Bitcoin exchange balance drop sharply, and that means BTC will now…

- Extra BTC LTHs have bought their holdings previously week.

- The market remained within the “Greed” part regardless of these sell-offs.

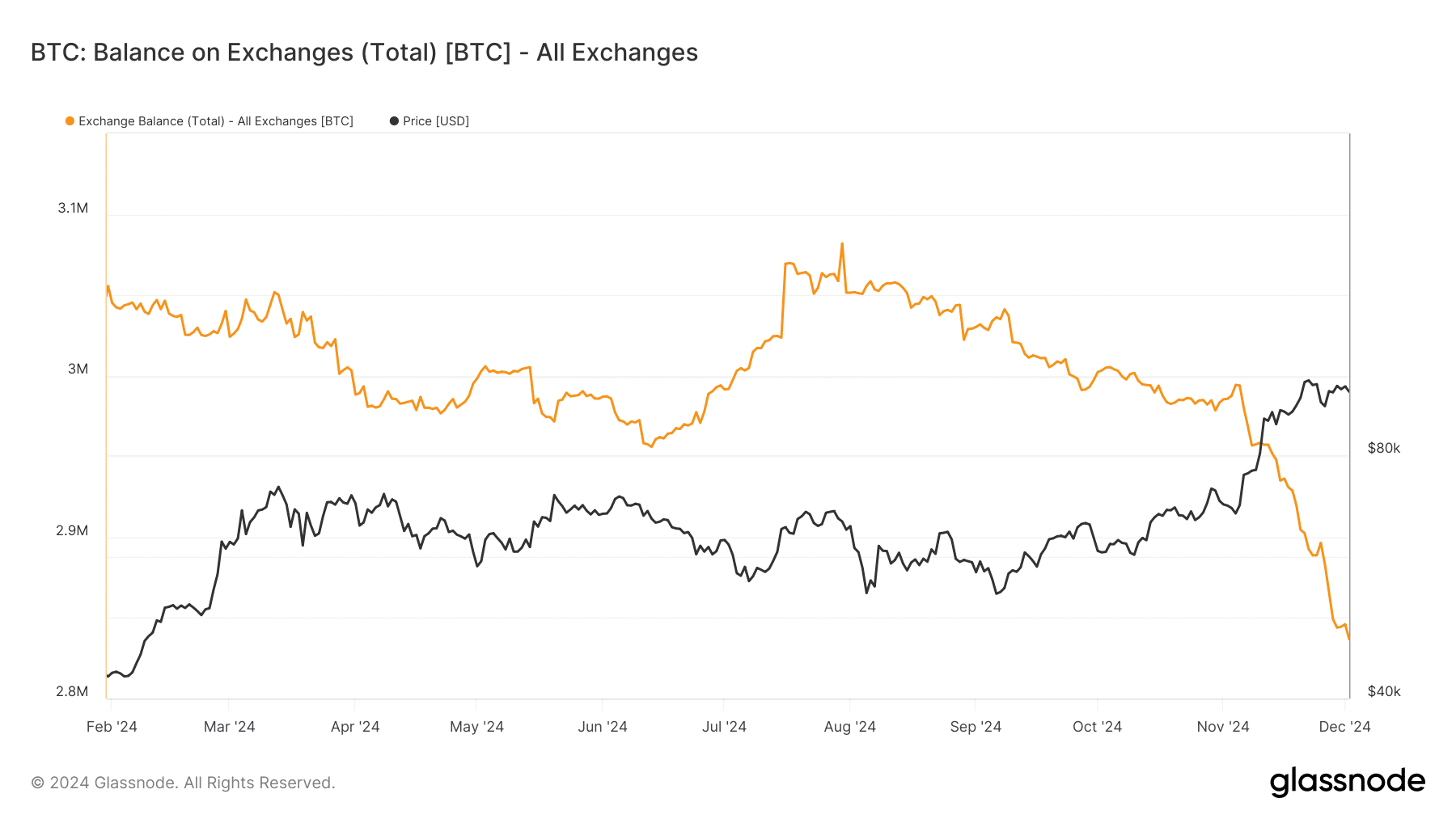

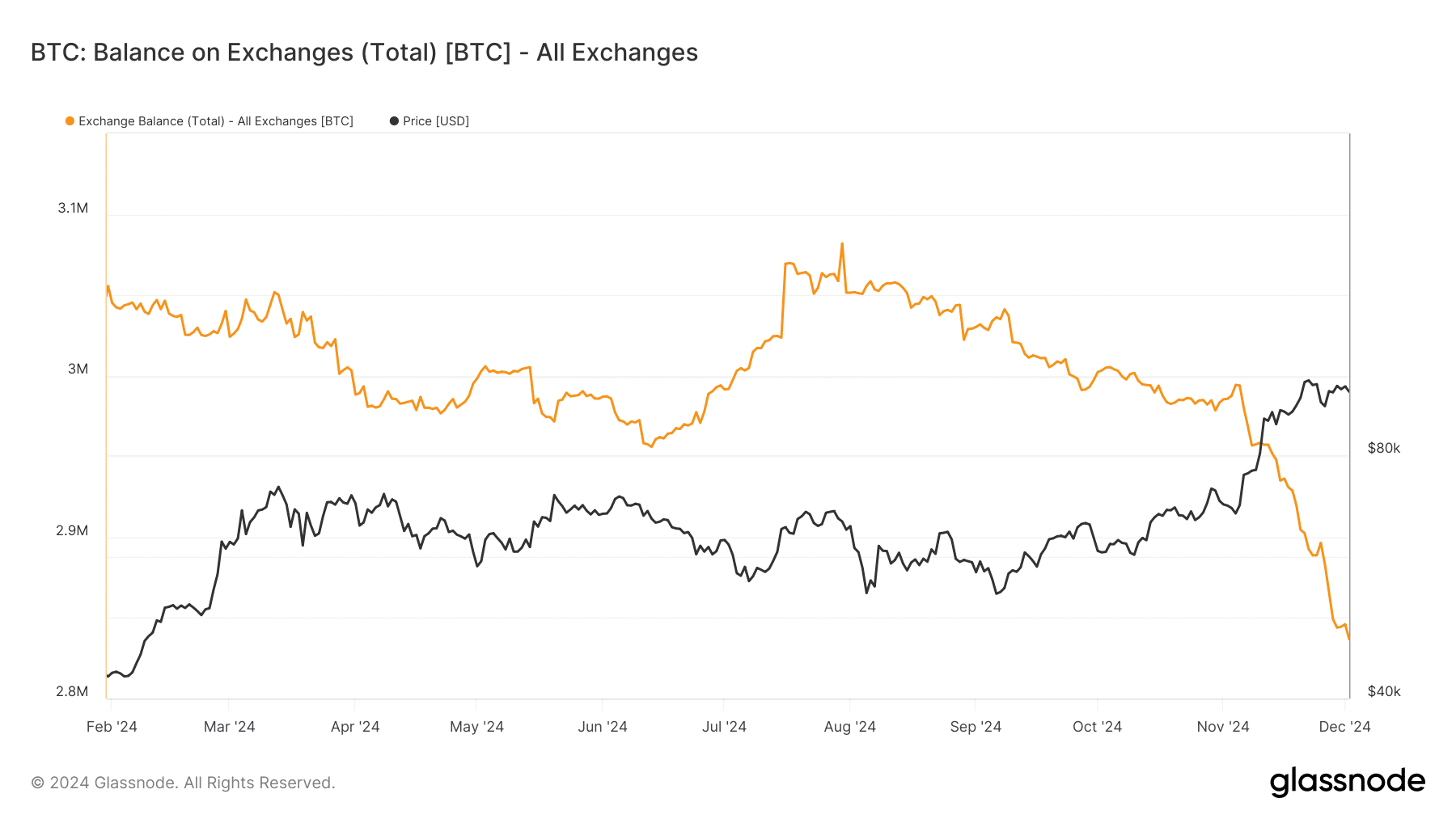

The Bitcoin[BTC] Trade Steadiness has considerably declined, reaching ranges not noticed since early 2023. This sharp drop, mixed with bullish worth developments and adjustments in long-term holder habits, paints a compelling image of present market dynamics.

By analyzing on-chain metrics equivalent to change balances, long-term holder positions, and the Worry & Greed Index, AMBCrypto deciphered what this pattern means for Bitcoin’s worth trajectory and the broader crypto market.

Bitcoin change stability hits multi-year lows

Information reveals that Bitcoin’s complete balance across all exchanges has fallen to roughly 2.8 million BTC, down from over 3.2 million BTC, earlier this 12 months.

This vital discount in change reserves typically correlates with bullish market sentiment, suggesting a decreased probability of promoting strain.

Supply: Glassnode

Traders withdrawing Bitcoin to non-public wallets typically point out long-term holding habits or a transfer towards self-custody, reflecting confidence within the asset’s future worth appreciation.

Apparently, this pattern aligns with Bitcoin’s worth surging above $90,000, highlighting a possible accumulation part by each retail and institutional traders.

The connection between declining change balances and rising costs alerts tightening liquidity on exchanges, which may result in elevated worth volatility if demand spikes.

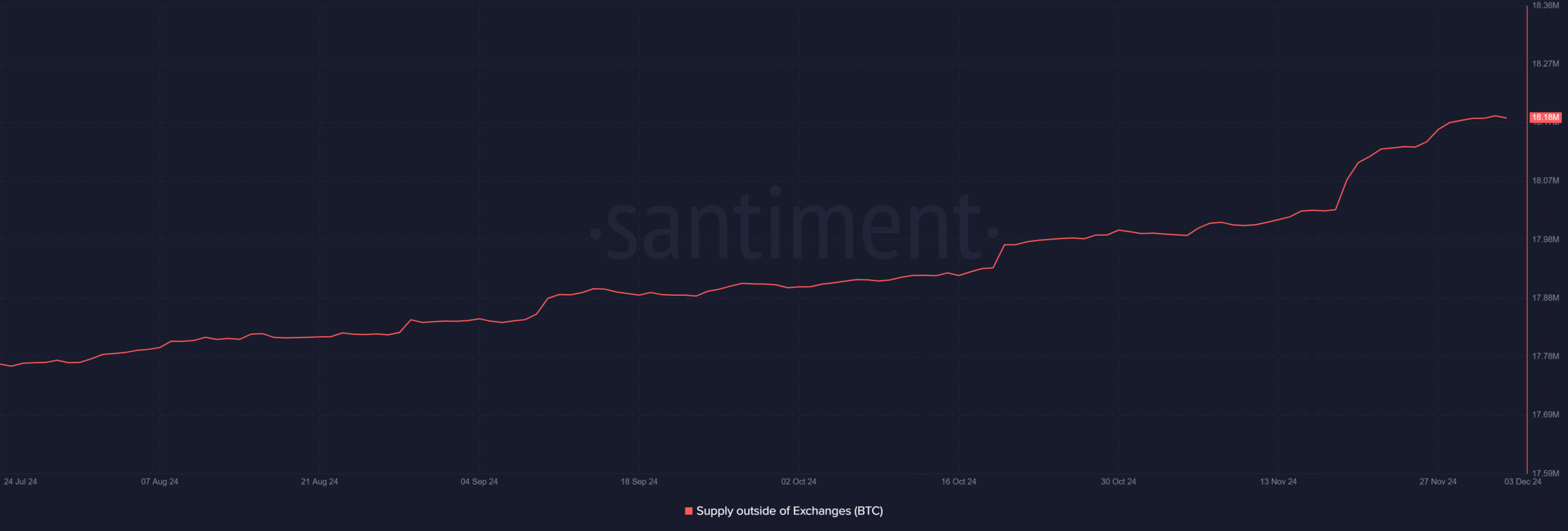

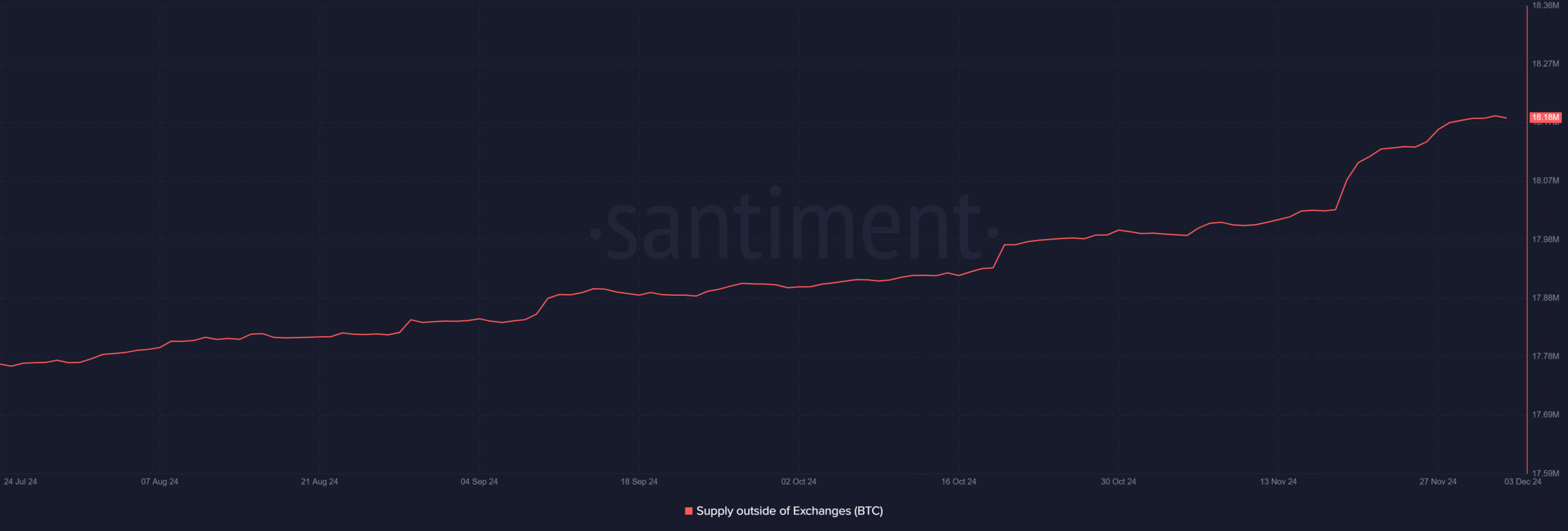

Extra BTC goes off exchanges

Complementing this pattern, the provision of Bitcoin exterior of exchanges has risen steadily, surpassing 18.18 million BTC.

Traditionally, such strikes away from exchanges correlate with lowered promoting strain, contributing to tighter provide dynamics. These components typically create favorable situations for upward worth actions, particularly throughout heightened demand.

Supply: Santiment

Lengthy-term holders shift gears

Evaluation of the Lengthy-Time period Holder (LTH) internet place change reveals an important narrative. After months of accumulation, LTHs have began to cut back their positions. This internet discount signifies profit-taking at present worth ranges, a typical habits throughout bullish market cycles.

Nevertheless, the discount in LTH positions shouldn’t be essentially bearish, as it’s offset by elevated exercise amongst short-term members and a surge in self-custody.

Sentiment stays constructive amid declining stability

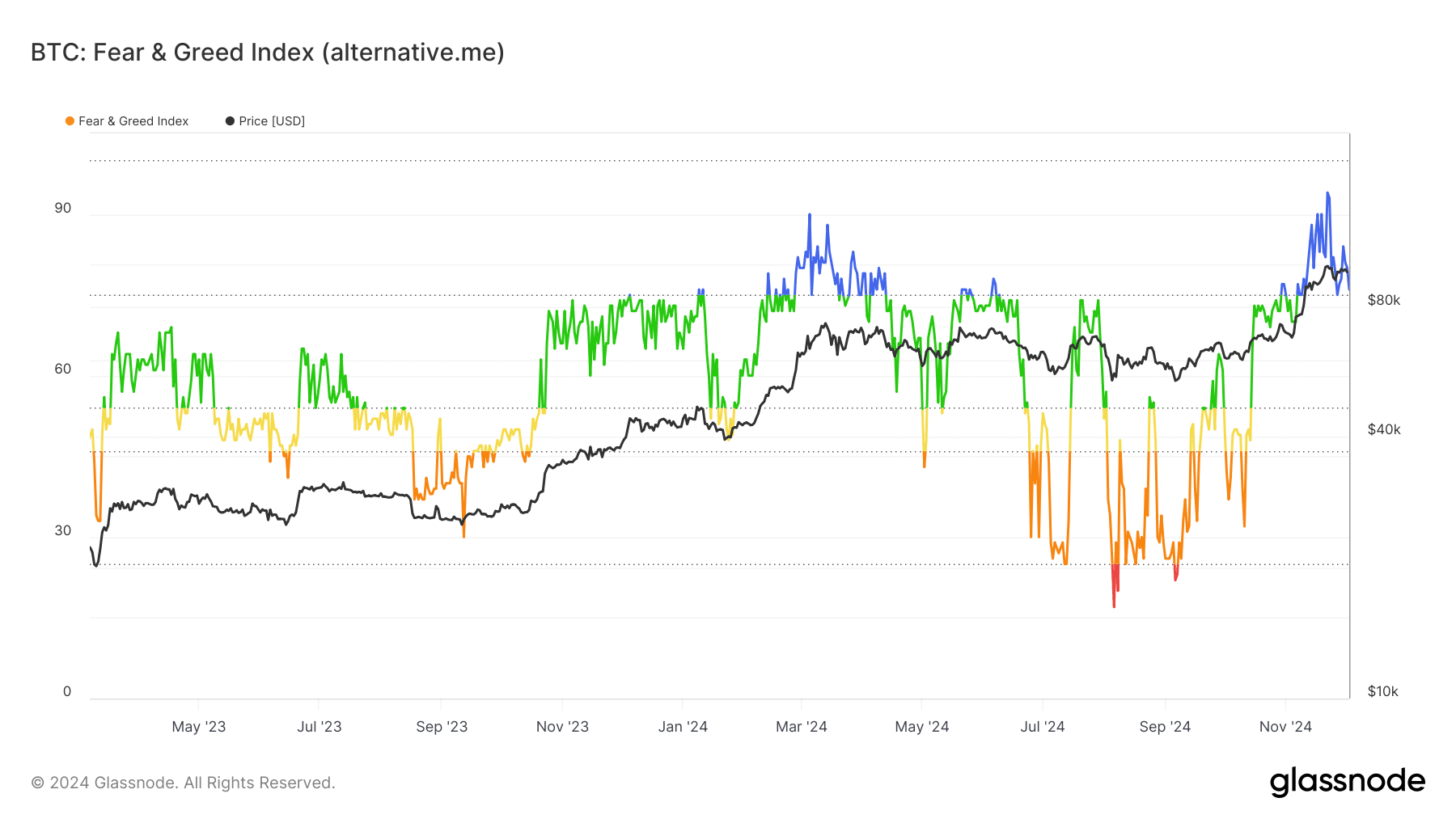

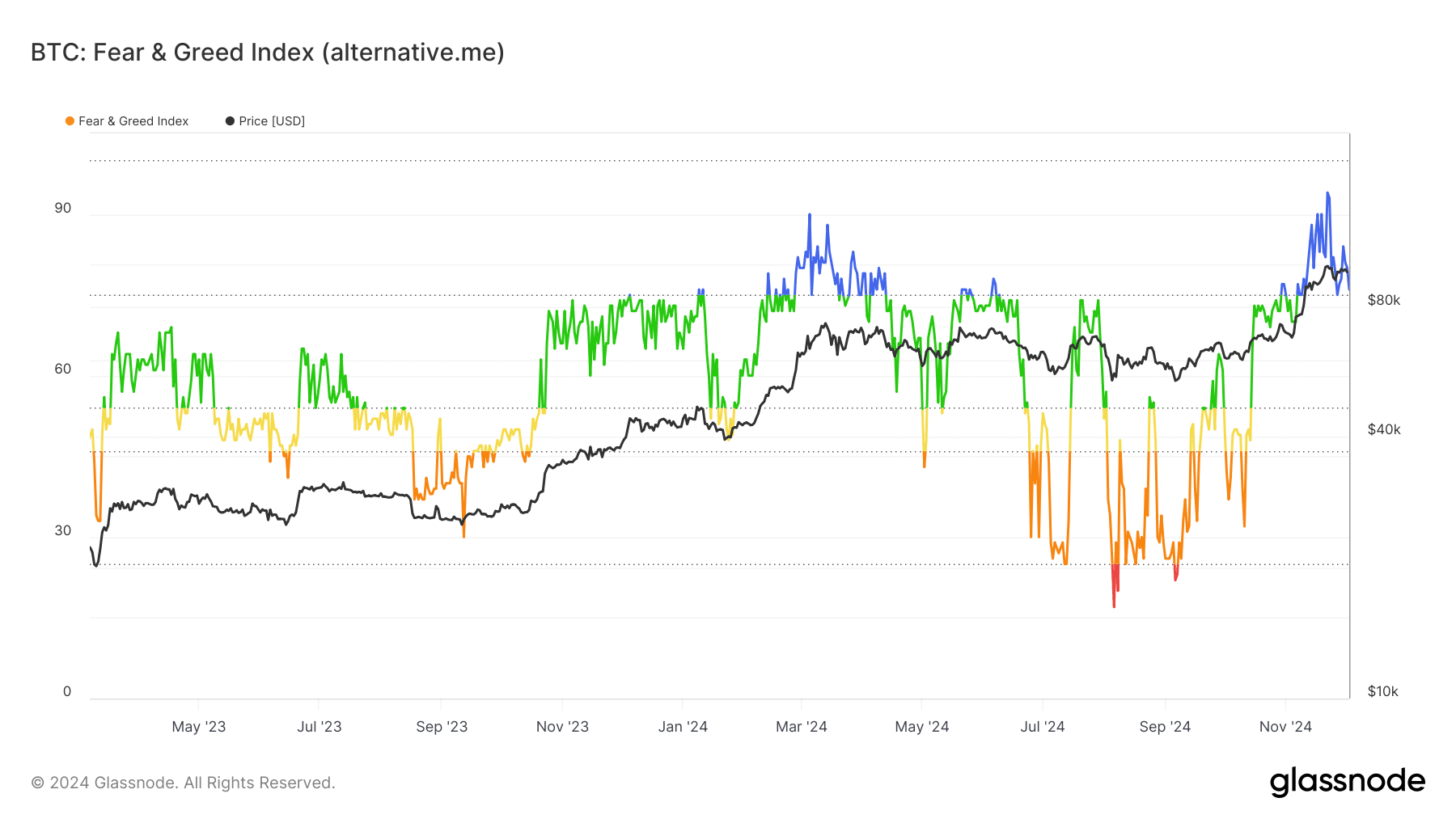

The Worry & Greed Index alerts “Greed,” reflecting Bitcoin’s latest worth highs and bullish sentiment. The index has stayed within the “Greed” or “Excessive Greed” zone for a number of weeks, which is linked to elevated retail participation and speculative shopping for.

Supply: Glassnode

Whereas excessive ranges of greed can sign overbought situations, they’re additionally in line with robust upward momentum within the quick to medium time period.

The pattern and declining Bitcoin Trade Steadiness point out a possible provide crunch that might push Bitcoin costs increased, barring any vital macroeconomic disruptions.

What does this imply for Bitcoin

Bitcoin’s sharp decline in change balances and the corresponding rise in provide exterior of exchanges spotlight a market in transition. The mixture of lowered change balances, profit-taking by long-term holders, and excessive ranges of greed suggests a fancy however bullish market dynamic.

Declining change reserves point out a tightening provide. Nevertheless, profit-taking by long-term holders introduces the opportunity of short-term volatility because the market digests these gross sales.

Learn Bitcoin (BTC) Value Prediction 2024-25

Trying forward, Bitcoin’s means to maintain its bullish momentum will rely on continued accumulation developments, secure macroeconomic situations, and its means to draw new capital inflows.

If the present developments persist, Bitcoin may proceed its climb towards new all-time highs, supported by robust on-chain metrics and constructive sentiment. On the time of writing, BTC was buying and selling at round $95,000.