Bitcoin, Ethereum ETF reshaped: Grayscale finalizes reverse share splits

- Grayscale carried out reverse share splits of Bitcoin and Ethereum ETF.

- Choices buying and selling for the agency’s BTC ETFs will begin immediately.

Grayscale Investments, a digital forex asset supervisor, has finalized reverse share splits for its Bitcoin [BTC] Mini Belief ETF (BTC) and Ethereum [ETH] Mini Belief ETF.

The adjustments took impact on the twentieth of November, following the reverse share splits executed the earlier night.

David LaValle, Grayscale’s World Head of ETFs, acknowledged in a current blog put up,

“Primarily based on suggestions from our shoppers, we consider that is the proper choice and useful to our shoppers and the funding group.”

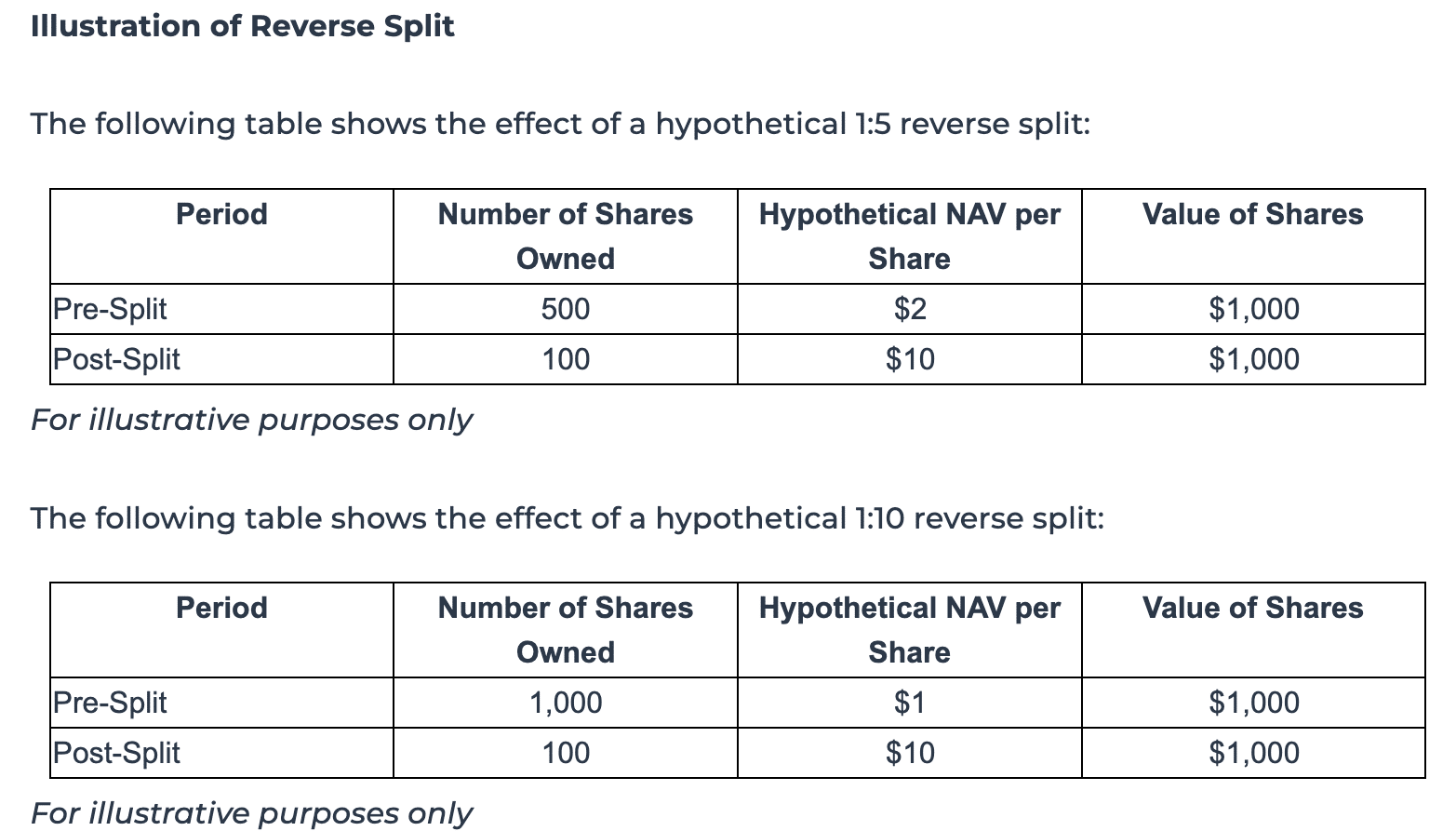

For context, a reverse share break up combines a number of shares into one, decreasing whole shares however elevating the share value.

Implications of the reverse share break up

The agency famous the benefits of reverse share splits, emphasizing their skill to streamline buying and selling and make it extra “cost-effective” for market members.

Because of this newest transfer, Grayscale Ethereum Mini Belief ETF underwent a 1:10 reverse share break up.

This elevated the worth per share to 10 instances its pre-split internet asset worth (NAV) whereas decreasing the variety of shares excellent proportionately.

Equally, Grayscale Bitcoin Mini Belief ETF executed a 1:5 reverse break up, elevating the worth per share to 5 instances its pre-split NAV with a corresponding lower in shares excellent.

Supply: Grayscale

Nevertheless, the asset supervisor highlighted that the shareholders could discover themselves holding fractional shares post-split.

Relying on their Depository Belief Firm (DTC) participant’s insurance policies, these fractional shares can both be tracked internally or aggregated and offered, with shareholders receiving money proceeds.

Notably, fractional shares are ineligible for buying and selling on the NYSE Arca.

Grayscale’s Bitcoin and Ethereum ETF efficiency

Following the break up, the agency’s ETFs for Bitcoin and Ethereum confirmed combined efficiency, in keeping with Yahoo Finance.

The Bitcoin Mini Belief ETF closed at $41.84, marking a 1.80% improve throughout common buying and selling hours.

Then again, the Ethereum Mini Belief ended at $28.93, representing a depreciation of 0.92%. Nevertheless, it noticed a pre-market rise to $29.58, gaining 2.25%.

BTC ETF choices start buying and selling

The reverse share splits precede a significant growth for the agency. Grayscale is ready to launch the Bitcoin ETF choices for its Grayscale Bitcoin Belief (GBTC) the Mini Belief on the twenty first of November, marking a major enlargement within the U.S. market.

The asset supervisor shared its pleasure about this milestone in a current post on X.

Supply: Grayscale/X

This transfer comes on the heels of BlackRock’s IBIT choices debut, which noticed practically $1.9 billion in buying and selling quantity on its opening day.