Bitcoin – Here’s the true scale of halving’s impact on miners, mining rewards

- Bitcoin’s bullish value trajectory ensures profitability amid challenges

- Halving might trigger provide shock, driving volatility and value rise

The yr 2024 has confirmed to be an distinctive one for Bitcoin [BTC], boosted by ETFs and capped off by its 4th halving. Nonetheless, that’s not all as apparently, there has additionally been a big change in miner habits.

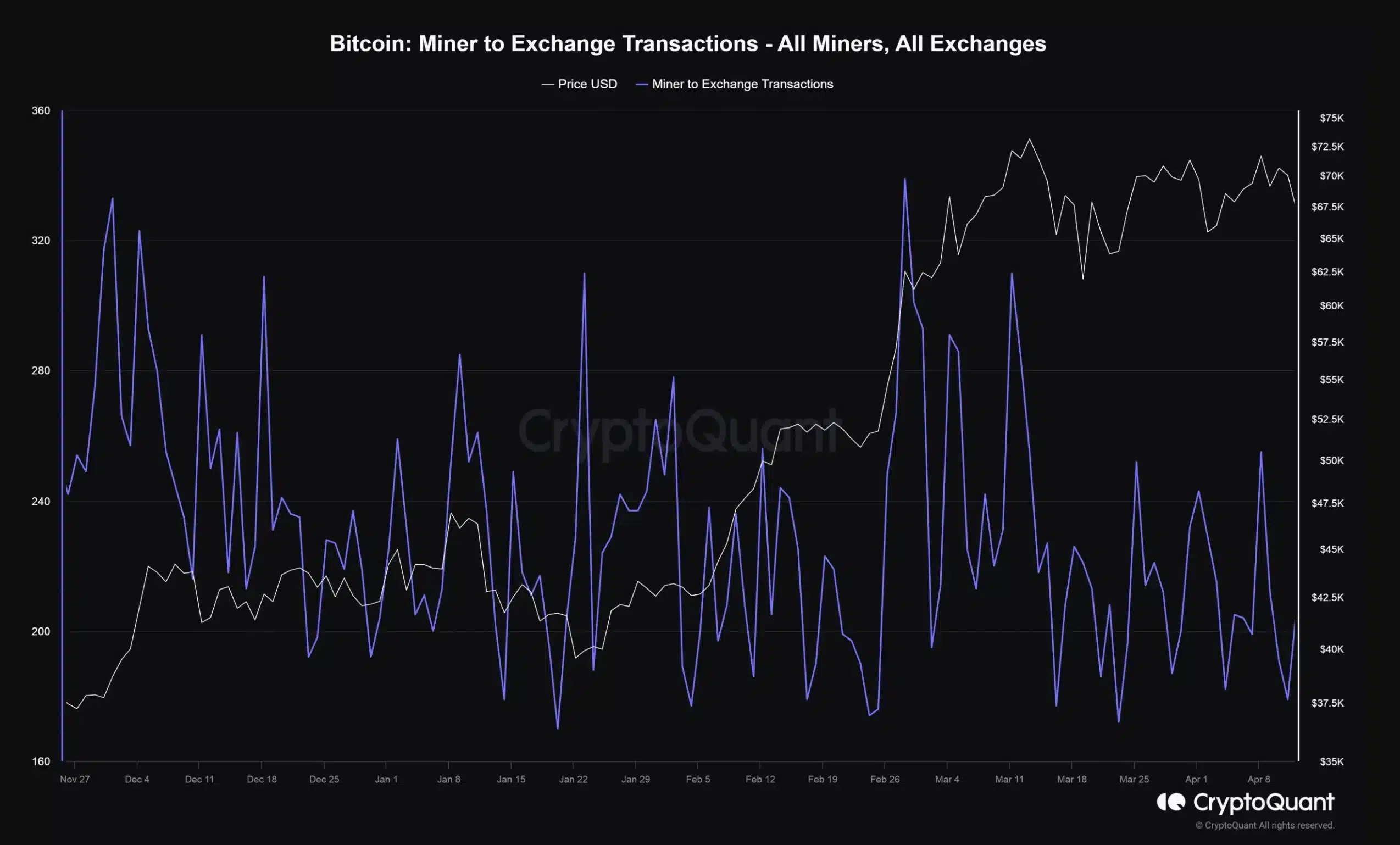

In actual fact, current data from CryptoQuant’s researcher revealed that miners have been sending roughly 374 BTC to identify exchanges each day over the previous month. This quantity was lower than one-third of the each day common noticed again in February.

Supply: CryptoQuant

How will Bitcoin’s halving have an effect on miners?

Opposite to what some would say, the Bitcoin halving occasion isn’t essentially a doomsday state of affairs for miners. This, in accordance with Adam Sullivan, CEO of Core Scientific. In a current interview, he stated,

“Bitcoin halving is just not the Armageddon second for us.”

He added,

“Properly at this time, with Bitcoin above $60,000, profitability means nearly no machines are literally going to show off. Throughout the halving, lots of them are going to keep up profitability.”

What this implies is that quite a few mining corporations are financially sturdy and able to endure short-term profitability challenges. Perhaps, smaller, much less environment friendly miners might face difficulties post-halving. This, nonetheless, would seemingly lead to trade consolidation.

Is there potential for a provide shock?

Mark Yusko, Founding father of Morgan Creek Capital Administration, believes in any other case although. He believes that Bitcoin’s halving occasion could also be underestimated, with the potential for a big provide shock. Shedding mild on the identical he stated,

“I really assume the halving goes to have a much bigger influence and I don’t assume it’s priced in. I believe individuals are distracted by the demand shift that occurred that prompted this ATH.”

He added,

“In order that they’re forgetting that when the having happens there’ll nonetheless be miners who’re in hassle as a result of their prices are fastened and the variety of rewards goes down and so there’ll be a a provide shock occasion.”

Moreover, in a separate interview, Dan Dolev, Managing Director at Mizuho Securities, expressed the view that the halving occasion would immediate a “sell-the-news” response.

@BobLoukas was fast to refute this although, stating,

“‘The halving is just not priced in.Completely False.”

Bitcoin’s future outlook

Regardless of prevailing skepticism earlier than its halving, Bitcoin projected robust shopping for stress publish the occasion, as is evidenced by its value appreciation of three.26%. In response to David Alderman, a Digital Asset Analysis Analyst at Franklin Templeton,

“As the worth goes up, I believe the noise goes up much more.”

Therefore, it’s intriguing to watch that regardless of ongoing geopolitical tensions, Bitcoin has adhered to its historic patterns and surged following the halving occasion.

Supply: LayahHeilpern/Twitter