Bitcoin Hits Deep Demand As Liquidity Finally Sweeps The Lows

Bitcoin has lastly swept the sell-side liquidity that had been constructing beneath the market, driving value right into a deep demand zone the place stronger patrons are anticipated to step in. With the draw back transfer now largely full, consideration shifts as to whether this degree can spark a significant response or mark the beginning of a broader reset.

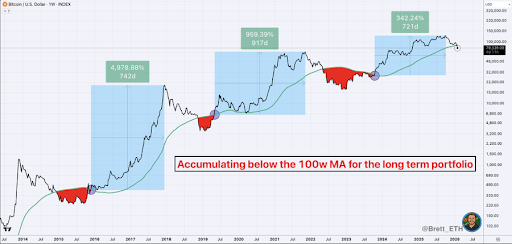

Why The 100-Week SMA Stays A Confirmed Bitcoin Accumulation Zone

Crypto analyst Brett emphasized that accumulating Bitcoin under the 100-week Easy Transferring Common has repeatedly confirmed to be one of the vital dependable long-term funding methods. In line with the knowledgeable, this zone has traditionally marked intervals of most pessimism, the place risk-to-reward strongly favors affected person patrons slightly than short-term merchants.

Brett defined that his private method intentionally avoids making an attempt to pinpoint the precise market backside. As a substitute, he focuses on regular accumulation by inserting purchase orders throughout a variety between $55,000 and $75,000, supported by every day recurring purchases.

For traders with a extra conservative mindset, Brett identified that ready for affirmation will be simply as efficient. Taking a look at previous cycles, Brett famous that purchasing after Bitcoin strikes again above the 100-week SMA has persistently delivered robust returns. He burdened that BTC has by no means fallen under the earlier cycle’s 100-week SMA, reinforcing its significance as a structural help degree. Those that adopted this technique in prior market cycles are actually sitting on important long-term earnings.

Breakdown Confirmed As Key Lows Failed To Maintain

In line with the newest BTC Heatmap update by Columbus, the market has adopted the precise trajectory beforehand mapped out. Columbus notes that the lack of the native lows to carry, mixed with weak reactions on the tape, signaled that the liquidity stacked under would act as a magnet. Consequently, the continuation leg performed out as an inevitable results of this structural weak point.

In his evaluation of the present value motion, Columbus highlights that Bitcoin is now buying and selling instantly inside a cluster of heavier bids positioned across the low-$70,000 area. The analyst identifies this particular zone as the primary space the place a “actual response” is prone to happen, because it represents a big focus of buy-side curiosity. For Columbus, the sweep into these deeper pockets was the mandatory clearing occasion to achieve this major demand zone.

Columbus concludes that for the reason that anticipated draw back has totally performed out, the main focus now shifts completely to the quick response from patrons. With the liquidity targets hit and the worth sitting on heavy help, Columbus is now carefully awaiting a definitive response to find out if this degree will present the muse for the following leg of the development.