Bitcoin – Here’s how mining stocks and Spot ETFs are fueling a market shift

- Bitcoin’s decentralization may very well be in danger as mining energy turns into more and more centralized

- The position of BTC ETFs in powering this shift can’t be missed

On the coronary heart of the Bitcoin [BTC] community are miners with main BTC holdings. In right this moment’s unstable market, retaining monitor of their reserves is extra essential than ever. Curiously, the quantity of BTC held in miner wallets has dropped to a yearly low of simply 1.809 million.

Whereas components like rising mining problem, breakeven bills, halving, and diminished rewards are sometimes blamed, there could also be a deeper shift at play. This shift may very well be eroding miners’ affect over the market as extra buyers flock to different funding autos like Bitcoin ETFs.

Consequently, Bitcoin’s community dangers turning into extra centralized, elevating the query – Is that this a step ahead or a setback for Bitcoin’s decentralized future?

Bitcoin’s decentralized future is perhaps beneath menace

A yr after the 2008 monetary disaster, Bitcoin emerged as a game-changer, eliminating the necessity for monetary middlemen. Over time, it has constructed a passionate group of ‘believers’ who see BTC not simply as a digital asset, however as a robust image of decentralization.

It’s no shock that miners play a key position in making this imaginative and prescient a actuality. Within the 15 years since Bitcoin’s creation, particular person miners have developed into giant corporations, now holding important quantities of BTC themselves.

Marathon Digital Holdings (MARA) is leading the best way, with over 40k BTC in its reserves. Whereas that is bullish for Bitcoin – driving up accumulation – it additionally indicators a troubling development – The rising centralization of mining energy, now managed by just some key gamers.

The plot thickens as buyers more and more flip to mining shares as an funding device, intently tied to Bitcoin’s value. When Bitcoin drops, these shares comply with, leaving buyers with losses.

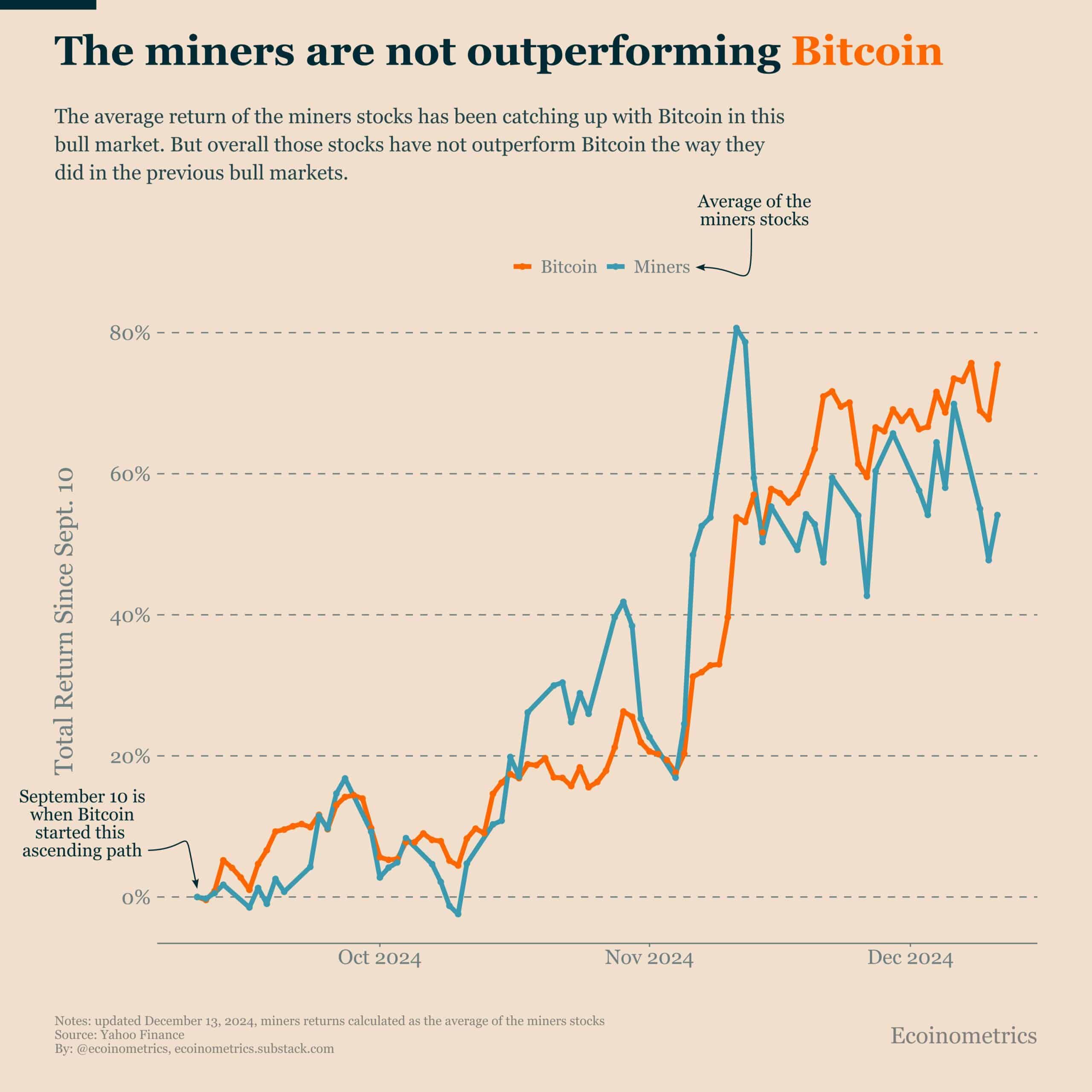

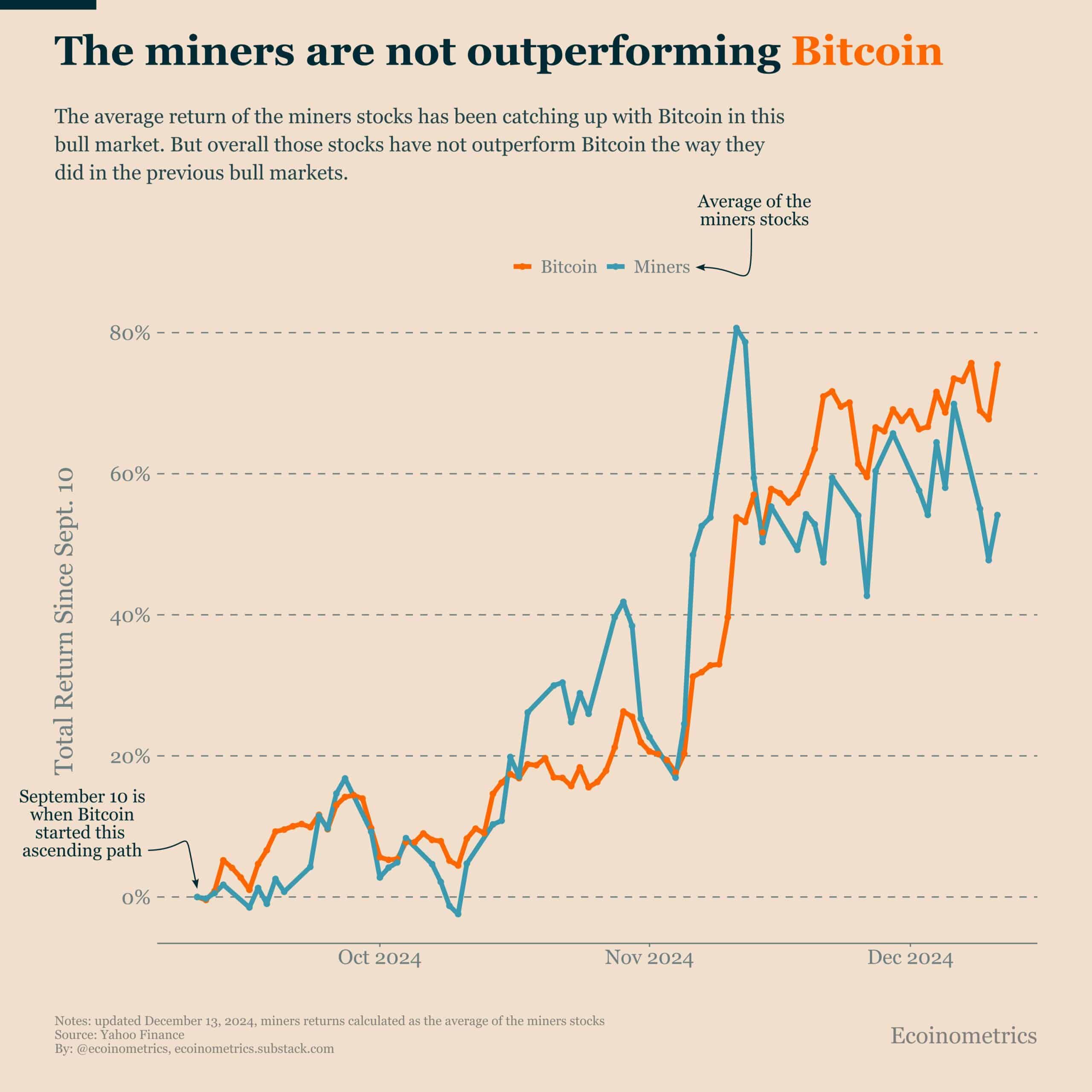

Supply : Ecoinometrics on X

As ROI continues to shrink, extra buyers are pulling out, forcing mining corporations to both unload their Bitcoin holdings or shut down. This dynamic, in flip, instantly or not directly impacts Bitcoin’s value, including one more layer of volatility to the market.

A better have a look at the chart above revealed an attention-grabbing sample – The anticipated returns on Bitcoin holdings didn’t play out the best way mining corporations anticipated, notably as Bitcoin neared the $100k mark.

In a typical situation, this may have induced mining shares to surge, attracting new buyers longing for a slice of the motion.

And but, Marathon Digital Holdings (MARA) has been on a gradual downtrend, signaling a shift in a market that calls for deeper exploration.

What’s behind this modification?

Since launching in January, Bitcoin ETFs have made it simpler for each institutional and retail buyers to achieve publicity to Bitcoin with out really proudly owning it.

This new funding automobile removes the complexities of pockets administration and mining. Actually, on the day the “Trump pump” started, $1.3 billion in inflows had been recorded into Bitcoin ETFs.

Clearly, these newer gamers are shortly outpacing conventional mining shares, providing a “much less dangerous” route for buyers desirous to faucet into Bitcoin’s potential.

Learn Bitcoin [BTC] Worth Prediction 2024-2025

However right here’s the catch – This shift isn’t with out its dangers. As huge establishments like BlackRock (IBIT) scoop up big quantities of BTC, Bitcoin’s decentralized nature is beginning to really feel the pressure. Actually, finally depend, BlackRock held a staggering 530K BTC.

With such giant gamers within the combine, their affect on Bitcoin’s value is simple. Traders want to remain sharp, train warning, and hold a detailed eye on their holdings transferring ahead.