Bitcoin – THIS could be the breakout setup that changes everything!

- Merchants piled into Bitcoin forward of robust U.S. jobs knowledge, triggering a $100 million Binance quantity spike.

- Regardless of macro elements, analysts see rising altcoin momentum and potential for a broader crypto breakout.

Merchants rushed into Bitcoin [BTC] forward of the U.S. jobs report, betting massive on a continued rally.

Over $100 million in web taker quantity poured in on Binance alone, simply earlier than the information shocked to the upside. Now, with the Fed prone to maintain charges greater for longer, crypto’s bullish momentum is going through a contemporary take a look at.

Aggressive Bitcoin shopping for on Binance

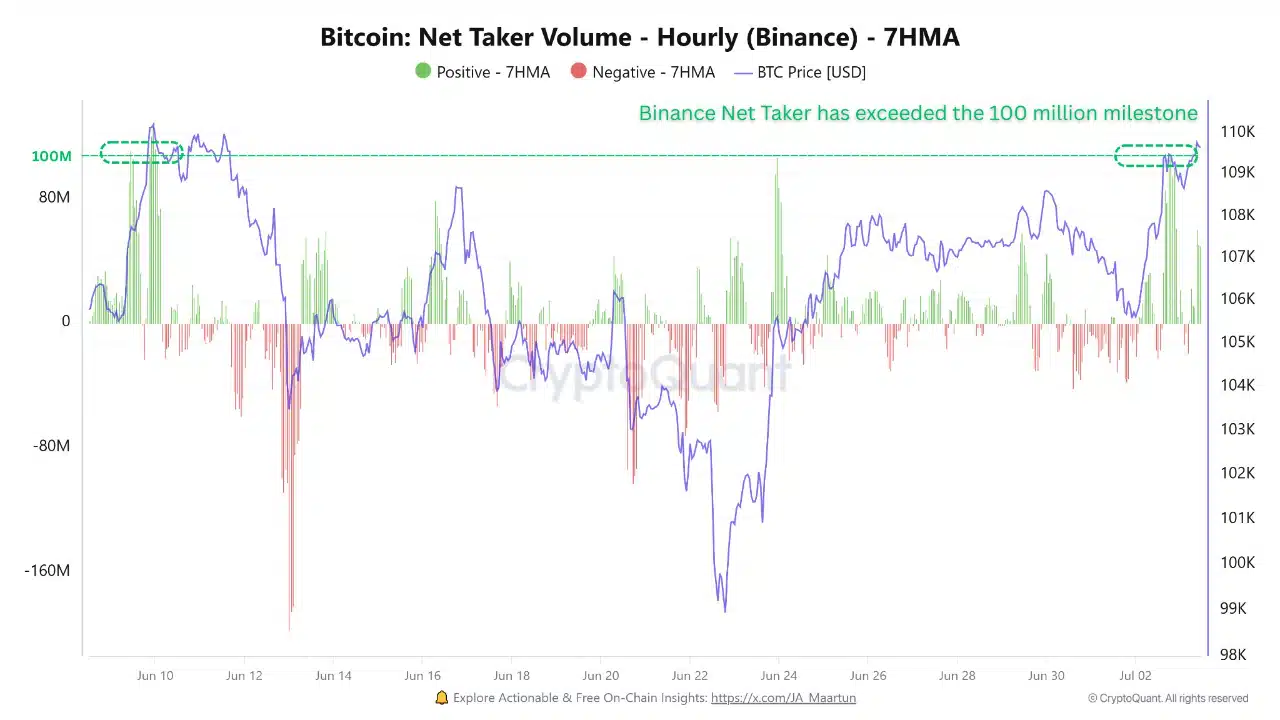

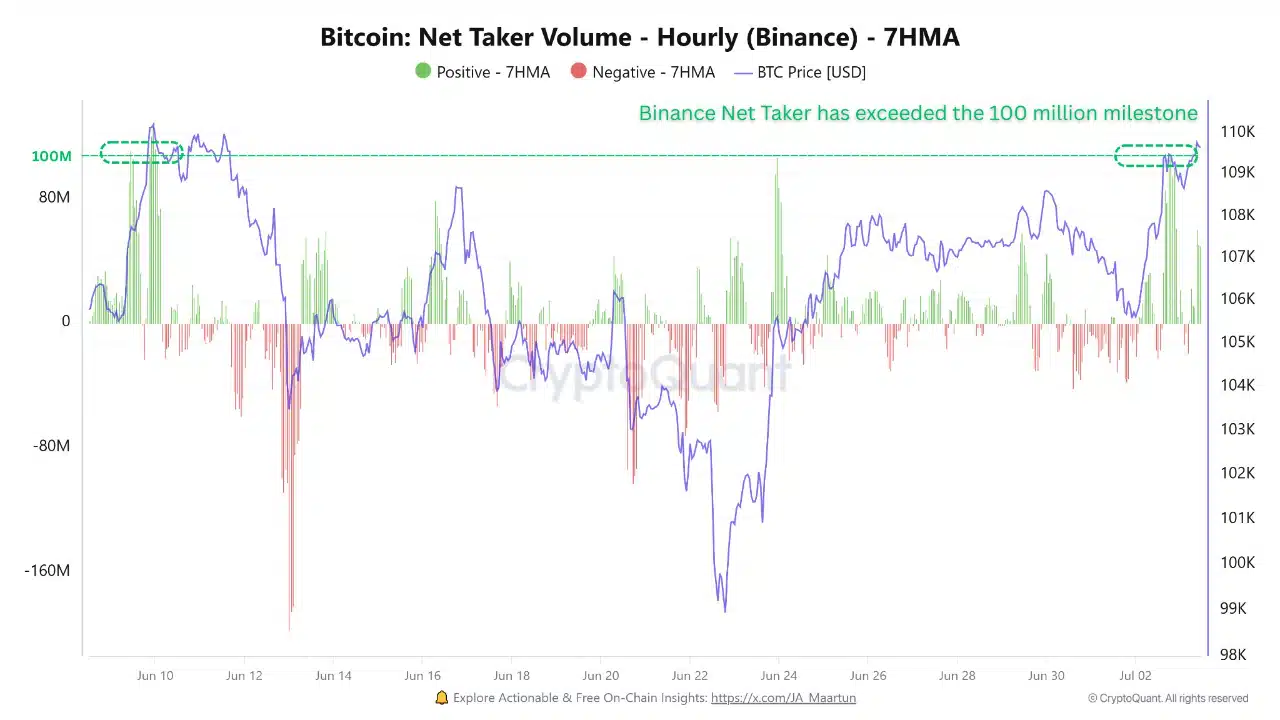

Bitcoin’s Web Taker Quantity on Binance spiked sharply above the $100 million threshold within the hours main as much as the U.S. Nonfarm Payrolls report, as proven within the chart under.

Supply: CryptoQuant

Web Taker Quantity exhibits the distinction between market buys and sells; so this surge means merchants had been aggressively putting purchase orders, not ready on dips.

The timing is essential: the buildup occurred simply earlier than the information launch, suggesting speculative positioning tied to macro expectations.

The pronounced inexperienced bars and steep rise in BTC value present basic FOMO habits, with merchants chasing momentum forward of a doubtlessly market-moving catalyst.

In response to Matt Mena, Crypto Analysis Strategist at 21Shares, risk-on sentiment was evident throughout broader markets.

He highlighted that S&P 500 Futures had been near all-time highs and that Bitcoin appeared range-bound between $108,000 and $110,000, positioned for a possible breakout.

Mena said,

“Maybe most tellingly, Bitcoin dominance has dropped by 3% in latest days to 62% – a sign that the altcoin market is starting to indicate indicators of life.”

Jobs report for upside

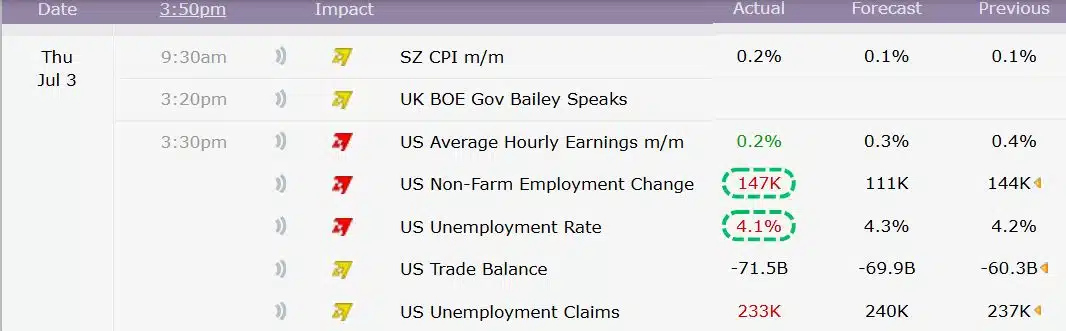

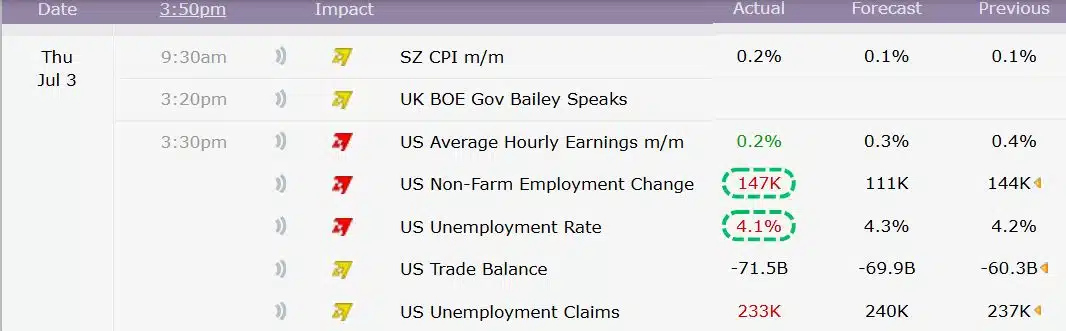

On the third of July, the U.S. labor market delivered a stronger-than-expected efficiency. Nonfarm Payrolls rose by 147,000, considerably above the consensus forecast of 110,000 to 118,000.

In the meantime, the unemployment charge fell to 4.1%, its lowest stage since February.

These upbeat figures spotlight the resilience of the U.S. economic system and recommend that the Federal Reserve might maintain off on easing financial coverage within the close to time period.

Supply: CryptoQuant Quicktake

Consequently, merchants shortly adjusted their charge expectations: Fed funds futures now present a 95% chance that the central financial institution will preserve charges unchanged at its July assembly, up from 75% earlier than the information launch.

Mena famous that the mixture of robust financial knowledge, enhancing investor sentiment, and potential regulatory readability may create excellent situations for digital belongings.

He added,

“For Bitcoin, that might imply a decisive breakout towards $200,000 and past,”

He additionally highlighted that altcoins may benefit much more as capital begins to rotate throughout the broader market.

Bitcoin bulls vs. a stronger greenback

Merchants loaded up on Bitcoin earlier than the roles report, however the knowledge now factors to a harder backdrop.

A robust labor market means the Fed is prone to preserve rates of interest excessive, which helps a stronger U.S. greenback.

That’s normally unhealthy information for Bitcoin – traditionally, robust jobs numbers and fewer charge cuts have pressured crypto costs.

So whereas bullish bets are rising, the macro surroundings may work in opposition to them, making a dangerous setup for merchants. Mena concluded {that a} runway is forming, saying,

“With labor markets secure, inflation cooling, and liquidity on the horizon – each conventional and digital threat belongings are responding accordingly.”