Bitcoin has lessons to learn from gold’s Spot ETF journey

- BTC surged to $31,000 for the primary time in over a yr.

- Gold’s worth grew exponentially after its Spot ETF in 2003.

The world’s largest cryptocurrency, Bitcoin [BTC], briefly breached previous the $31,000 as market optimism continued to develop within the wake of a number of purposes for a Spot Bitcoin Trade-Traded Fund (ETF).

How a lot are 1,10,100 BTCs value immediately?

The transfer previous $31,000 was the asset’s greatest efficiency in over a yr. The bullish rally was triggered after BlackRock, the world’s largest asset administration firm, utilized for an ETF that may straight monitor Bitcoin.

Since then, different TradFi gamers like WisdomTree and Invesco have thrown their hats within the ring as properly.

The curiosity proven by huge institutional gamers strengthened hopes of a BTC bull run and altered the market sentiment to greed, which was caught on the impartial place over the past month. This begs the query – What’s it with Spot ETF that has heightened merchants’ hopes?

The gold instance

Bitcoin’s ETF will permit patrons to put money into the king coin with out shopping for the precise asset. Thus, they may have the ability to escape the hassles of cryptocurrency exchanges and crypto wallets.

Thus, ETFs assist to bridge the hole between the standard finance and the property in query. Let’s take the instance of the bullion market, particularly gold.

In keeping with on-chain analytics agency IntoTheBlock, the launch of its Spot ETF in 2003 revolutionized gold buying and selling. The fund made investing within the yellow metallic hassle-free, leading to a meteoric rise in its worth.

Attaching a snippet from TradingView, IntoTheBlock highlighted that gold costs rose 27% in a yr’s time after the launch, 172% in 5 years and almost 5x in a decade. This implied that the launch of ETFs performed an important half in attracting institutional funds.

Supply: IntoTheBlock

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

And whereas Bitcoin futures ETFs are already out there, the applying for Spot ETFs holds better significance. Spot ETFs, in contrast to futures ETFs, will probably be backed by actual BTC, and the value of 1 share on the alternate will react to the Spot worth of BTC, akin to holding a BTC.

Lengthy positions for BTC surge

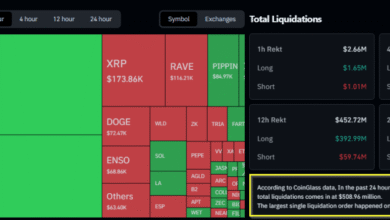

The bullish sentiment pervaded the futures markets as merchants positioning for worth beneficial properties outpaced these trying to profit out of worth losses. In keeping with Coinglass, BTC longs surged to 51% of the entire variety of energetic positions out there at press time.

Supply: Coinglass