Hyperliquid NFT adoption remains slow as HYPE drops 18% – What’s next?

- Hyperliquid NFTs remained resilient regardless of HYPE’s 18% drop, however adoption was area of interest.

- Gradual bridging to EVM limits liquidity, elevating questions on long-term NFT market potential.

Hyperliquid’s [HYPE] worth might have taken an 18% hit this week, however the NFT market tied to the protocol appears unfazed — or maybe simply uninterested.

With just one.5% of customers bridging to the Ethereum Digital Machine (EVM) ecosystem, adoption stays sluggish.

Regardless of early-stage initiatives like Hypers and Mechacats exhibiting potential, it’s too quickly to inform in the event that they’ll trip the wave — or sink with it.

HYPE’s 18% drop, NFT quietly soldiering via

Hyperliquid’s native token, HYPE, has confronted a pointy decline, dropping 18% in worth.

Supply: Coinmarketcap

Regardless of this downturn, NFTs related to the protocol, together with Hypers and Mechacats, seem largely unaffected. Not like the token’s worth volatility, these collections proceed to commerce steadily.

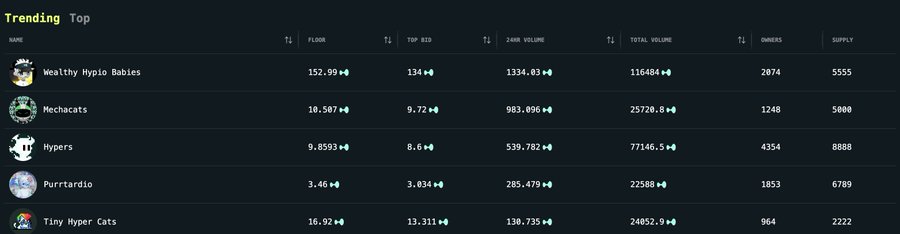

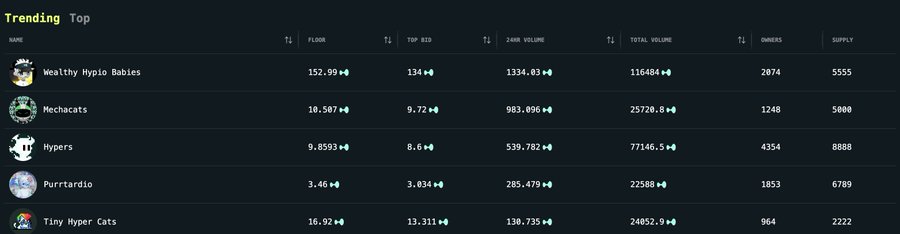

Flooring costs for these NFTs stay intact, with Hypers at 9.85 and Mechacats at 10.50, suggesting a level of resilience. Nonetheless, the shortage of fast worth motion doesn’t essentially point out long-term power.

With just one.5% of customers bridging to EVM, adoption stays gradual, limiting liquidity and potential demand.

Merchants eyeing these initiatives should weigh the dangers: whereas early adoption might be profitable, the ecosystem’s lack of deep engagement presents challenges.

For now, Hyperliquid NFTs look like holding agency, however whether or not they thrive is dependent upon broader consumer participation.

Hypers and Mechacats; Why NFT adoption stays area of interest

Hypers and Mechacats stand out as two of the main NFT projects tied to Hyperliquid, but adoption stays area of interest.

Supply: X

Hypers, with a complete quantity of 77,146, and Mechacats, at 25,720, are among the many most actively traded collections. Nonetheless, liquidity constraints restrict their development potential.

The small fraction of customers bridging to EVM implies that demand is primarily speculative moderately than pushed by utility.

Moreover, NFT adoption within the broader crypto market has slowed, with many merchants specializing in fungible tokens moderately than non-fungible property.

With out deeper integration into Hyperliquid’s ecosystem or further incentives for customers to bridge, these initiatives danger stagnation. However the challenge stays:

If the consumer base isn’t rising at a significant tempo, demand for NFTs will wrestle to realize momentum past the present area of interest buyers.

The highway forward

For Hyperliquid’s NFT ecosystem to flourish, broader adoption is important.

A key problem stays bridging extra customers to EVM — with out this, liquidity will stay scarce, limiting worth appreciation for collections like Hypers and Mechacats.

Incentives, whether or not via staking, governance perks, or distinctive integrations inside Hyperliquid’s ecosystem, may drive participation.

Moreover, partnerships with present NFT marketplaces may expose these initiatives to a wider viewers.

The general market sentiment towards NFTs can even play a job; if the sector experiences a resurgence, Hyperliquid’s digital property may see renewed curiosity.

Nonetheless, if the ecosystem fails to broaden, present buyers might face diminishing returns.

For now, Hyperliquid NFTs stay a speculative play with potential — one which hinges on broader consumer engagement and strategic growth throughout the protocol.