Bitcoin: FUD to the rescue? Data for BTC suggests…

- About 311,000 wallets exited the community within the final 10 days.

- The 30-day MVRV ratio indicated that the coin may produce extra positive factors.

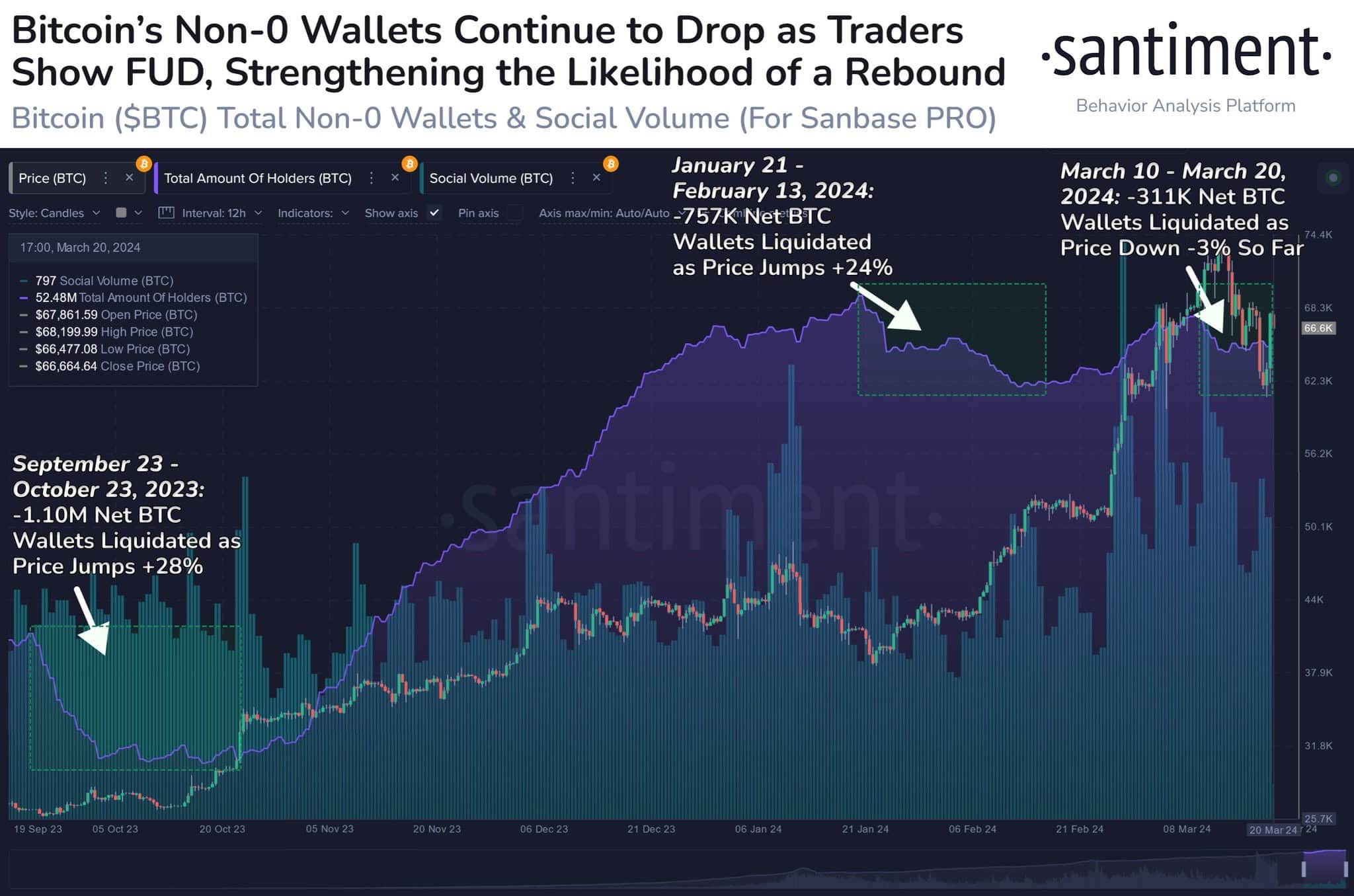

Although Bitcoin’s [BTC] value virtually hit $68,000 once more, on-chain information confirmed that the sooner correction led to vital exits. In keeping with AMBCrypto’s evaluation, 311,00 non-zero addresses left the Bitcoin community within the final 10 days.

Our investigation confirmed that the exodus was a results of Concern, Uncertainty, and Doubt (FUD) as costs collapsed. Nonetheless, those that are aware of the market terrain can affirm that this departure ought to set off panic.

The coin’s showtime isn’t over

As an alternative, it gave whales, the chance to purchase low cost BTC on the expense of these “paper palms.” Past that, Santiment information showed Bitcoin usually positive factors from a state of affairs like this.

As an illustration, between September and October 2023, 1.10 million non-zero addresses left the community. However the ensuing consequence was a 28% value improve.

Supply: Santiment

Likewise, between twenty first January and thirteenth February, some addresses departed. However the value of BTC rose by 24% in a while. At press time, Bitcoin was at a 3% detrimental 10-day efficiency.

If historical past repeats itself, Bitcoin may head towards $83,000 in just a few weeks. Nonetheless, it is usually essential to take a look at BTC from one other angle.

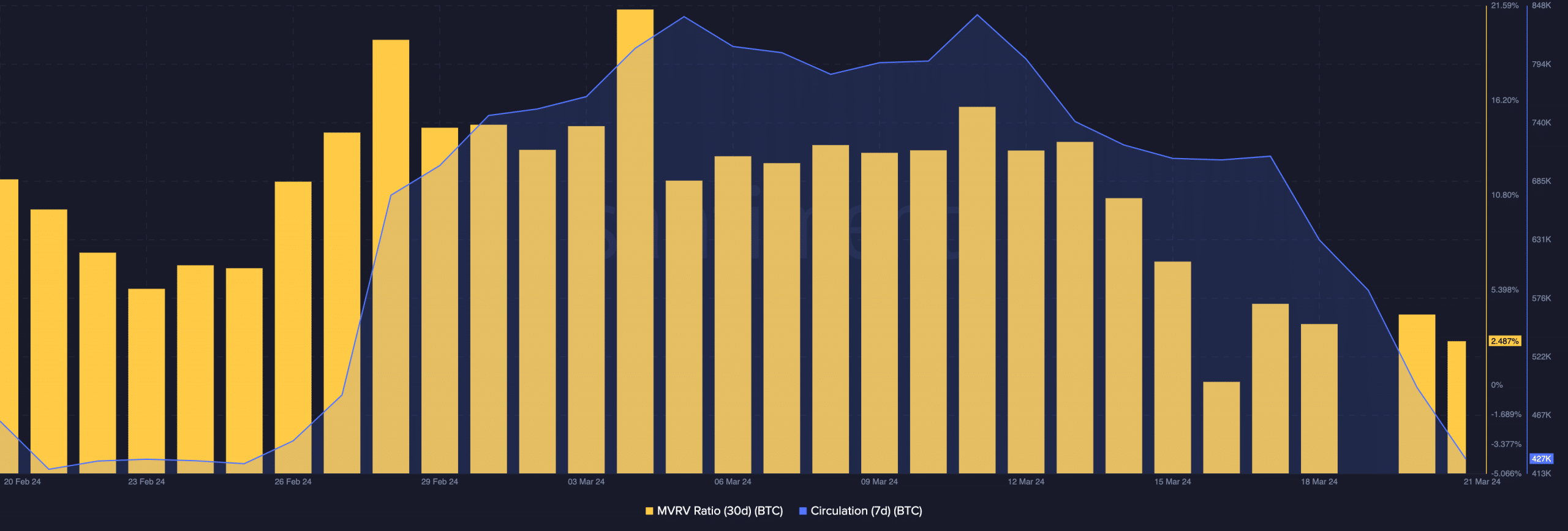

As such, AMBCrypto checked its Market Worth to Realized Worth (MVRV) ratio. Sometimes, the MVRV ratio displays the common revenue or lack of all cryptocurrencies at present in circulation. It additionally signifies whether or not an asset is at honest worth or not.

Will optimism return?

As of this writing, the 30-day MVRV ratio was 2.487%, indicating that BTC holders had been hit arduous by the latest correction. However the situation of the metric looks as if excellent news for the worth. At such a low ratio, the worth of Bitcoin has the potential to climb greater.

On a seven-day foundation, on-chain information confirmed that Bitcoin circulation had decreased. At press time, the circulation was 427,000. This was virtually 50% down from what it was on the eleventh of March.

Supply: Santiment

Regarding the value motion, the lower in circulation implies that BTC would possibly expertise much less promoting strain. Because of this, the worth of the coin can recognize.

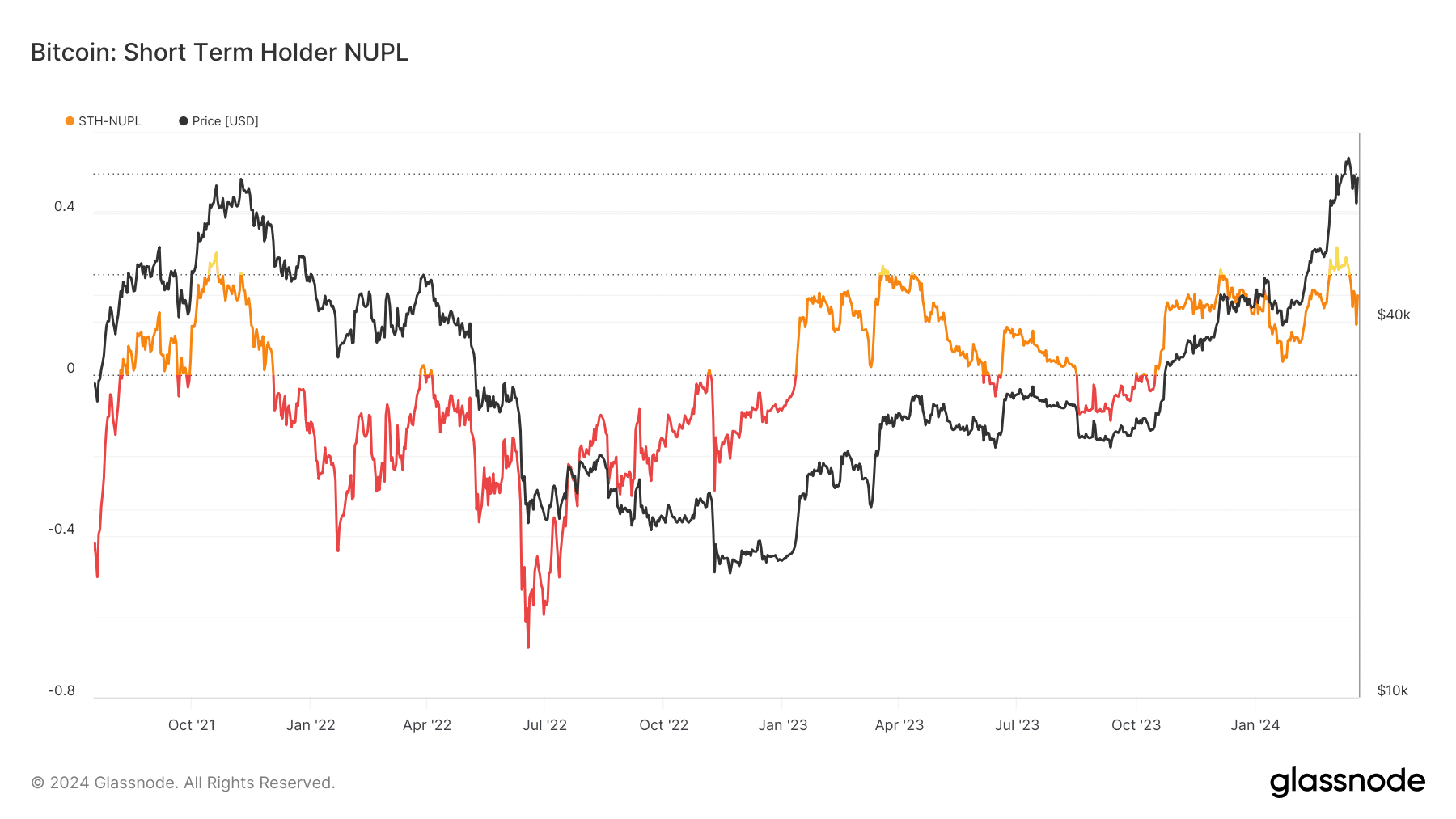

Moreover, AMBCrypto noticed that there was a change within the short-term sentiment round Bitcoin. We obtained this inference after analyzing the Brief Time period Holder- Web Unrealized Revenue/Loss (STH-NUPL).

The STH-NUPL serves as an indicator of the habits of short-term traders. When March started, the metric moved from hope (orange) to optimism (yellow).

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

Nonetheless, the switch to the brighter coloration didn’t final lengthy. As of this writing, the STH-NUPL was again within the hope-fear territory, indicating that traders had been skeptical about betting on a value improve.

However on the similar time, this means a slight lower in greed, suggesting that the market was not overheated. Ought to this stay the case, the coin value would possibly rise greater than $67,631.

Supply: Glassnode