Bitcoin halving fallout – ‘1st time in history’ update leaves miners wary

- Bitcoin’s hash fee has risen sharply for the reason that halving

- BTC’s value decline adversely affected mining profitability too

As anticipated, the price of Bitcoin [BTC] mining has risen sharply since final week’s halving, creating issues for an business already affected by declining revenue margins.

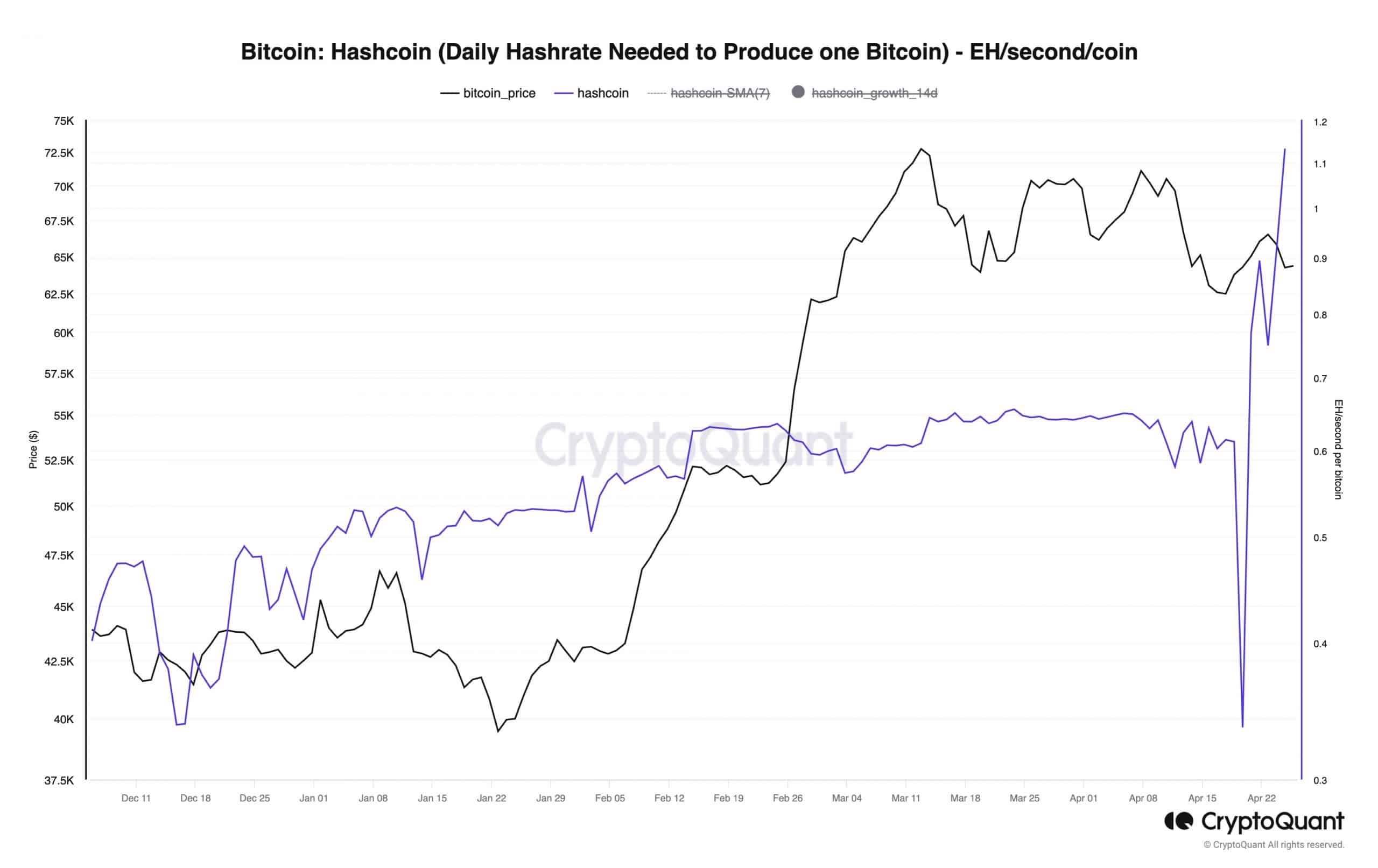

Based on Julio Moreno, Head of Analysis at on-chain analytics agency CryptoQuant, the hash energy required to provide one Bitcoin per day has now surpassed 1 exahash per second (EH/s) for the primary time in historical past.

Supply: CryptoQuant

Halving will increase miners’ bills

Halvings assault an important element of miners’ income – Fastened block rewards. The most recent one slashed the incentives from 6.25 BTC to three.125 BTC per block. In less complicated phrases, after every halving, miners need to double their mining investments to interrupt even.

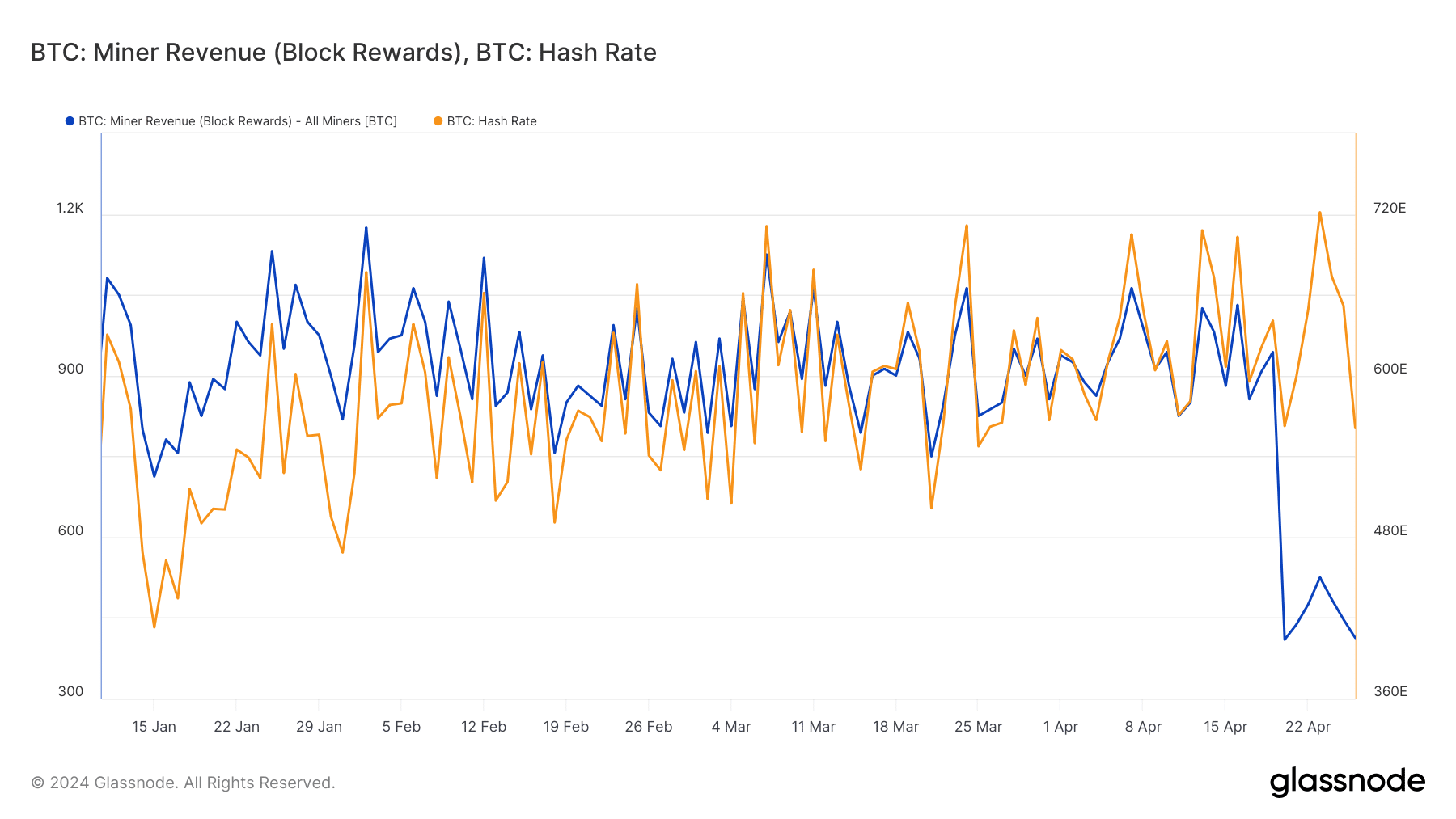

This was additional scrutinised by AMBCrypto with the assistance of Glassnode knowledge. The entire variety of Bitcoins produced fell from a mean of 900/day earlier than the halving to between 400 and 500 for the reason that occasion.

Alongside the identical, the hash fee (The computational energy wanted to create new blocks and add them to the Bitcoin ledger) rose considerably, hitting 721 EH/s earlier within the week.

Supply: Glassnode

Bitcoin’s value decline has a bearing

What has added to their woes is Bitcoin’s unimpressive present on the worth charts. After a short bullish impulse, the king coin slipped, with the crypto down 1.63% at press time, based on CoinMarketCap.

Actually, due to the aforementioned droop, hashprice, which is a barometer of Bitcoin mining profitability, fell by 72% over the week.

Supply: Hash Fee Index

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Will charges come to the rescue?

Whereas block rewards could also be changing into an unviable income stream for miners, there’s a lot to look ahead to from transaction charges.

AMBCrypto reported beforehand how the Runes protocol led to an astronomical surge in charges instantly after the halving, serving to offset the losses from the halving. Actually, round 3/4th of the cumulative miner earnings from halving day have been composed of charges paid by customers.