Bitcoin gets leg-up from Chinese liquidity: Here’s why this is important

- Bitcoin’s newest upside obtained a confidence increase from the East.

- Promote stress stays at bay regardless of Bitcoin dipping into overbought territory.

A couple of weeks in the past we seemed into China’s choice to melt its stance on Bitcoin [BTC] and the general crypto market. The consequences of that call have been now evident in BTC’s newest efficiency.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Current information instructed that China has been increasingly contributing to the extent of liquidity flowing into BTC. A number of elements have contributed to this commentary. For instance, the most recent PMI information revealed that China’s manufacturing sector shrunk in April. In consequence, traders shifted their consideration elsewhere, thus BTC benefited.

The info additionally confirmed that China’s central financial institution has been utilizing open market operations to pump extra funds into the monetary system. This will likely have inspired extra Chinese language traders to accumulate extra BTC.

Moreover, China’s short-term lending charge lately fell to a 10-month low, therefore encouraging extra borrowing. A number of the low cost borrowed liquidity might have discovered its method into BTC.

Will the bears proceed quenching their thirst on Chinese language liquidity?

A state of affairs wherein China abruptly raises lending charges would disfavor BTC. Maybe even power some to promote. Such an end result would doubtless have a bearish affect on BTC. Away from that, traders needs to be taking be aware on the truth that China is at the moment among the many markets contributing closely to the latest BTC demand and rally.

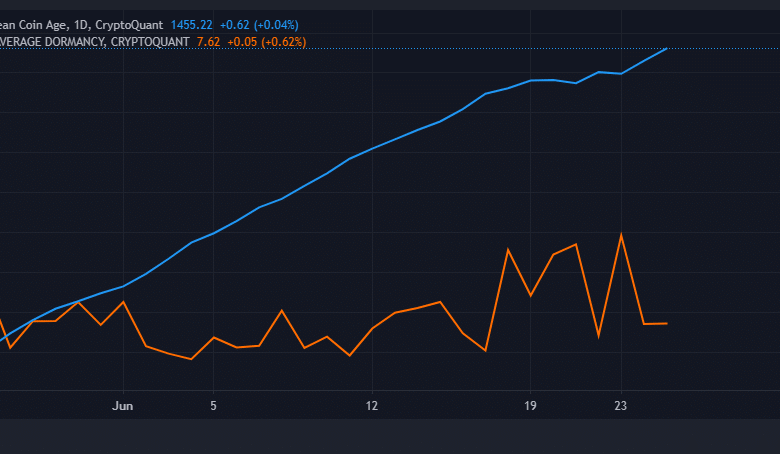

BTC’s on-chain traits may educate us just a few issues about its present place and prevailing demand. BTC’s imply coin age metric was seen rising on the time of writing regardless of intervals YTD.

Supply: CryptoQuant

Moreover, BTC’s dormancy launched into some draw back in the previous couple of days, since 23 June. It was additionally notably decrease than it was on the finish of Could. This mirrored the promote stress noticed on the finish of Could, as merchants took revenue. Apparently, BTC’s $30,580 press time worth was now on the earlier YTD peak in April.

Supply: TradingView

Can the Chinese language liquidity assist push costs to new YTD highs? This Asian liquidity has actually contributed to the latest bullish momentum and would possibly maybe help the latest highs. However, merchants ought to ponder the truth that BTC lately popped into overbought territory final week. Thus promote stress expectations are notably larger.

Moreover, BTC’s provide distribution revealed one thing fascinating in regards to the present state of the market. Whales weren’t contributing as a lot to promote stress as one would anticipate particularly after being overbought.

Supply: Santiment

What number of are 1,10,100 BTCs price as we speak

The above findings indicated that there was nonetheless some confidence in BTC’s potential upside. Particularly now that demand from the East has been on the rise.