Bitcoin Faces Potential Drop To $25K, Data Signals Bearish Trend

Bitcoin (BTC) has been experiencing a risky worth motion since late April, with significant fluctuations in its worth. On the time of writing, the cryptocurrency has skilled a 3% decline within the final 24 hours and is at present buying and selling at $28,400. Nevertheless, it has now settled inside an accumulation vary of $27,800 to $30,000.

Bitcoin Bulls Take Warning

BaroVirtual from Cryptoquant just lately shared his analysis concerning the potential draw back targets for Bitcoin. In keeping with the analyst, the bearish divergence of the BTC: On-Chain Summation Index suggests a goal of roughly $27.200. A Head and Shoulders (H&S) sample additionally signifies a decrease vary goal of $25,000.

The BTC on-Chain Summation Index is a metric that tracks the variety of Bitcoin being transferred on the blockchain. When the index exhibits a bearish divergence, it suggests a lower within the quantity of Bitcoin being transferred, which might result in a decline in worth.

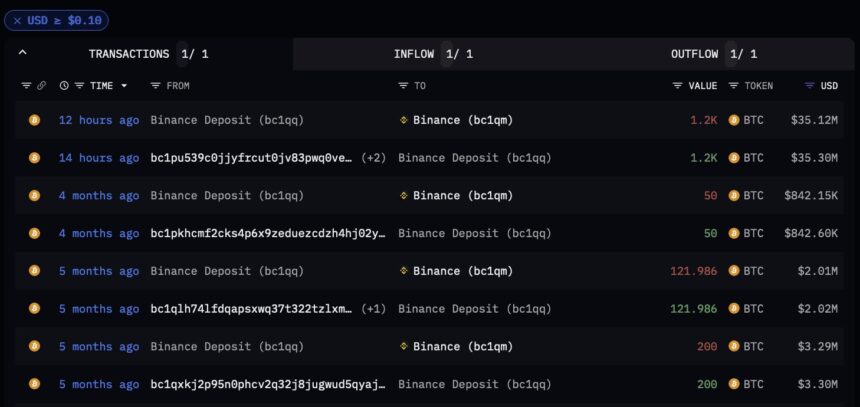

On the identical word, Binance, one of many world’s largest cryptocurrency exchanges, obtained its largest single Bitcoin deposit prior to now week. The deposit, made to an deal with that had remained inactive for 4 months, got here from 5 separate addresses and totaled over 1,200 BTC, value over $35M at present market costs.

Arkham, a blockchain analytics agency that tracks cryptocurrency transactions, reported the information. The agency famous that the deposit was made in a single transaction and that the funds had been despatched to a beforehand unused deposit deal with. Will this translate into an extension of the bearish momentum? It stays to be seen.

Furthermore, according to Materials Indicators, a crypto analytics agency, the current Bitcoin month-to-month candle shut/open has signaled a possible short-term worth correction for the cryptocurrency. The agency’s Development Precognition A2+ algo flashed a brief sign, indicating a possible decline in Bitcoin’s worth, as seen within the chart beneath.

Nevertheless, in line with Materials Indicators, the sign is tentative till the candle closes, and a pump above the April excessive might invalidate it. Moreover, Wednesday’s upcoming U.S. Federal Open Market Committee (FOMC) Federal Reserve rate of interest resolution might catalyze a major worth transfer in both path.

If the Federal Reserve raises rates of interest by 25 foundation factors, it might result in a stronger US greenback and put downward stress on Bitcoin’s worth. Nevertheless, persevering with to pause or keep present charges might increase investor confidence and result in a worth improve for the cryptocurrency.

Though the potential draw back targets predicted for BTC, proof means that the $27,000 mark might help the cryptocurrency and push again the bears. This stage has already demonstrated its resilience as a help ground, holding up nicely towards vital promoting stress since April twenty first.

Featured picture from Unsplash, chart from TradingView.com