Bitcoin ETFs inch towards $10B in 3 days despite slow start

- The buying and selling volumes of Bitcoin ETFs have surged to new highs.

- The motion of outdated whales raised considerations of doable sell-off.

Optimism impressed by the Bitcoin [BTC] ETFs approval slowly waned after the value of BTC crashed following the occasion. However regardless of this, the newest occurrences have instilled hope in merchants.

Not but the tip for Bitcoin ETFs?

Regardless of issues seeming uninteresting on the floor, Bitcoin ETFs have began making their mark, slowly but steadily.

In accordance with Bloomberg analyst James Seyffart, the combination buying and selling quantity of U.S. Bitcoin spot ETFs surpassed $10 billion inside three days.

Grayscale GBTC led the pack, with a three-day buying and selling quantity of $5.174 billion, adopted by BlackRock’s IBIT at $1.997 billion and FBTC at $1.479 billion, totaling $9.771 billion in ETF commerce volumes.

Replace on the #Bitcoin ETF Cointucky Derby. The ETFs have traded nearly $10 billion whole over 3 days. Can have up to date flows and property later tonight or tomorrow morning. pic.twitter.com/OnpCshjYJP

— James Seyffart (@JSeyff) January 16, 2024

Seyffart added that these launches had been deemed extremely profitable by most metrics, with the one exception being Wisdomtree, which reported $3.25 million in property on its third day.

By most any metric — these are all very profitable launches. The one caveat to that is likely to be Wisdomtree at simply $3.25 mln in property however its solely day 3 — this can be a LONG race.

— James Seyffart (@JSeyff) January 16, 2024

This heightened exercise urged rising curiosity from institutional buyers, probably growing Bitcoin’s liquidity and market depth.

The success of those launches additionally enhanced Bitcoin’s legitimacy in conventional monetary markets, signaling a constructive path for its future.

Because the race unfolds, continued institutional participation may additional solidify Bitcoin’s place as a compelling funding choice for individuals unfamiliar with crypto.

Troubles forward?

Nevertheless, latest developments may trigger skepticism across the king coin. One among them was the motion of huge quantities of BTC by largely dormant accounts.

In accordance with a tweet by Arkham Intelligence, on the sixteenth of January, massive addresses, assumed to be linked collectively, moved $2 billion price of BTC.

$2 BILLION of dormant Bitcoin moved simply earlier than US market open at this time, throughout a number of linked addresses.

The BTC had moved as soon as in 2019, and earlier than that had been dormant since 2013. pic.twitter.com/xD4frjzQuP

— Arkham (@ArkhamIntel) January 16, 2024

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This sudden whale motion may strike uncertainty amongst holders, because the concern of a sell-off looms. Nevertheless, till the time of writing, there had been no vital affect on BTC.

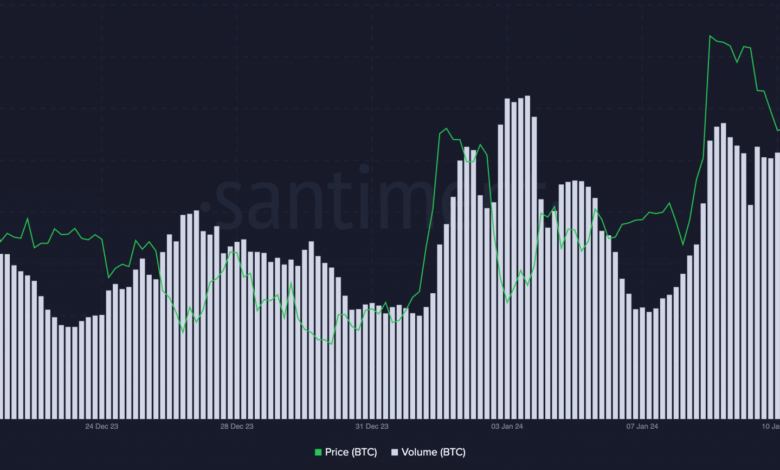

At press time, Bitcoin was buying and selling at $42,715.13, with its worth rising by 0.4% within the final 24 hours.

Supply: Santiment