Bitcoin & Ethereum – Why traders should pray Hong Kong saves the day

- Bitcoin and Ethereum recorded a decline in volatility over the previous few days

- Bearish sentiment retained dominance throughout the market

After noting huge fluctuations by way of value over the previous few weeks, each Bitcoin [BTC] and Ethereum [ETH] noticed a interval of stagnancy on the value entrance.

Calm earlier than the storm?

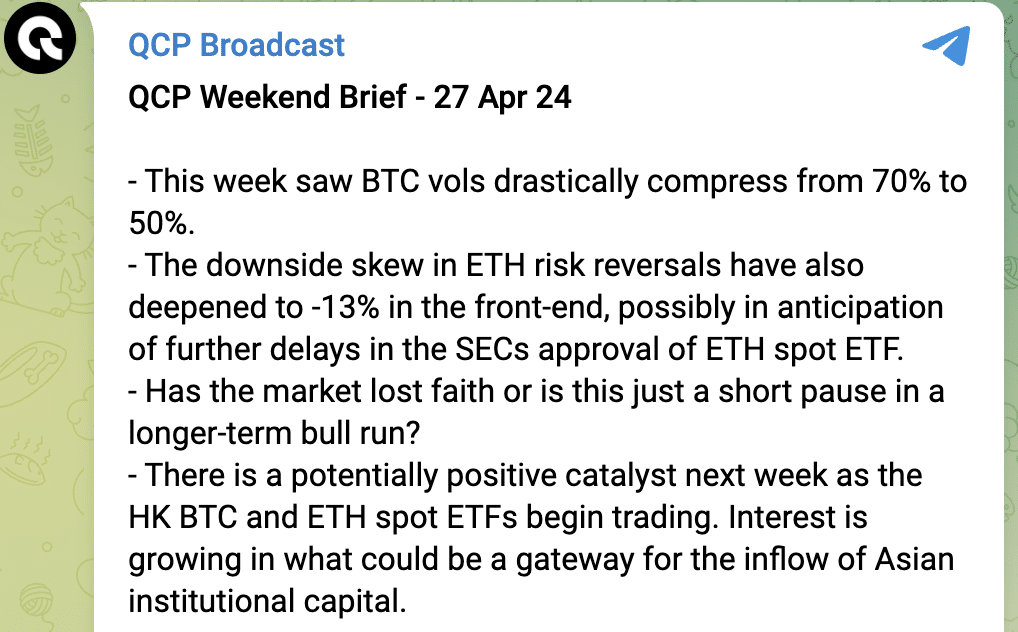

In truth, Bitcoin buying and selling calmed down considerably this week, with volatility dropping on the again of buying and selling volumes being compressed from 70% to 50%.

When a market is consolidating, many merchants favor to build up lengthy positions. Regardless of this development, nonetheless, most merchants have determined to be bearish so far as BTC and ETH are involved.

One of many causes for a similar is that the market appears to be anticipating additional delays within the U.S Securities and Trade Fee’s (SEC) approval of a spot Ethereum ETF. That is mirrored within the deepening unfavourable skew of ETH danger reversals, which now stand at -13% within the front-month contract. A unfavourable skew implies that put choices are costlier than name choices for a similar strike value and expiry.

On this context, a unfavourable skew of -13% in front-month contracts suggests a stronger choice for places. This means that buyers are extra apprehensive about potential value declines than they’re enthusiastic about value surges within the close to future.

Supply: QCP

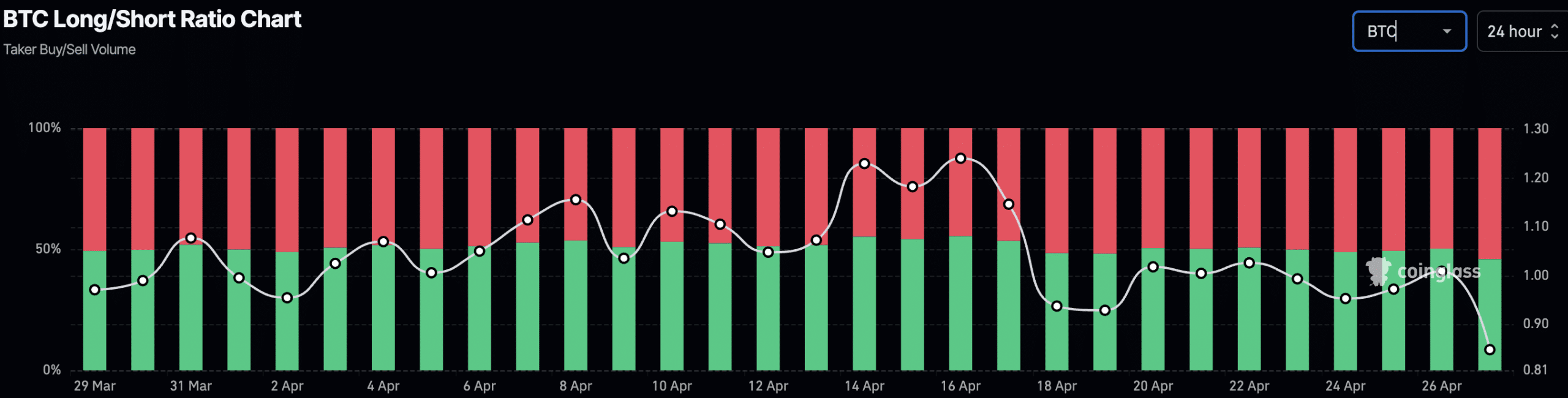

For Bitcoin, the proportion of brief positions taken towards BTC has risen from 49% to 54% within the final 24 hours.

Supply: Coinglass

Nevertheless, there’s a possible vivid spot on the horizon subsequent week. The launch of Hong Kong-based spot ETFs for each BTC and ETH may function a gateway for institutional capital inflows from Asia.

This will assist flip the tides in favor of each BTC and ETH and the bearish sentiment round each these cryptos may fall.

A story of two cash

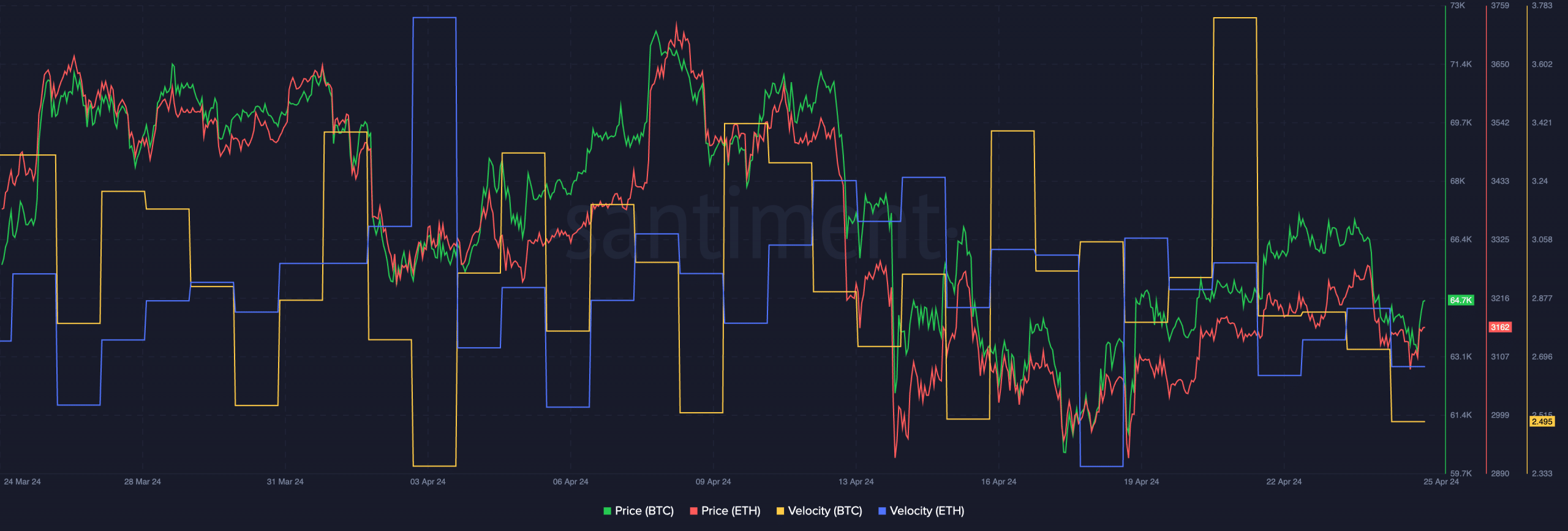

Over the previous few weeks, the value actions of BTC and ETH have been closely correlated. Each the cash have seen some corrections over the previous few days which have added to the bearish sentiment round these cryptocurrencies. Moreover, the rate at which each these cryptos have been buying and selling at has additionally declined these days.

Merely put, the frequency at which BTC and ETH have been being traded fell on the charts.

Supply: Santiment

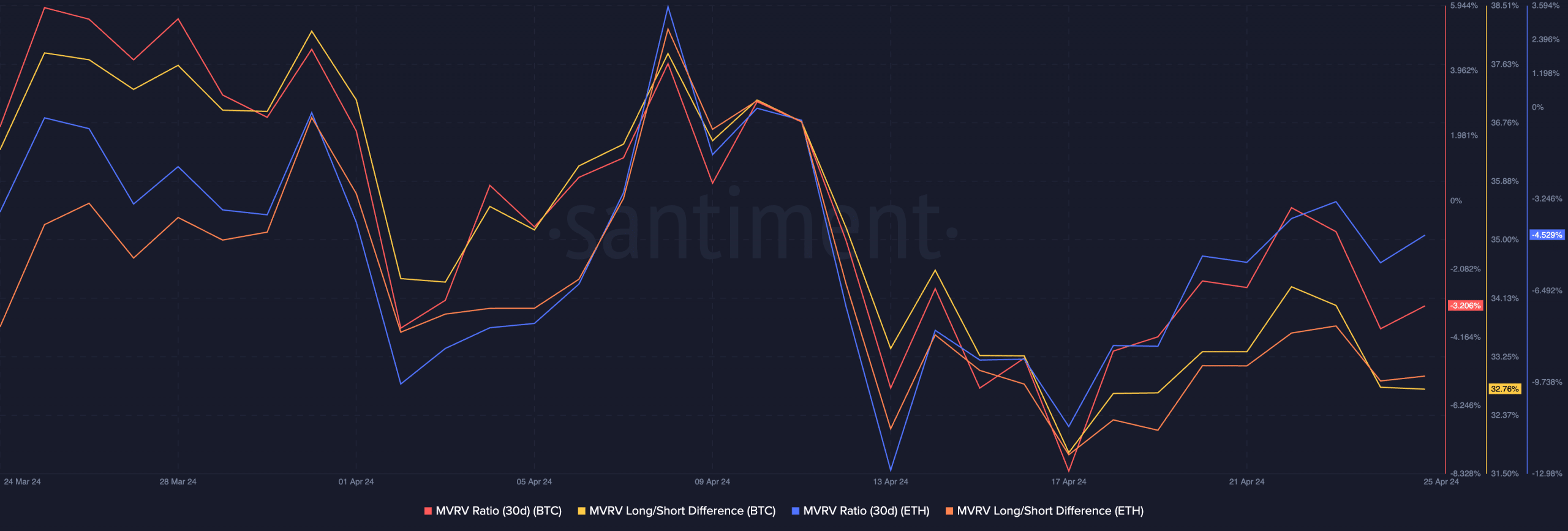

Lastly, the MVRV ratio for each BTC and ETH hiked, indicating that the profitability of most addresses holding these cash was comparatively excessive.

Moreover, the Lengthy/Brief distinction for these cash additionally surged – Signaling that there was a rise in variety of long-term holders of BTC.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Supply: Santiment