Bitcoin hits new ATH of $107K! Key levels driving BTC’s next move

- Analysts highlighted rising spot demand whereas futures exercise cooled, sustaining Bitcoin’s upward momentum.

- Bitcoin’s MVRV ratio at 2.69 and rising Open Curiosity steered additional potential for value development.

Bitcoin [BTC] continues to dominate headlines because it maintains its upward momentum, lately reaching a brand new all-time excessive of $107,822.

This newest milestone highlighted Bitcoin’s spectacular year-to-date efficiency, which exceeded 150% at press time.

Nonetheless, after touching this peak, the asset skilled a modest correction, buying and selling at $107,064. This mirrored a slight 0.6% decline from the current excessive, however nonetheless marked a 2% acquire over the previous day.

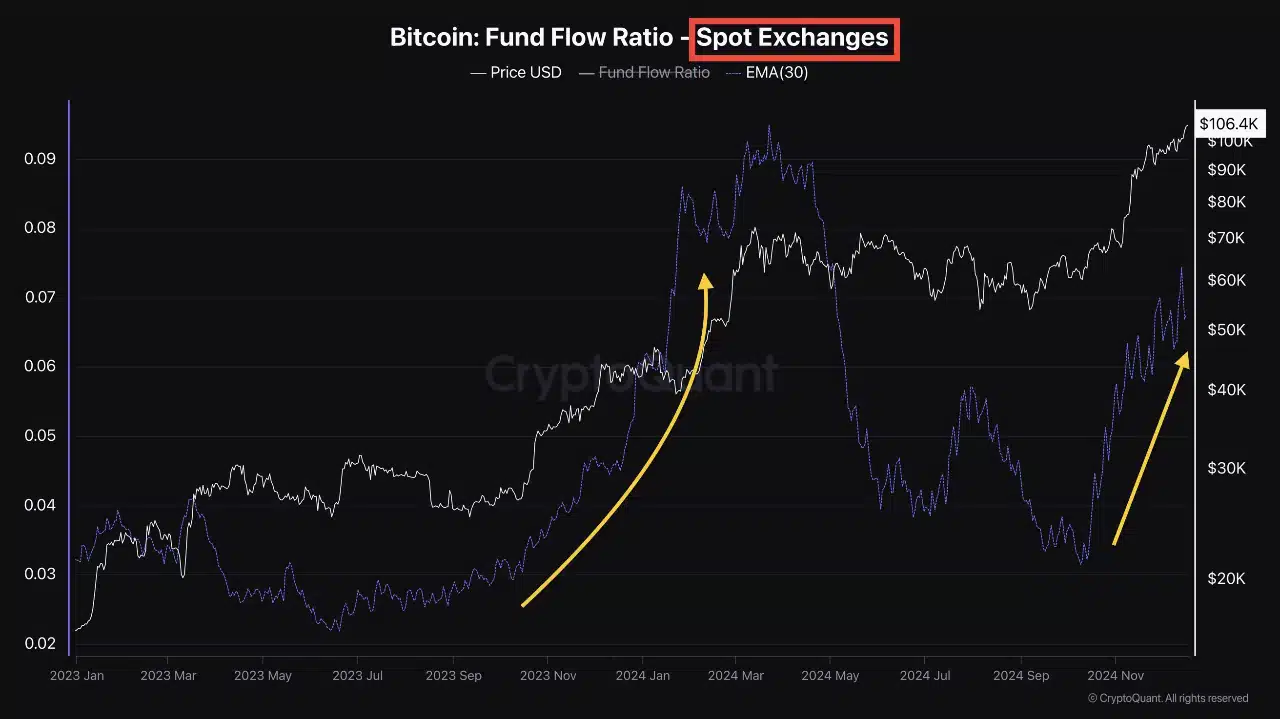

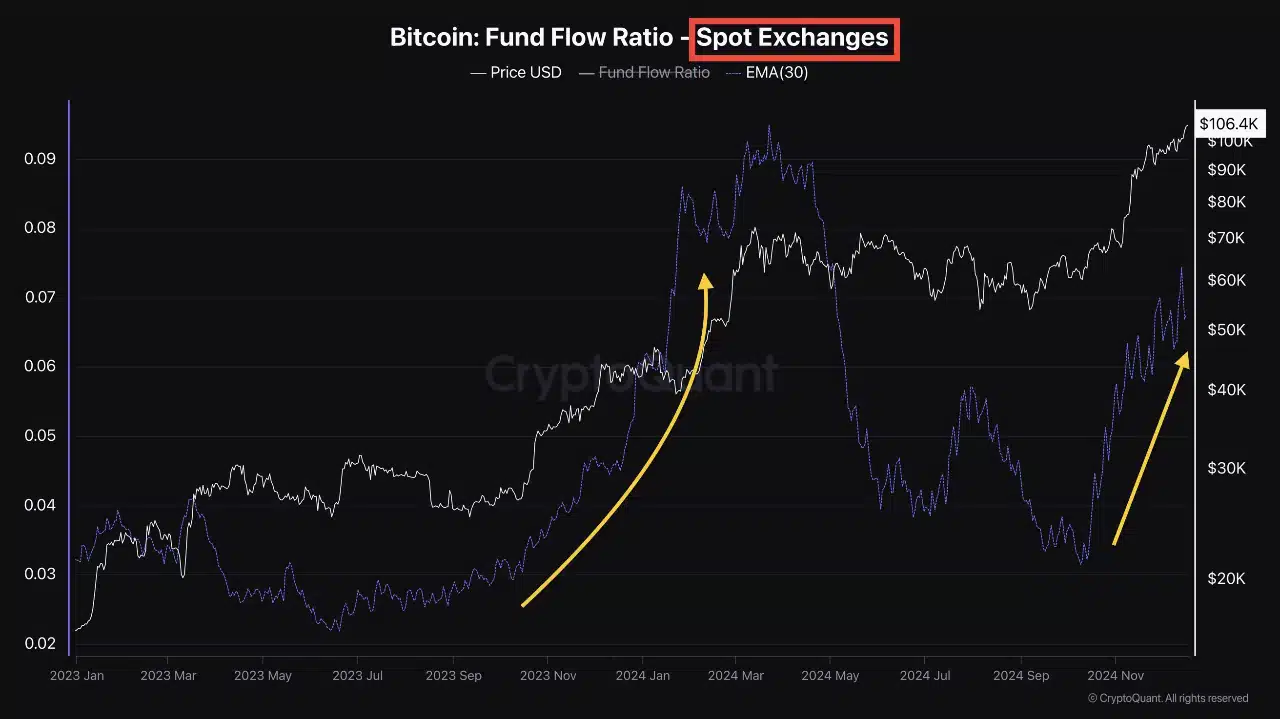

Amid this value efficiency, a current evaluation from CryptoQuant shed light on the underlying market forces contributing to the present rally, emphasizing the rising function of spot market demand in sustaining Bitcoin’s value development.

Spot market demand drives Bitcoin’s momentum

In response to the CryptoQuant analyst, Bitcoin’s ongoing bull cycle, which started in early 2023, was initially fueled by speculative exercise within the Futures market.

Nonetheless, since October 2024, the pattern has shifted as each the spot and Futures markets noticed a rise in buying and selling volumes, triggering additional upward momentum in Bitcoin’s value.

Supply: CryptoQuant

Extra lately, whereas fFutures market exercise has begun to chill off, the spot market is gaining dominance.

This shift suggests that purchasing stress from long-term buyers and retail members is rising, decreasing speculative extra and offering a stronger basis for sustained value development.

The analyst additionally identified that the funding fee, analyzed utilizing a 30-day exponential transferring common (EMA), exhibits no indicators of late-cycle overheating.

This means that Bitcoin’s bullish trajectory has room for additional enlargement with out rapid indicators of correction.

The report additional means that whereas the Futures market will doubtless expertise cycles of elevated exercise and liquidations, this volatility might entice further capital inflows into the spot market.

Rising optimism

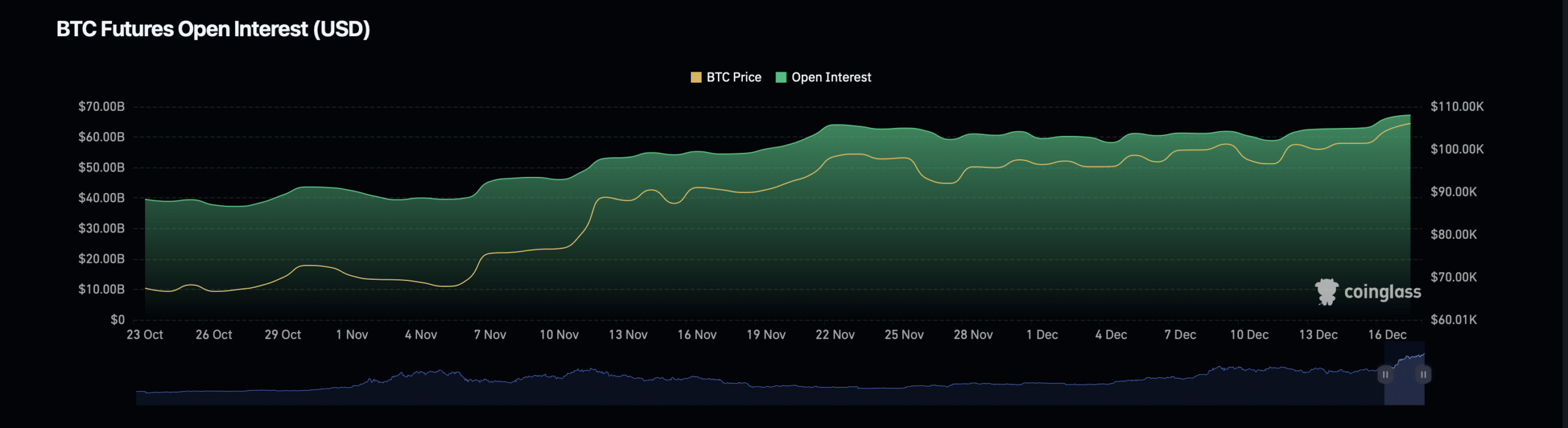

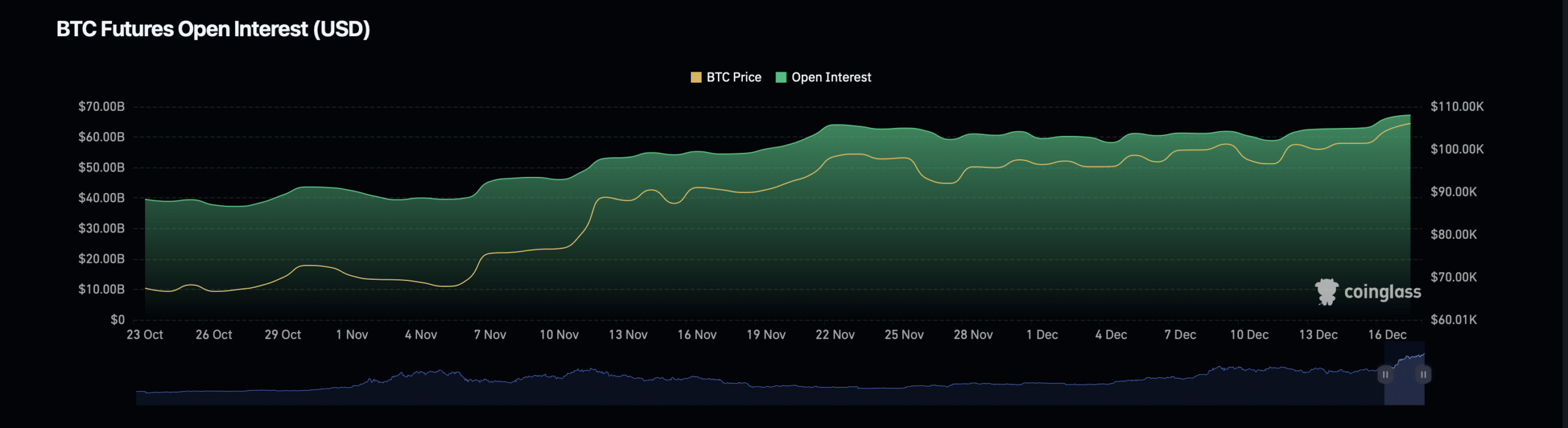

Past the surge in spot market demand, different key Bitcoin metrics additional validated the asset’s constructive outlook.

Data from Coinglass revealed that Bitcoin’s Open Curiosity—a measure of the overall worth of excellent Futures contracts—has elevated alongside its value.

Supply: Coinglass

Particularly, BTC’s open Curiosity has risen by 2.56%, reaching $68.82 billion, whereas longer-term knowledge confirmed a considerable 19.13% improve, bringing the overall to $100.63 billion.

Rising Open Curiosity usually indicators rising market exercise and investor confidence in Bitcoin’s future value motion.

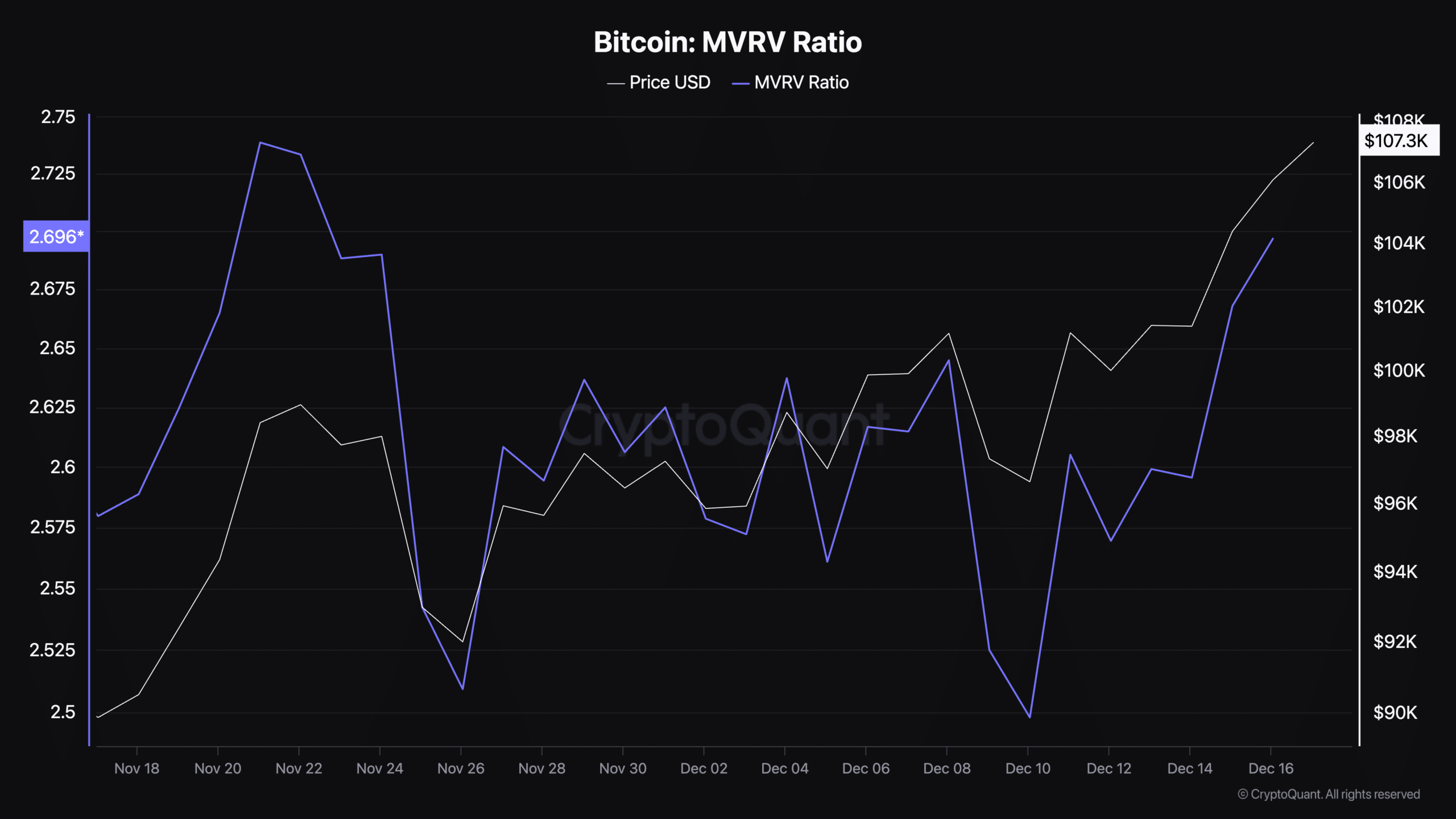

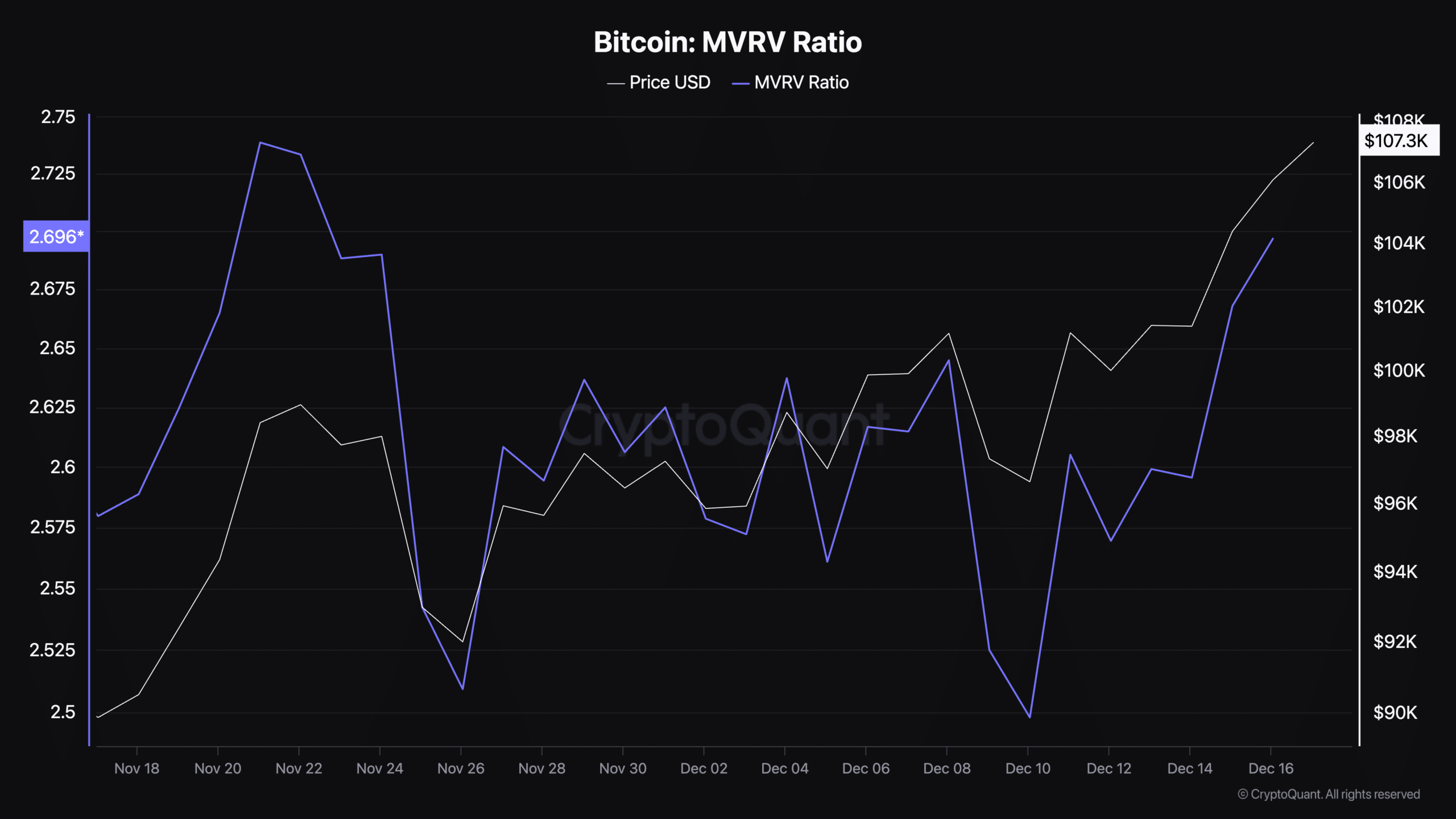

Moreover, CryptoQuant knowledge highlighted Bitcoin’s Market Worth to Realized Worth (MVRV) ratio, which has climbed to 2.69 as of the sixteenth of December.

The MVRV ratio is a key on-chain metric used to judge whether or not an asset is overvalued or undervalued relative to its realized worth.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

An MVRV ratio above 2.5 signifies that Bitcoin is in a robust bull section, nevertheless it additionally means that buyers could quickly start taking income.

Traditionally, MVRV values above 3 have signaled market peaks, so the present degree of two.69 suggests Bitcoin nonetheless has room for upward motion whereas signaling a necessity for warning amongst merchants.