Bitcoin ETFs see $1B inflows: Can they overtake Satoshi’s holdings?

- Bitcoin ETFs noticed $1 billion in inflows, nearing Satoshi’s holdings and gold ETFs.

- Bitcoin’s 160% rise in 2024, now value $1.91 trillion, challenged gold’s market dominance.

Following the aftermath of the U.S. Presidential election, Bitcoin’s [BTC] market has skilled a big surge, with spot Bitcoin ETFs seeing a large inflow of capital.

In actual fact, as BTC’s worth continues to inch nearer to the $100K mark, the momentum is mirrored within the ETF market.

Bitcoin ETFs replace

In keeping with Farside Investors, Bitcoin ETFs noticed a formidable $490.3 million in inflows on the twenty second of November, marking a placing continuation of the upward development.

Cumulatively, by the twenty first of November, BTC ETFs had attracted over $1 billion in new investments. This signaled a strong investor urge for food for publicity to the main cryptocurrency amid a wave of bullish sentiment.

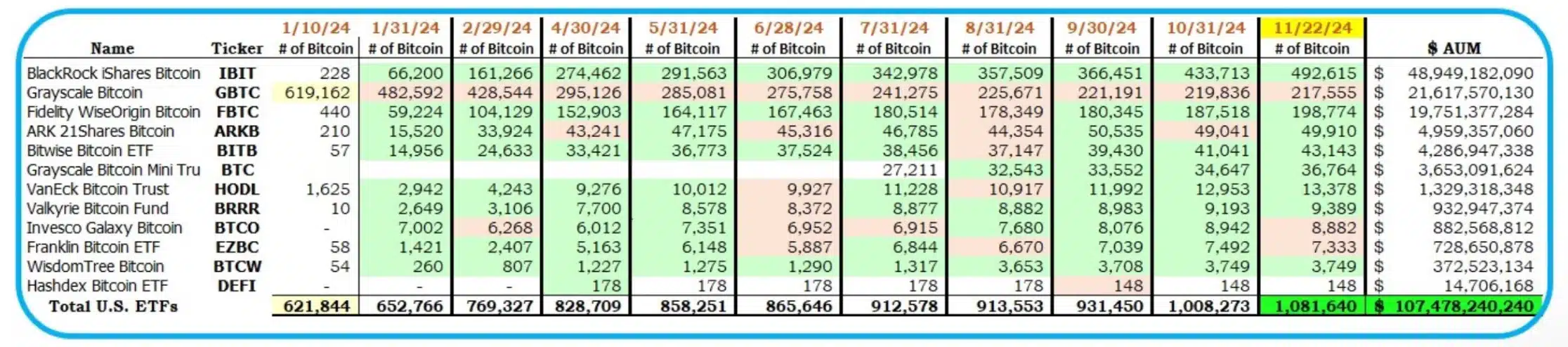

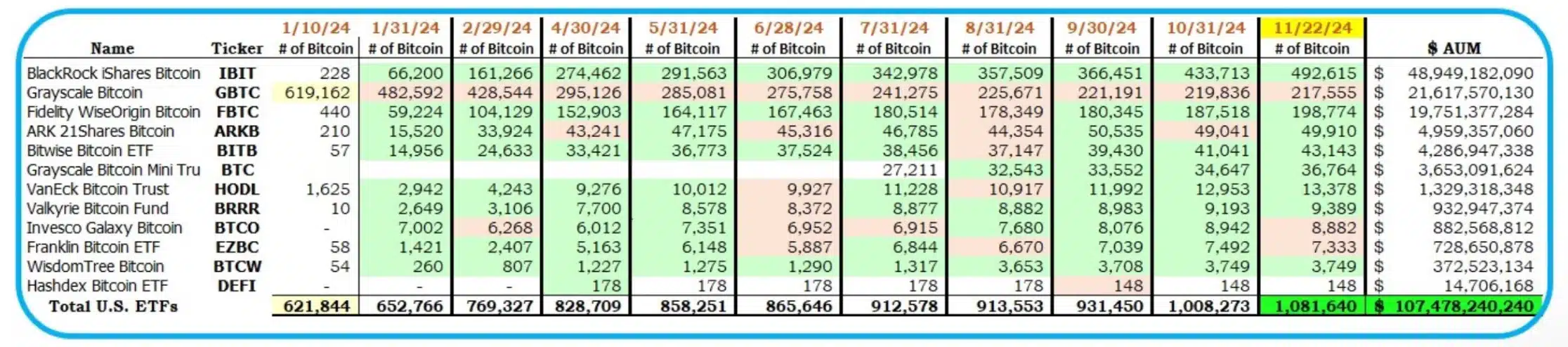

In between the flood of Bitcoin ETF inflows, BlackRock’s IBIT has emerged because the front-runner, recording a formidable $513.2 million on the twenty second of November and $608.4 million on the twenty first of November.

Following intently behind is Constancy’s FBTc, solidifying its place out there. Nevertheless, not all Bitcoin ETFs are seeing development, as Grayscale’s GBTC skilled outflows, dropping $67.1 million on the twenty second of November.

Will they surpass Satoshi Nakamoto’s holdings?

Regardless of this, the collective inflows into spot Bitcoin ETFs are making headlines, with discussions rising about these funds nearing a big milestone and changing into the most important holders of Bitcoin globally.

Knowledge instructed its potential of surpassing even the legendary Satoshi Nakamoto, whereas additionally closing in on gold ETFs in whole internet property.

Remarking on the identical, Bloomberg’s Senior ETF Analyst, Eric Balchunas famous,

“US spot ETFs now 98% of manner there to passing Satoshi as world’s largest holder. My over/below date of Thanksgiving wanting good.”

He added,

“If subsequent 3 days are just like the previous 3 days flow-wise it’s a accomplished deal. Additionally at $107b aum they solely lag gold ETFs by $23b, good shot to surpass by xmas.”

Journey thus far

Properly, since their debut in January, U.S. spot Bitcoin ETFs have skilled speedy development.

As of current estimates from crypto analyst HODL15Capital, these funds collectively held round 1.081 million BTC, bringing them tantalizingly near Satoshi Nakamoto’s purported 1.1 million Bitcoin holdings.

Supply: HODL15Capital/X

Nakamoto, the elusive creator of Bitcoin, is believed to personal about 5.68% of the full Bitcoin provide, with their holdings valued at over $100 billion.

Due to this fact, if Nakamoto have been a dwelling, single particular person, these huge holdings would place them among the many wealthiest individuals on this planet.

The yr 2024 and Bitcoin

Evidently, Bitcoin’s exceptional efficiency in 2024 has solidified its place as a dominant power within the monetary panorama.

With a 160% surge since January, BTC is now approaching the $100,000 mark, whereas its market capitalization of $1.91 trillion surpasses that of silver and business giants like Saudi Aramco.

Regardless of this spectacular development, Bitcoin nonetheless trails gold, the world’s largest asset, with a market cap exceeding $18 trillion.

These developments spotlight Bitcoin’s rising prominence but additionally underscore its ongoing journey to problem conventional property like gold for the highest spot.