth entrance, Ethereum was down by 1.35%, buying and selling at $2,436, reflecting the shifting dynamics within the crypto house.