Bitcoin flashes ‘buy’ as Binance, Metaplanet accumulate: Good news for BTC?

- The Divergence metric between World Liquidity and Bitcoin has flashed a uncommon inexperienced purchase sign.

- Binance and Metaplanet shopping for BTC as promoting strain decreases noticeably over the previous month.

Logarithmic measurement of the worth of Bitcoin [BTC] and world liquidity throughout the similar scale confirmed intriguing dynamics.

Traditionally, this mixture has seen inexperienced purchase alerts emerge when Z-Rating reached -3 under zero and pink promote alerts developed as Z-Rating climbed above +3.

As an example, Bitcoin noticed its substantial value rise from under $500 to above $1,000 throughout the interval beginning in early 2016 when a transaction sign appeared.

The pink warning signal emerged in late 2017 earlier than Bitcoin reached its most worth at $20,000, which triggered a swift value lower.

Supply: Alpha Extract

In early 2020, the shopping for indicator triggered as Bitcoin surpassed the $10,000 stage, which might later lead to reaching its highest value level ever.

The present inexperienced sign revealed a possibility for a Bitcoin value rise due to rising market liquidity.

Binance and Metaplanet purchase BTC

Institutional buyers like Binance and Metaplanet additionally participated in BTC purchases following a purchase indicator showing out there suggesting potential for an increase in BTC worth.

Binance retains purchasing Bitcoin with the final 24 hours, seeing tokens value $250 million being bought and despatched to the market maker, Wintermute, because the cryptocurrency continues to achieve market presence.

Moreover Binances’s strategic purchase, Metaplanet additionally made further purchases of 150 Bitcoin as per their post on X (previously Twitter).

The acquisition actions of establishments might drive BTC value development by way of elevated market demand and thus each create extra shopping for energy and strengthen market belief.

Prolonged purchases confirmed potential to drive the BTC value greater as a result of they could appeal to further buyers to hitch this rising market.

The shopping for coincides with different establishments like BlackRock and MicroStrategy additionally accumulating BTC throughout the latest dip to $80K.

What’s the impression of lowering promoting strain?

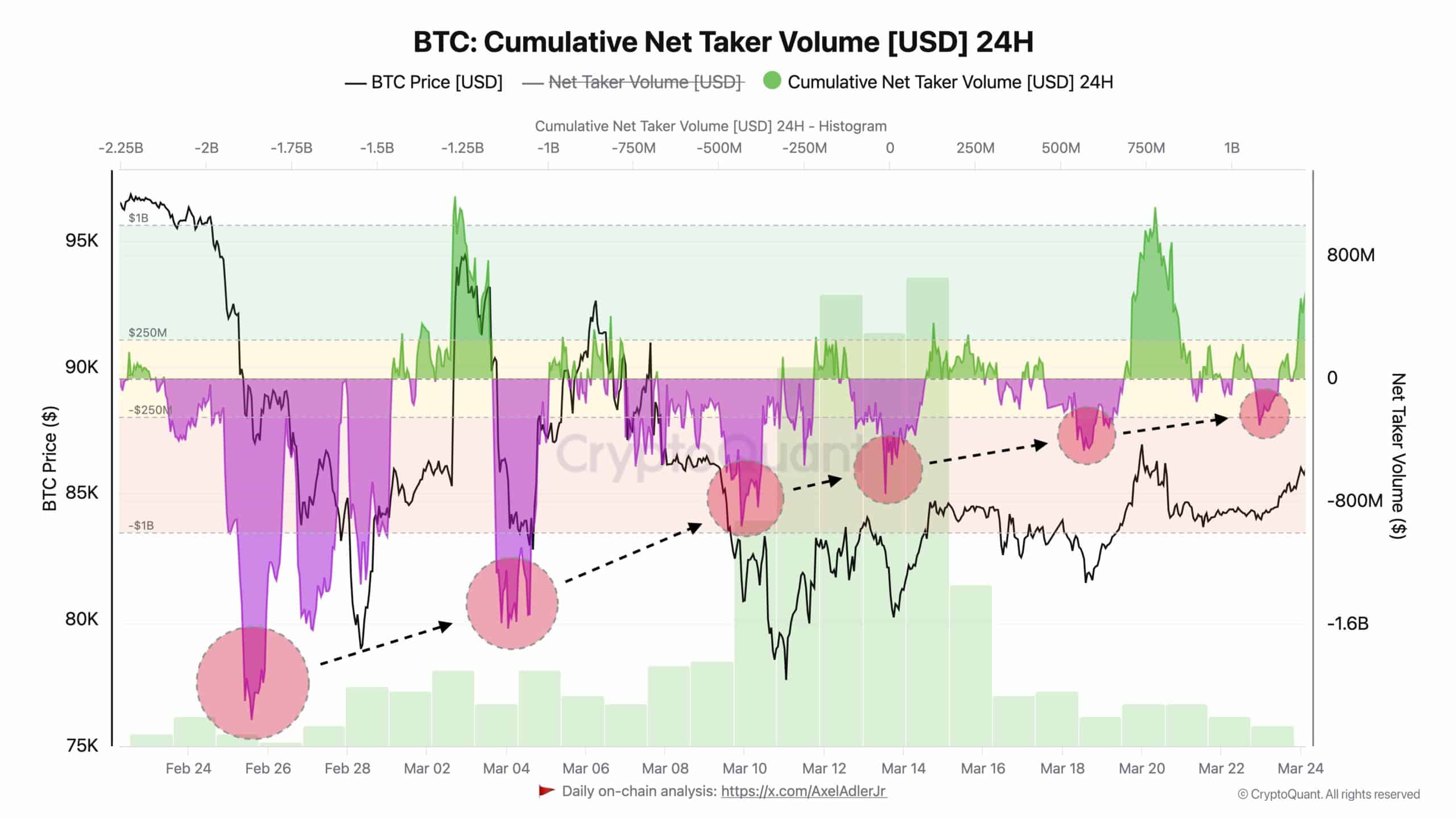

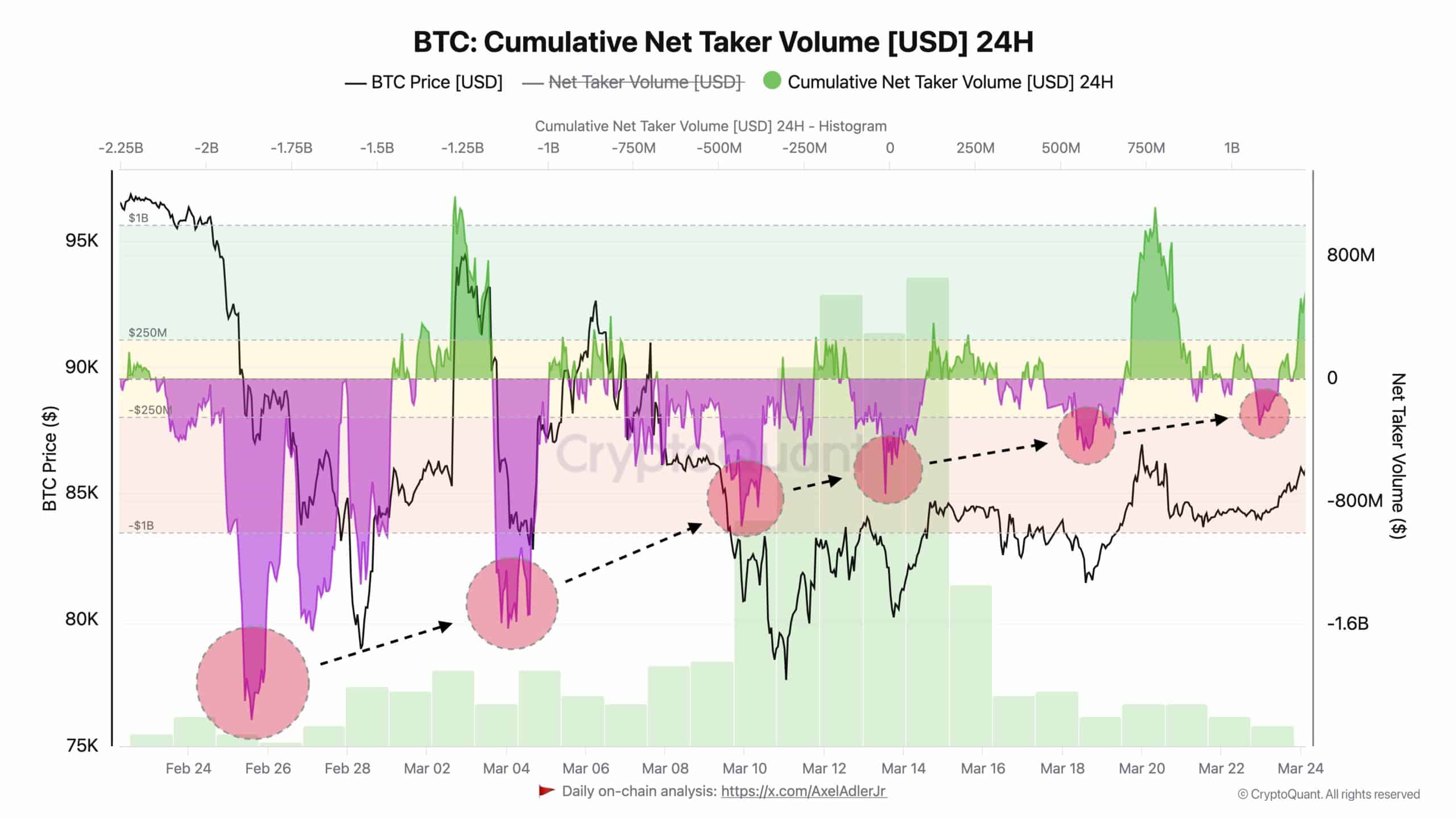

The cumulative web taker quantity additionally indicated how aggressive BTC promoting has decreased since February by way of decrease web taker quantity adjustments.

Since February 24 to mid-March, Bitcoin has confronted large promoting strain that lowered its value from $95K to just about $75K.

Nevertheless, BTC costs have seen stabilization upon every main sell-off occasion after which began to get well slowly.

The unfavorable web taker quantity reached a degree of decline throughout mid-March, which indicated a discount in market promoting exercise.

Supply: CryptoQuant

Subsequently, Bitcoin skilled its value rebound above $85K because the inexperienced cumulative web taker quantity surfaced out there on the twentieth of March.

The absence of main financial slowdown along with managed asset liquidation factors towards cheap BTC value enlargement in accordance with present market patterns.