Bitcoin: History repeats itself? Inklings of 2013-2017 bull cycle emerge

- Bitcoin’s worth motion over the past two years correlated with the beginning of the 2013-2017 bullish cycle.

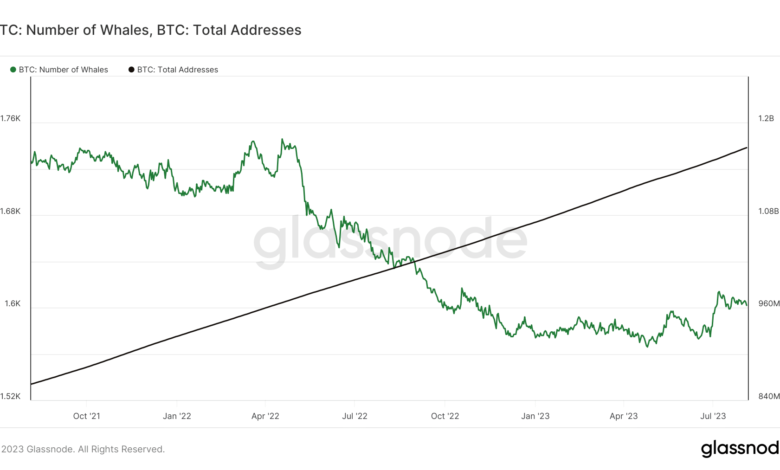

- Whales and deal with development assist long-term bullish expectations.

Have you ever just lately thought of the place Bitcoin [BTC] could possibly be within the subsequent two to 5 years? Properly, longer time frames are troublesome to estimate due to the varied listing of things that make it troublesome to precisely predict the end result. However what if Bitcoin’s previous might provide insights as to what to anticipate sooner or later?

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

A latest evaluation means that Bitcoin is repeating a sample that was beforehand seen through the 2013 to 2017 bullish cycle. It additionally appears into BTC’s efficiency from July 2021 to the current.

#Bitcoin worth historical past could possibly be repeating itself! $BTC worth trajectory post-2021 all-time excessive seems to be mirroring the 2013-2017 bullish cycle. pic.twitter.com/reCbCB8vCJ

— Ali (@ali_charts) August 4, 2023

Based mostly on the above evaluation, we see that Bitcoin’s efficiency within the final two years resembled its efficiency within the first two years of the 2013-2017 cycle. It maintained this correlation within the final seven months.

If Bitcoin’s present cycle maintains the identical correlation, then we are able to count on Bitcoin to enter an exponential development section throughout the subsequent two years.

Curiously, the above statement aligns with the timeline of the following Bitcoin halving, which is anticipated to behave as yet one more bullish catalyst. We beforehand appeared into how ongoing debt considerations within the U.S. might contribute to the following main wave of BTC adoption.

Whale exercise is recovering according to the prediction

The identical worth evaluation reveals that whale participation is recovering according to bullish expectations. If we have a look at whale exercise over the past two years, we see general outflows from August 2021, up till April 2023. Nevertheless, the variety of whales has been rising since April.

Supply: Glassnode

Bitcoin’s complete addresses have been rising steadily over the past two years. This constructive development confirmed that the retail phase has additionally been embracing Bitcoin. In the meantime, BTC’s HODLed or Misplaced Cash metric has been steadily rising as nicely.

Supply: Glassnode

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Bitcoin’s long-term holder provide has additionally maintained an general upward trajectory over the past two years. These observations additional assist the likelihood that Bitcoin may ship a bullish final result over the following two years.

This long-term final result might play out as the following bullish cycle. Nevertheless, these are simply speculative predictions primarily based on latest observations. They due to this fact don’t assure the absence of bearish short-term outcomes.