Bitcoin, Ethereum, Solana price predictions – What to expect this week

- Bitcoin and Ethereum have seen a deeper retracement than Solana.

- SOL bulls might need to attend for sentiment to shift of their favor as soon as extra earlier than going lengthy.

Bitcoin [BTC] and Ethereum [ETH] noticed a few of their beneficial properties from earlier this month retraced. Because the halving approaches, we might see a short-term “promote the occasion” sort of drop in costs earlier than bulls decide up the items as soon as extra.

Alternatively, Solana [SOL] maintained its bullish power, though it has additionally slowed down over the previous ten days. AMBCrypto assessed their value charts towards each other to grasp the place costs may very well be headed subsequent.

Bitcoin bulls might need to attend for some extra retracement

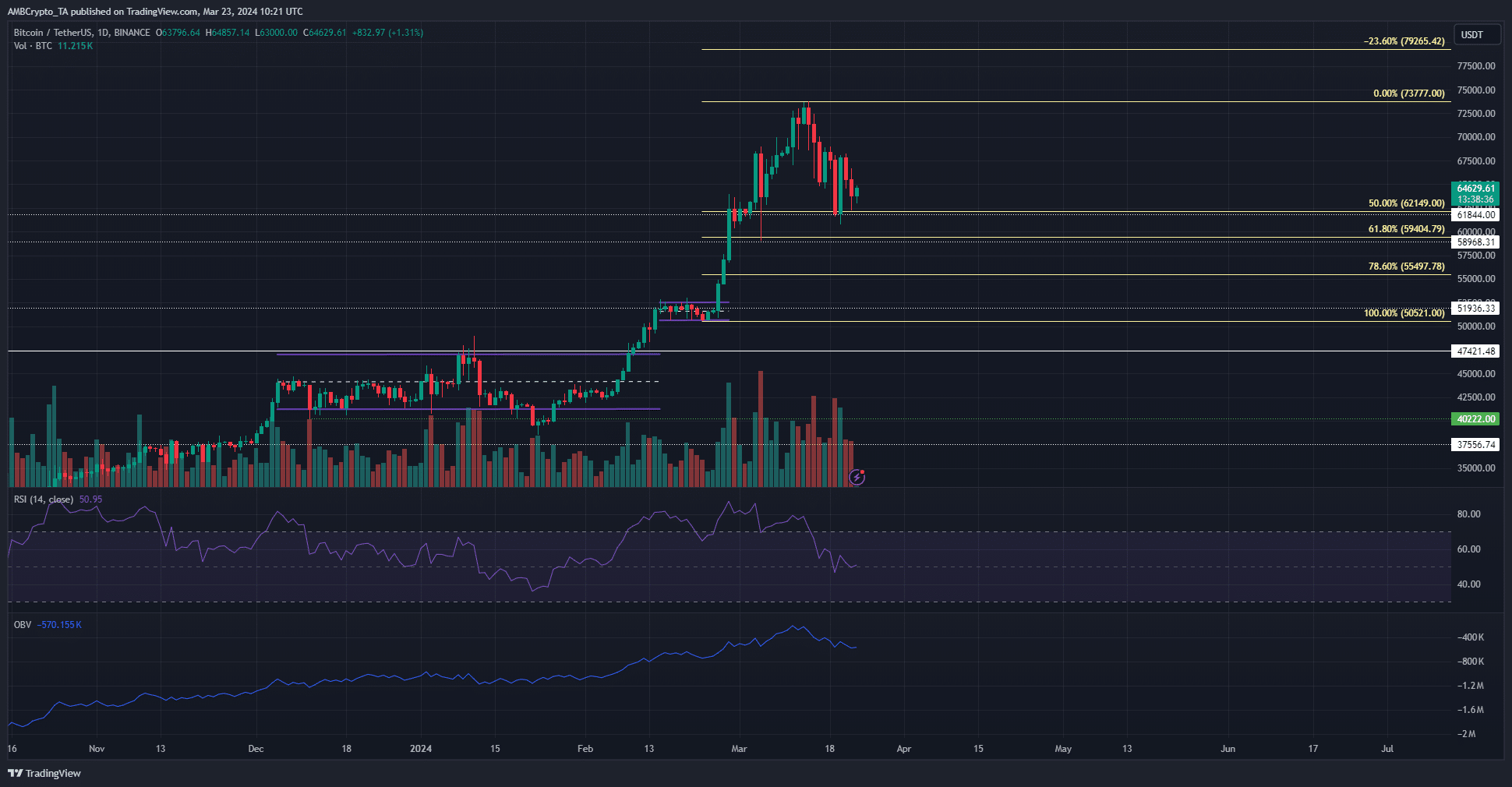

Supply: BTC/USDT on TradingView

The one-day market construction of BTC was bullish. A transfer beneath $50.5k would flip it bearishly, whereas a transfer above $73.7k would sign a bullish continuation. At press time, the $59.4k and $55.5k Fibonacci retracement ranges (pale yellow) have been necessary help ranges.

AMBCrypto expects that considered one of these ranges would probably be examined searching for liquidity earlier than the uptrend can resume. This retest might happen shortly, within the type of a liquidation cascade, or it may very well be a protracted transfer.

The RSI confirmed momentum was impartial and patrons have misplaced their benefit just lately. The OBV additionally approached a help stage in early March. Collectively, it signaled that patrons won’t be capable of maintain costs above the $60k mark.

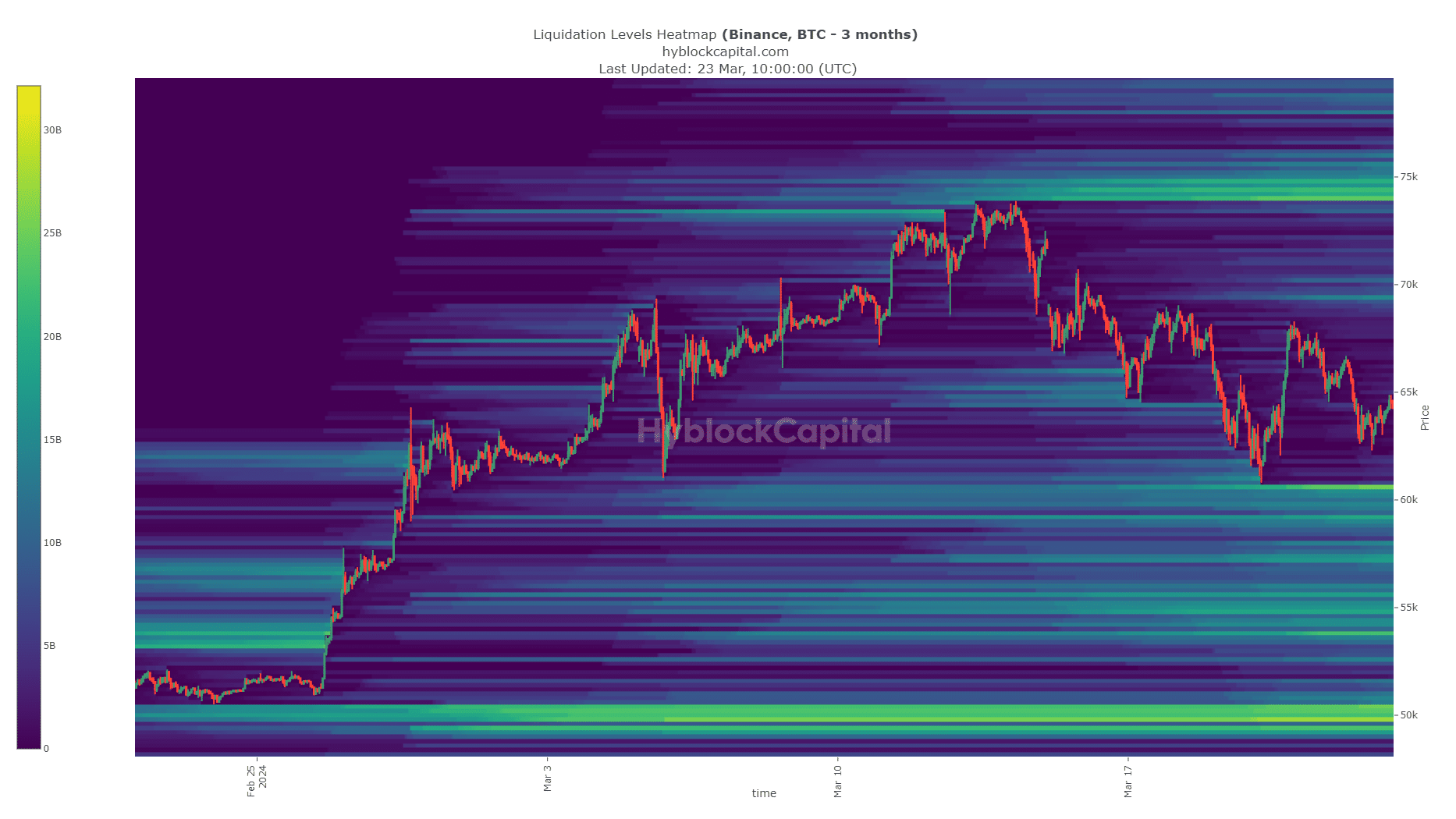

Supply: Hyblock

Analyzing the liquidation ranges confirmed the place BTC may very well be drawn to subsequent. The $50k psychological stage was vivid on the heatmap, however such a drop was unlikely primarily based on the proof at hand.

Nearer to present market costs, the $60.8k, $57.2k, and $55k ranges have been extra attainable targets for the bears. A sweep of those liquidity pockets might pave the best way for Bitcoin to renew its uptrend in earnest.

Ethereum had an ideal retest however confronted rejection anyway

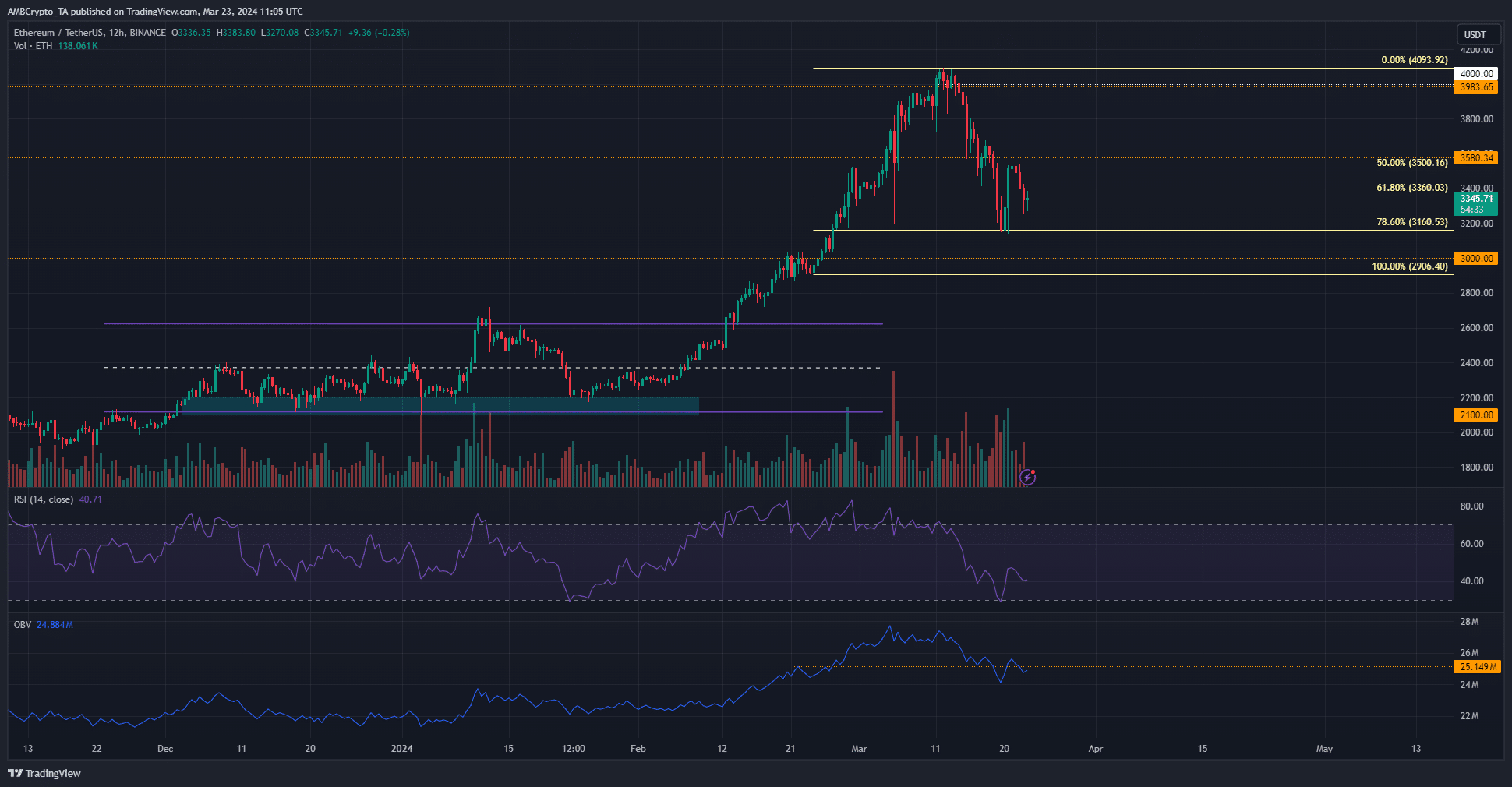

Supply: ETH/USDT on TradingView

In contrast to Bitcoin, Ethereum already examined its 78.6% retracement stage primarily based plotted primarily based on a latest rally. The drop to the $3160 stage noticed a robust, fast bullish response that drove costs to $3580.

But it was not sufficient and the bulls confronted rejection just under $3600. The OBV additionally sank to an area excessive it had made on the twenty first of February when the $3000 mark was a resistance zone.

The RSI has been beneath impartial 50 for the previous ten days and confirmed bearish momentum was robust. Collectively, the indications and value motion confirmed that the retracement was not essentially over. We might see ETH drop to $3160 or decrease as soon as extra.

There was a big pocket of liquidity at $3000 that costs might check shortly.

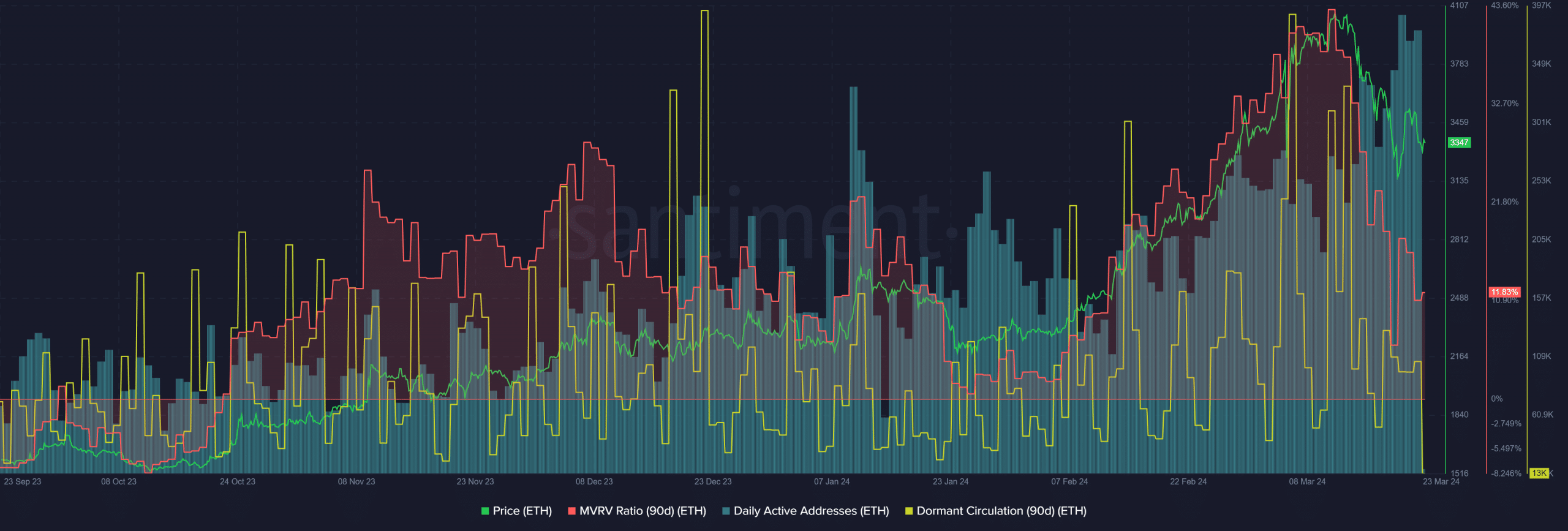

Supply: Santiment

The on-chain metrics have been barely extra encouraging. The MVRV ratio remained optimistic and confirmed holders have been at a revenue. The each day lively addresses metric has been trending increased because the tenth of February.

The dormant circulation metric has been profitable in latest months in marking an area prime. Surges on this metric also can point out panic promoting close to the underside. Subsequently, swing merchants would need to see a pointy drop in costs to key demand zones highlighted earlier.

A spike in dormant circulation alongside this might nicely mark the native backside and a great shopping for alternative.

Solana to $130 or $260 subsequent?

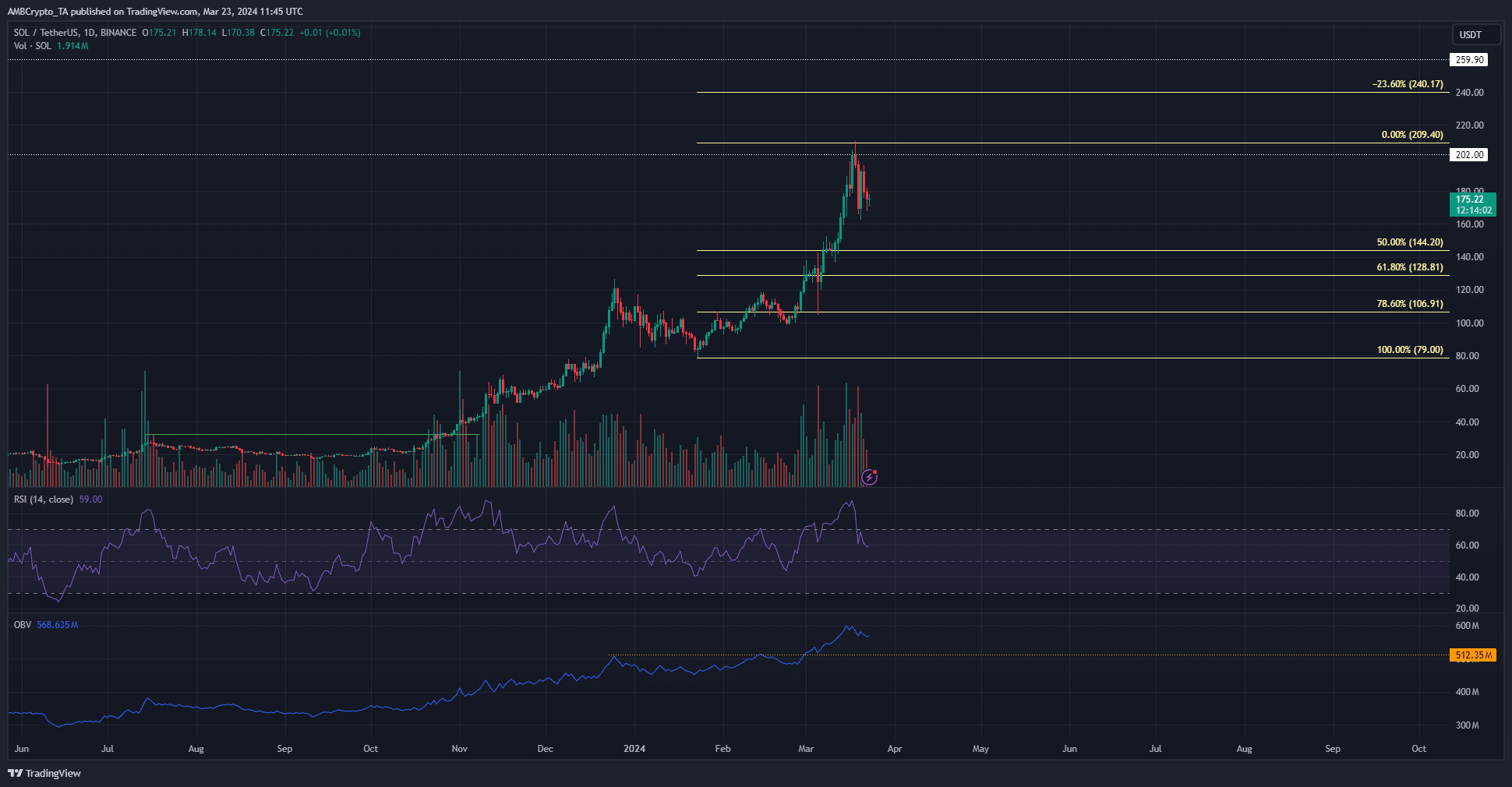

Supply: SOL/USDT on TradingView

Whereas BTC and Ethereum noticed notable retracements, SOL maintained its upward trajectory. It hasn’t closed in on the 50% retracement stage but from the earlier swing low. Though the bulls have been unable to climb above the psychological $200, it nonetheless urged bulls had power.

This was additional bolstered by the OBV staying nicely above a resistance stage it broke after a lot effort late in February. In the meantime, the RSI continued to maneuver above impartial 50 to point out bullish momentum was dominant.

The $106.9 and $128.8 help ranges might nonetheless be retested if Bitcoin falls beneath the $60k mark. Nonetheless, the indications don’t recommend that such a deep retracement was probably within the coming days.

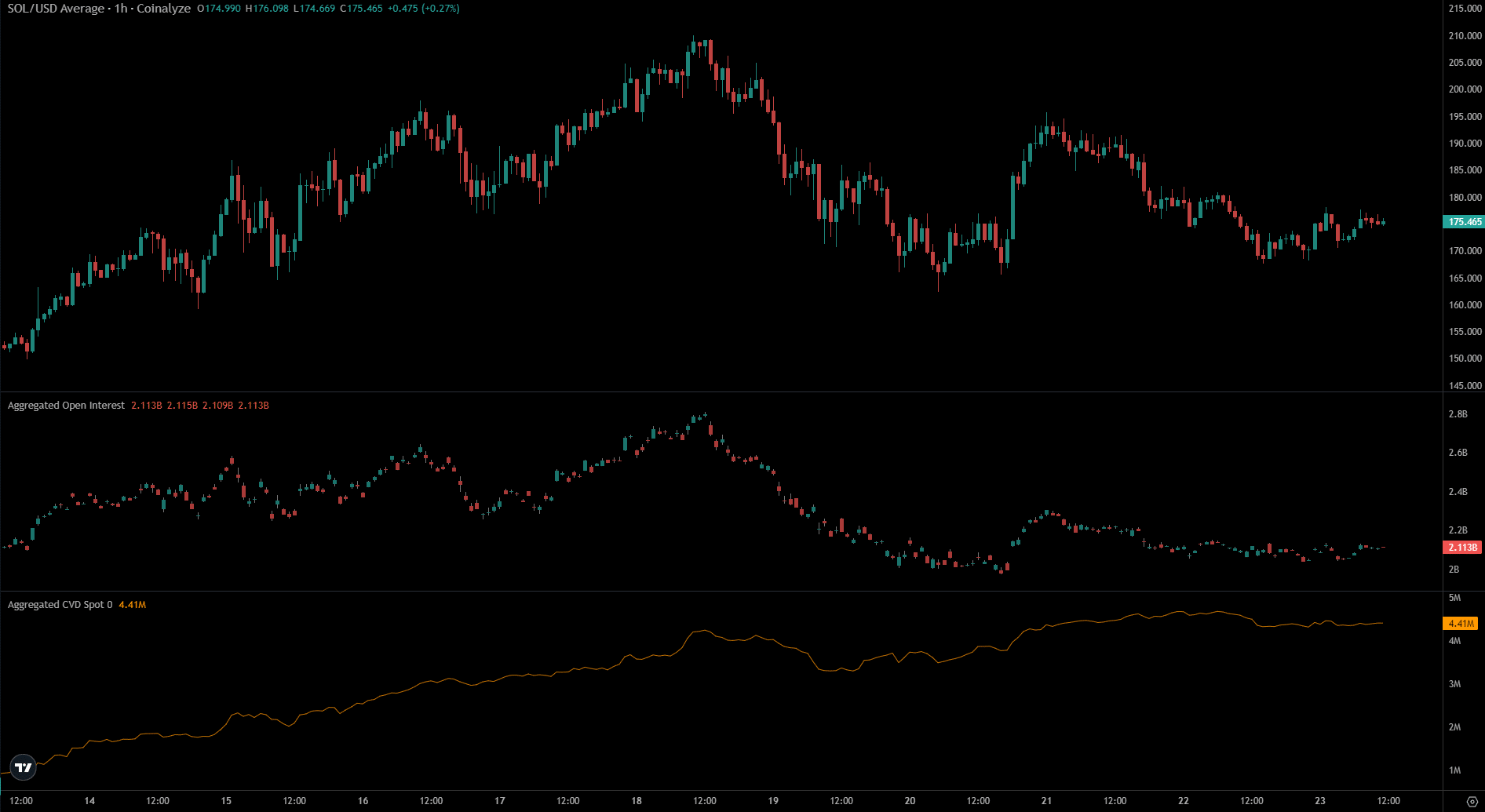

Supply: Coinalyze

The spot CVD has moved sideways over the previous two days, however was in an uptrend earlier. The spot demand slowed down alongside the Open Curiosity as costs remained beneath $200 over the previous week.

This urged that bullish conviction was not robust but, but in addition that promoting stress has not been outstanding within the spot markets. The bulls might pull off a restoration, offered sentiment behind BTC might shift bullishly as nicely.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

Total, all three markets had a long-term bullish bias. A Bitcoin transfer again above the $73k stage seems to be a query of when, not if, given the latest demand.

Over the approaching months, the losses of the previous two weeks may very well be only a blip.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.