Bitcoin ETF: Recent Grayscale ruling whets whales’ appetites

- Bitcoin broke by the $27,000-barrier on Sunday.

- The value rip additionally bolstered its demand within the derivatives market.

Bitcoin [BTC] blasted previous $27,000 within the final 24 hours, as market contributors braced for a continued upward development.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

The king coin saved shifting northwards till it confronted robust resistance at $27,900, knowledge from CoinMarketCap confirmed. On the time of writing, BTC exchanged palms at $27,724, however hopes of the coin gaining bullish power within the wake of current authorized wins remained excessive.

Whales accumulate Bitcoin

With the SEC deciding towards the enchantment within the keenly watched case towards digital asset supervisor Grayscale Investments, expectations of a Bitcoin spot ETF turning into a actuality have turn into larger than ever. Most likely, this performed on the minds of whale traders as effectively.

As per a current put up by on-chain sleuth Ali Martinez, the consumer cohort having 100-1,000 cash of their wallets accrued roughly 117 BTCs for the reason that aforementioned growth. At going market charges, the newly added provide amounted to $3.24 million.

#Bitcoin whales purchased round 117 $BTC up to now 48 hours, value roughly $3.2 million. pic.twitter.com/Aoshmy0r4D

— Ali (@ali_charts) October 15, 2023

A broadly noticed phenomenon in monetary markets is smart-money traders utilizing the consolidation part of a basically robust asset so as to add to their current stashes.

Spot ETFs, which might probably drive higher capital infusion into Bitcoin and the broader market, have been seen as the following massive factor.

Parts of doubt

Nevertheless, regardless of the optimistic developments, there remained issues about Bitcoin’s subsequent actions. In a separate put up, Ali Martinez highlighted that long-term holders (LTH) of the king coin had qualms a couple of BTC value correction within the short-term, in keeping with NUPL studying.

Be aware that NUPL (Internet Unrealized Revenue/Loss) particularly seems on the distinction between unrealized revenue and unrealized loss. This is completed to find out whether or not the community as an entire is at present in a state of revenue or loss.

#Bitcoin long-term holders are exhibiting “concern” amid issues of a major $BTC value correction! pic.twitter.com/7Zqkygibqd

— Ali (@ali_charts) October 15, 2023

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Speculative curiosity jumps

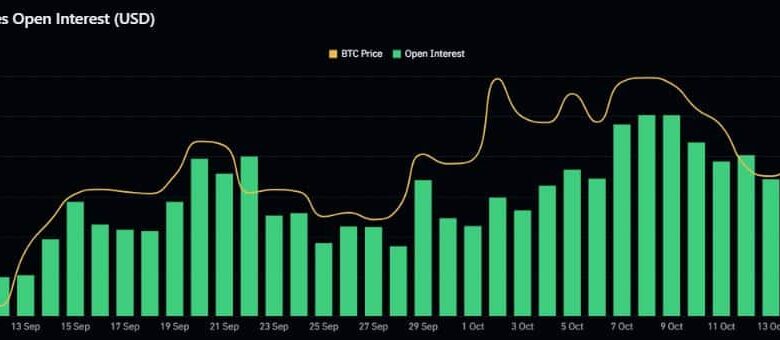

Bitcoin’s value rip additionally bolstered its demand within the derivatives market. Open Curiosity (OI) in Bitcoin Futures contracts jumped 5% to $11.67 billion within the final 24 hours, as per Coinglass. The truth is, a sustained improve was noticed ever for the reason that SEC vs. Grayscale growth final Friday.

Supply: Coinglass

Furthermore, the variety of longs continued to outpace the shorts, as per the Longs/Shorts Ratio. This implied that extra merchants have been hopeful of a northwards motion of Bitcoin within the brief time period.

Supply: Coinglass