Bitcoin Faces $33M Exodus As Altcoins Shine

The crypto funding panorama has skilled a notable shift lately, as digital asset funding merchandise noticed their first internet outflows in 11 weeks. This growth was predominantly led by Bitcoin, which had beforehand loved a constant influx into varied crypto funds.

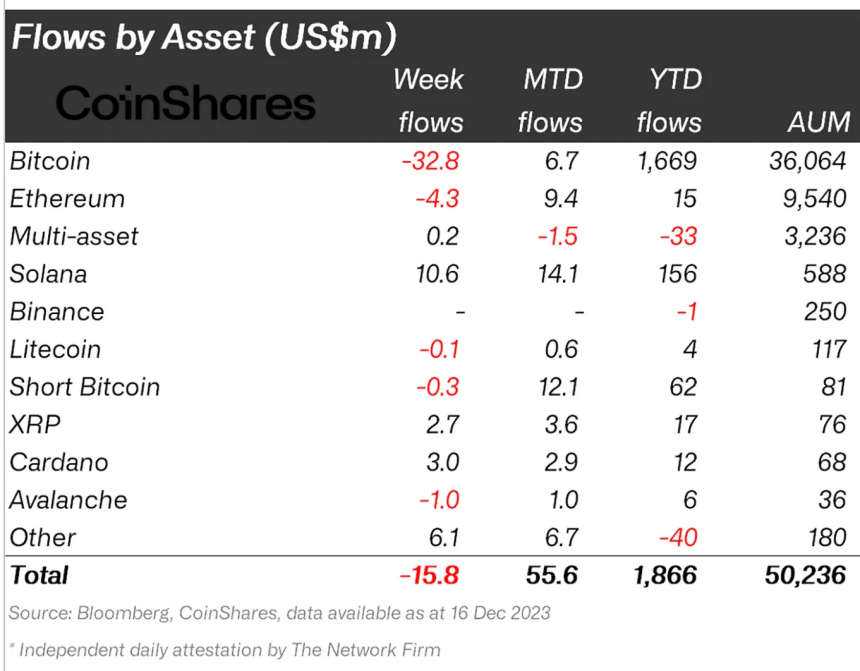

In a latest report by CoinShares, a number one digital asset administration agency, final week marked a break in an 11-week streak of inflows, with a internet outflow of $16 million. This alteration indicators a possible reevaluation amongst traders relating to their positions in digital property.

Bitcoin Funds Encounter Turbulence

Bitcoin-based funds have been on the forefront of this motion, experiencing important outflows. Final week, these funds skilled a internet outflow of $32.8 million, whereas quick Bitcoin funding merchandise additionally noticed a minor outflow of $300,000.

Regardless of this, buying and selling exercise for Bitcoin remained strong, grossing $3.6 billion final week, considerably larger than the $1.6 billion yearly common.

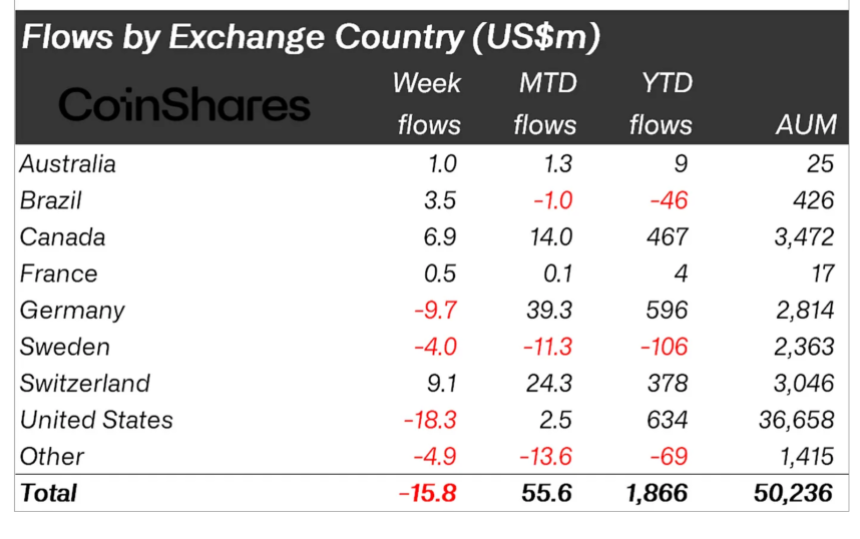

James Butterfill, Head of Analysis at CoinShares, analyzed the outflows and instructed that the online flows have been primarily pushed by the US and German markets, which noticed outflows of $18.3 million and $9.7 million, respectively.

In distinction, markets akin to Switzerland and Canada noticed inflows, indicating a blended regional response that leans extra in the direction of profit-taking somewhat than a wholesale sentiment shift within the asset class, in keeping with Butterfill.

Altcoins Achieve Traction As Blockchain Equities Surge

Curiously, whereas Bitcoin and different main property like Ethereum and Avalanche skilled outflows, altcoins akin to Solana, Cardano, and XRP bucked the pattern. They primarily registered inflows of $10.6 million, $3 million, and $2.7 million, respectively.

These actions underscore the diversification throughout the crypto asset class and spotlight investor curiosity in a broader vary of digital currencies past the dominant Bitcoin and Ethereum.

Blockchain equities additionally mirrored a beneficial sentiment, with inflows amounting to $122 million final week. This marks the continuation of a nine-week streak, accumulating $294 million in whole — the biggest streak to this point.

This uptick in blockchain equities underscores the rising investor confidence within the technological infrastructure underpinning cryptocurrencies.

Relating to value efficiency, the previous week noticed blended outcomes amongst high crypto property. Whereas Bitcoin recorded a comparatively modest decline of 1.8%, XRP and Ethereum noticed extra important drops of 4.4% and three.7%, respectively.

Conversely, altcoins akin to Solana, Cardano, and Avalanche showcased considerable beneficial properties. Avalanche led the pack with a rise of over 10% previously week, adopted by Solana and Cardano with beneficial properties of three.1% and three.6%, respectively.

Featured picture from iStock, Chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual danger.