Bitcoin hits new ATH before crashing – Will whales come to the rescue?

- Bitcoin moved previous $108,000 fueled by bullish whale and institutional exercise earlier than crashing.

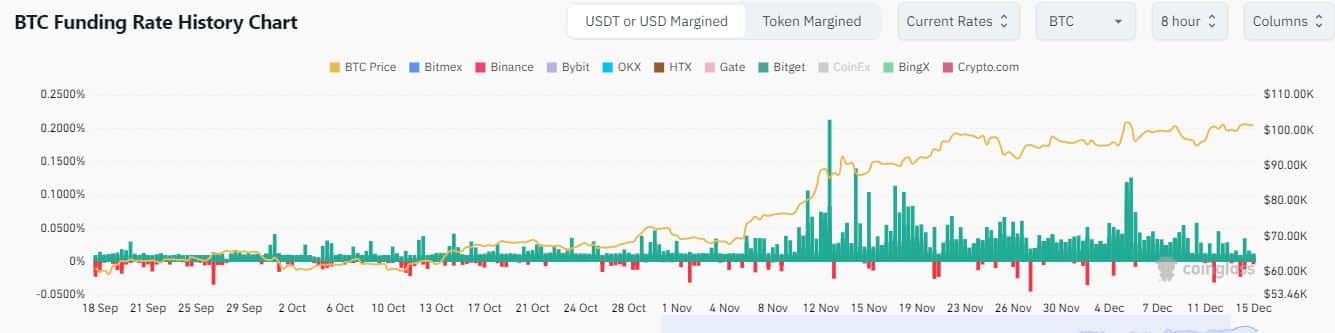

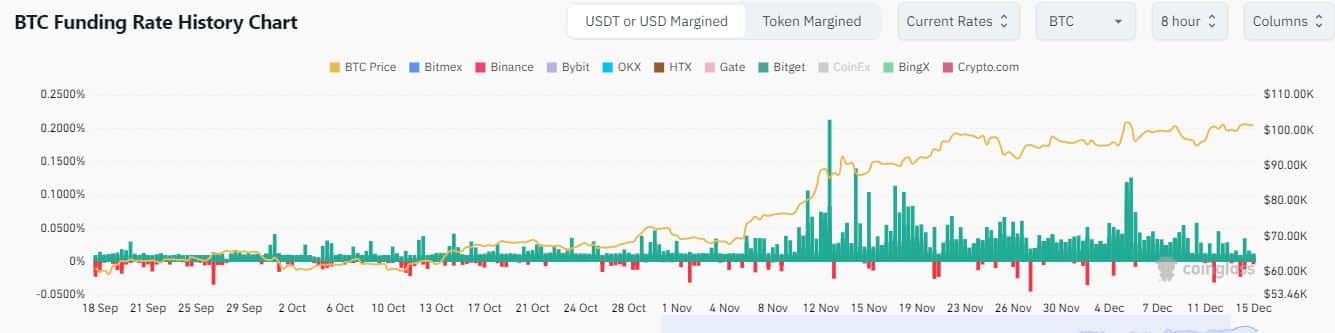

- Funding charges keep comparatively low exercise indicating spot dominance.

Bitcoin [BTC] maintained a bullish stance earlier this week judging by its pursuit of value discovery. The cryptocurrency clocked a brand new all-time excessive above $108,000 on Wednesday, the 18th of December, and this recent upside was largely aided by whale exercise.

Bitcoin bullish efficiency earlier within the week raised hopes of doubtless hovering to $110,000 earlier than the top of the week if it sustained the momentum. The king of the cryptos attained a brand new historic peak at $108,364 on Wednesday, proving but once more that the bulls have been nonetheless in management.

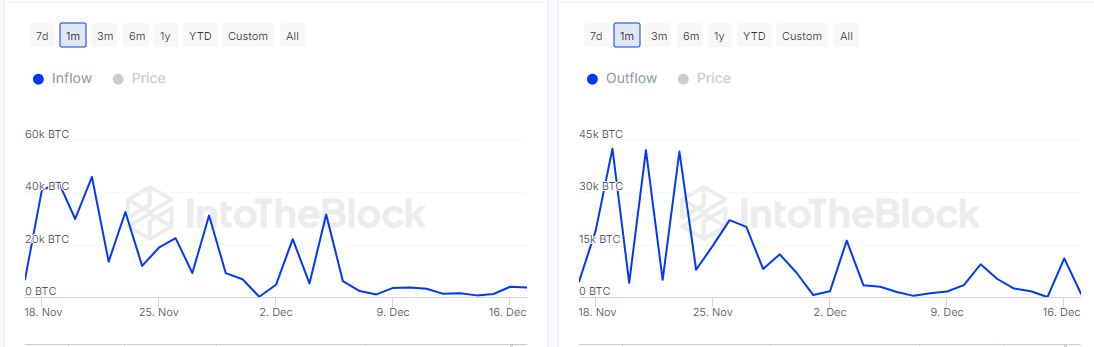

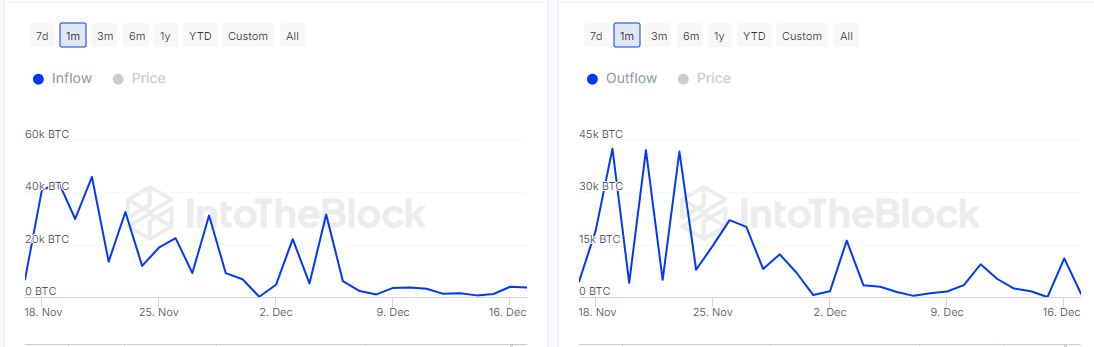

On-chain knowledge confirmed wholesome whale exercise as massive holder inflows grew from 619.43 BTC on 14th December to three,620 BTC as of seventeenth December. In the meantime, massive holder outflows dipped from 11,060 cash on sixteenth December to 917 BTC the subsequent day.

Supply: IntoTheBlock

The massive holder flows subsequently demonstrated a surge in demand at across the similar time that promote stress from whale subsided significantly.

As a consequence, the wave of demand pushed larger. Nonetheless, there was a notable dip in massive holder inflows by roughly half to 1843 BTC as of Wednesday. This was nonetheless larger than 473 BTC outflows.

To high issues up, Bitcoin additionally achieved general optimistic flows from ETFS. The latest BTC ETFs data revealed that ETF inflows peaked at 275.3 million BTC on Wednesday.

Are Bitcoin bears taking up?

Regardless of these observations, there have been notable outflows from among the ETFs together with Grayscale and Ark Make investments. Regardless of the sturdy bullish efficiency, a large pullback adopted swiftly, ending the day nearer to $101,000. This might point out potential for some profit-taking or extra quick time period outflows forward.

The pullback was primarily because of the market’s knee-jerk response to Fed chair Jerome Powell assertion. Powell remarked that the FED was not allowed to personal Bitcoin.

Bitcoin spot market flows knowledge revealed that outflows have been dominant within the final three days. This was significantly the case on Wednesday throughout which internet outflows spiked to $824.78 million.

supply: Coinglass

Why are these observations important? Nicely, based mostly on the observations to this point, whales and establishments have been driving this week’s rally. A sign that they anticipated larger costs. In the meantime, retail gave the impression to be folding beneath the stress as value pushed into new territory.

Bitcoin funding charges knowledge reveled comparatively subdued exercise in comparison with the primary half of December or November. An indication that derivatives merchants have been shifting cautiously this week to keep away from liquidations.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In different phrases, spot demand has arguably been extra dominant this week and liquidations have been comparatively low.

supply: Coinglass

Low funding charges may sign decrease volatility and probably low friction in Bitcoin’s bullish makes an attempt. Nonetheless, merchants ought to be cautious particularly now that a number of ETFs have demonstrated outflows.