Bitcoin holders cut their BTC holdings by 11% – Should you be worried?

- LTHs are unloading BTC, locking in huge positive factors as Bitcoin soared from $44k to $100k in only a yr

- Now, the legal guidelines of economics take over – excessive provide meets excessive demand

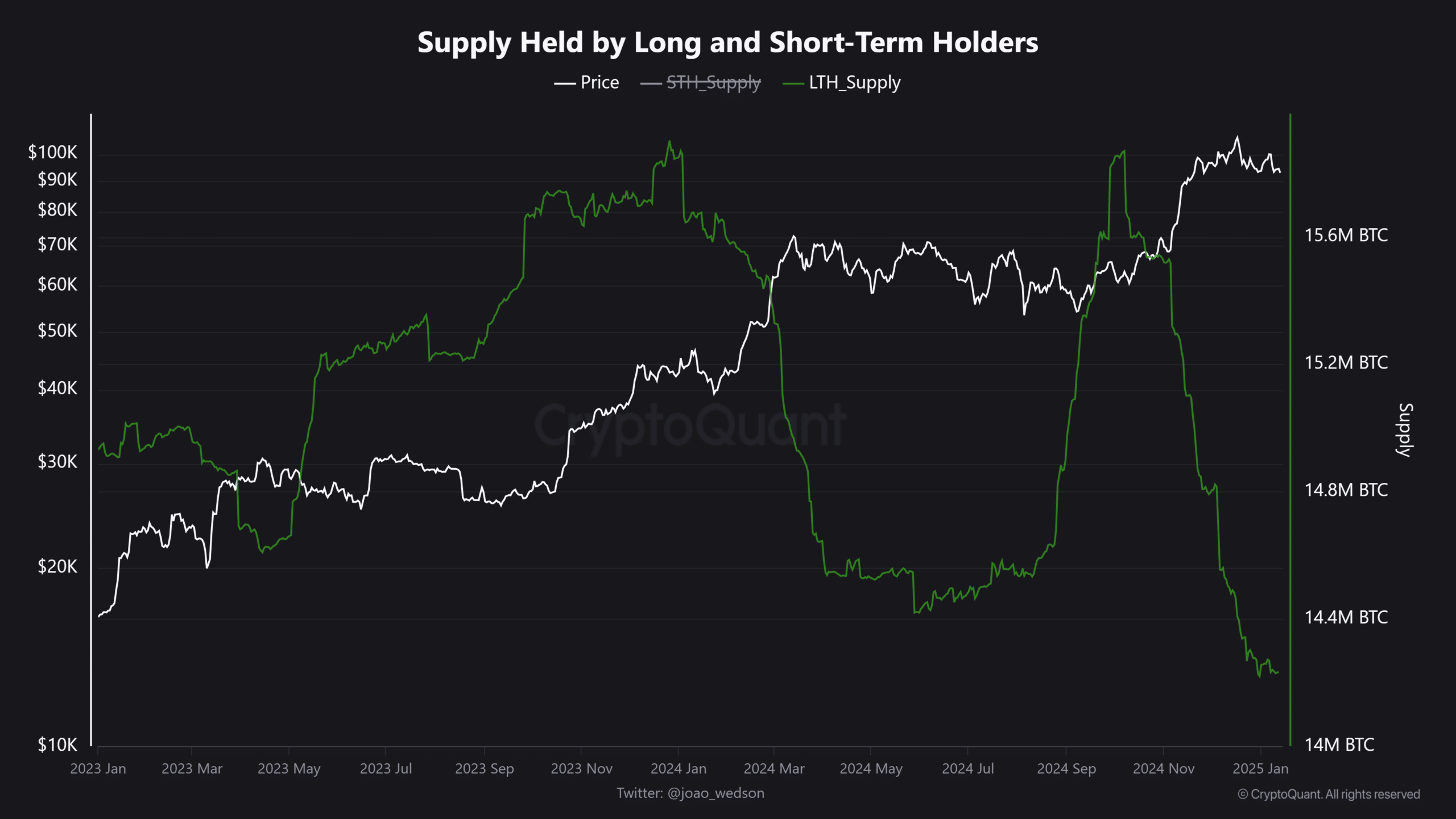

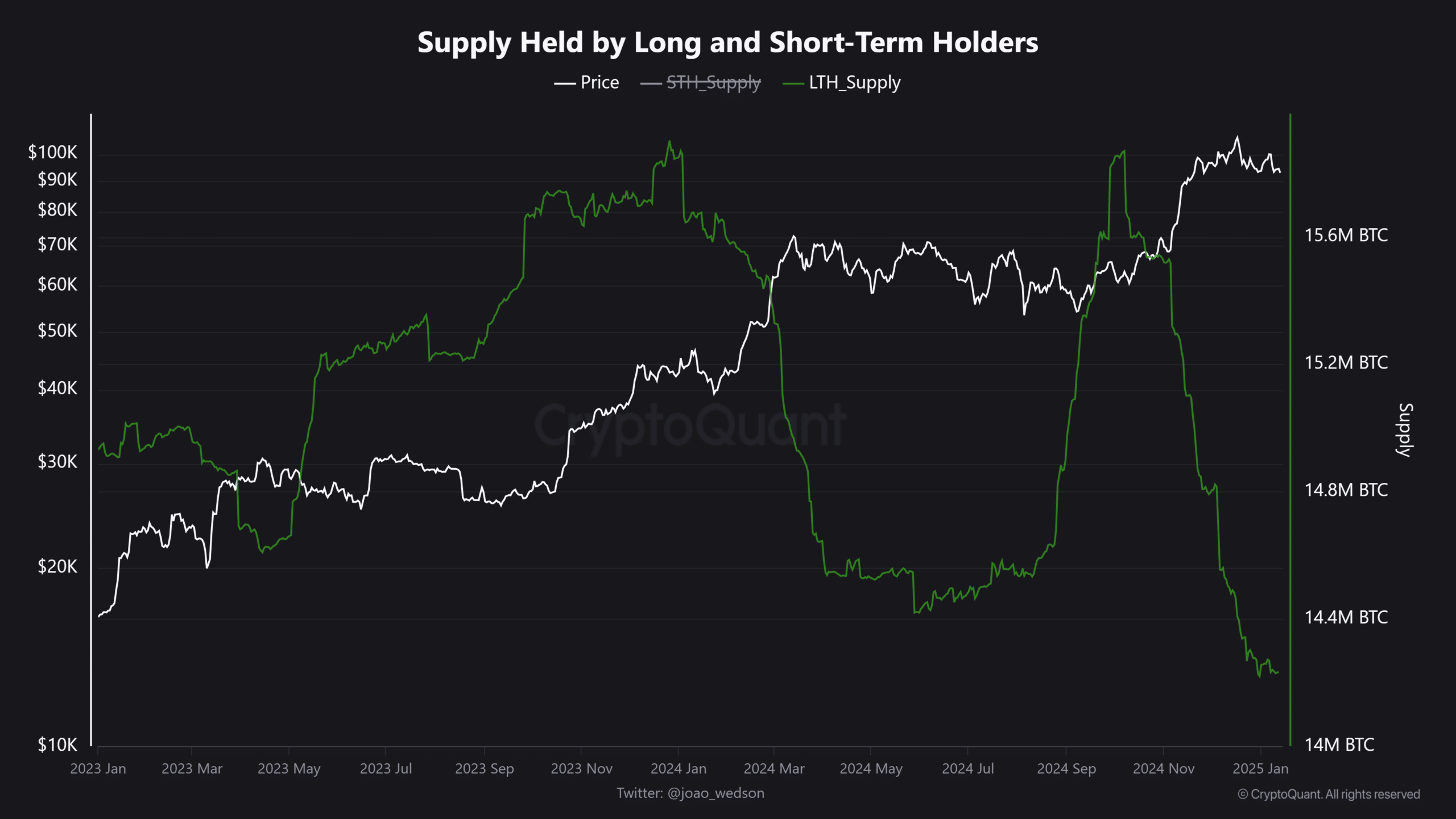

A yr in the past, long-term HODLers [LTHs] held 13.84M Bitcoin [BTC] at a median worth of $42k. At this time, it’s right down to 12.22M BTC – An 11% drop in only a yr. These HODLers, identified for accumulating when others promote, appear to be shifting their conduct.

Is that this a pink flag or an indication of market maturity?

Let’s rewind to 2023 – BTC kicked off Q1 at $16.6k, with 14.93 million BTC in LTH wallets. By yr’s finish, BTC had surged to $44k, and LTH provide grew to fifteen.85 million. Their regular accumulation was key to BTC’s hike on the charts.

Quick ahead to 2024, and we’re seeing a dramatic shift. LTHs entered a large distribution section, with holdings dropping from 15.8 million to 14.27 million in This fall alone. It’s clear these HODLers capitalized on the Trump commerce, locking in enormous positive factors.

Supply: CryptoQuant

Following BTC’s unimaginable 502% worth surge over two years, it’s no surprise these HODLers are actually cashing out. And with Bitcoin more and more being swayed by macro developments, this transfer is beginning to make good sense.

Nevertheless, LTHs are identified for his or her ‘contrarian’ technique – Shopping for when others panic. So, with their exit, is that this an indication that the market is maturing. Or might it’s a pink flag signaling hassle forward for Bitcoin?

LTHs exit – Will BTC survive the implications?

Only in the near past, Bitcoin flashed a pink candlestick, dipping to $89k – A degree not seen since mid-November. Nevertheless, in a shocking reversal, it bounced again rapidly, closing the session at $95k.

Huge establishments are stepping in to soak up the stress. Take MicroStrategy (MSTR), for instance – Simply two weeks into 2025, they’ve already made two vital BTC buys. Their newest purchase of two,530 BTC for $243 million performed a key function in Bitcoin’s restoration.

Little doubt, these LTHs are sticking to their contrarian technique, proving they’re able to capitalize on market dips.

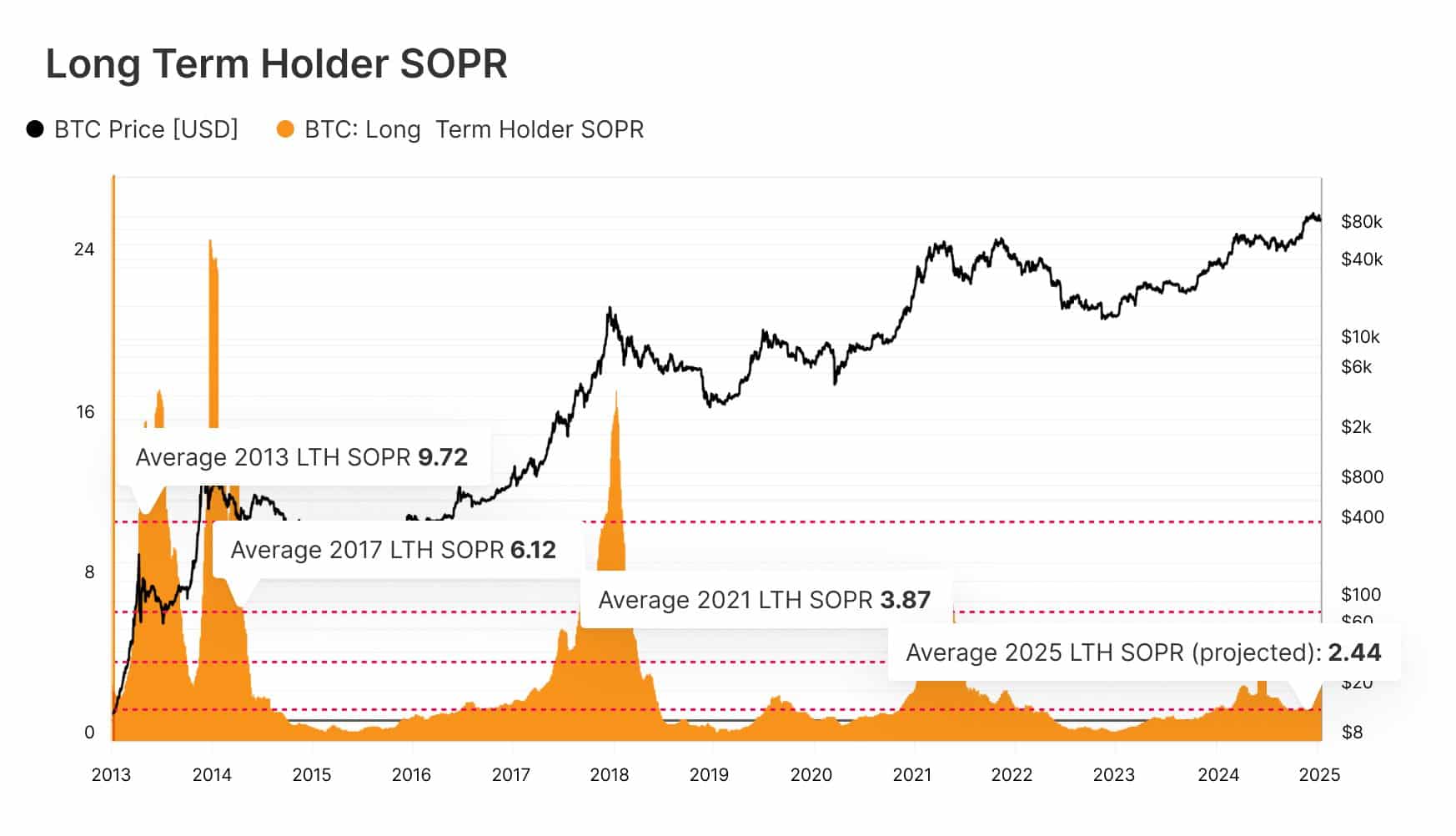

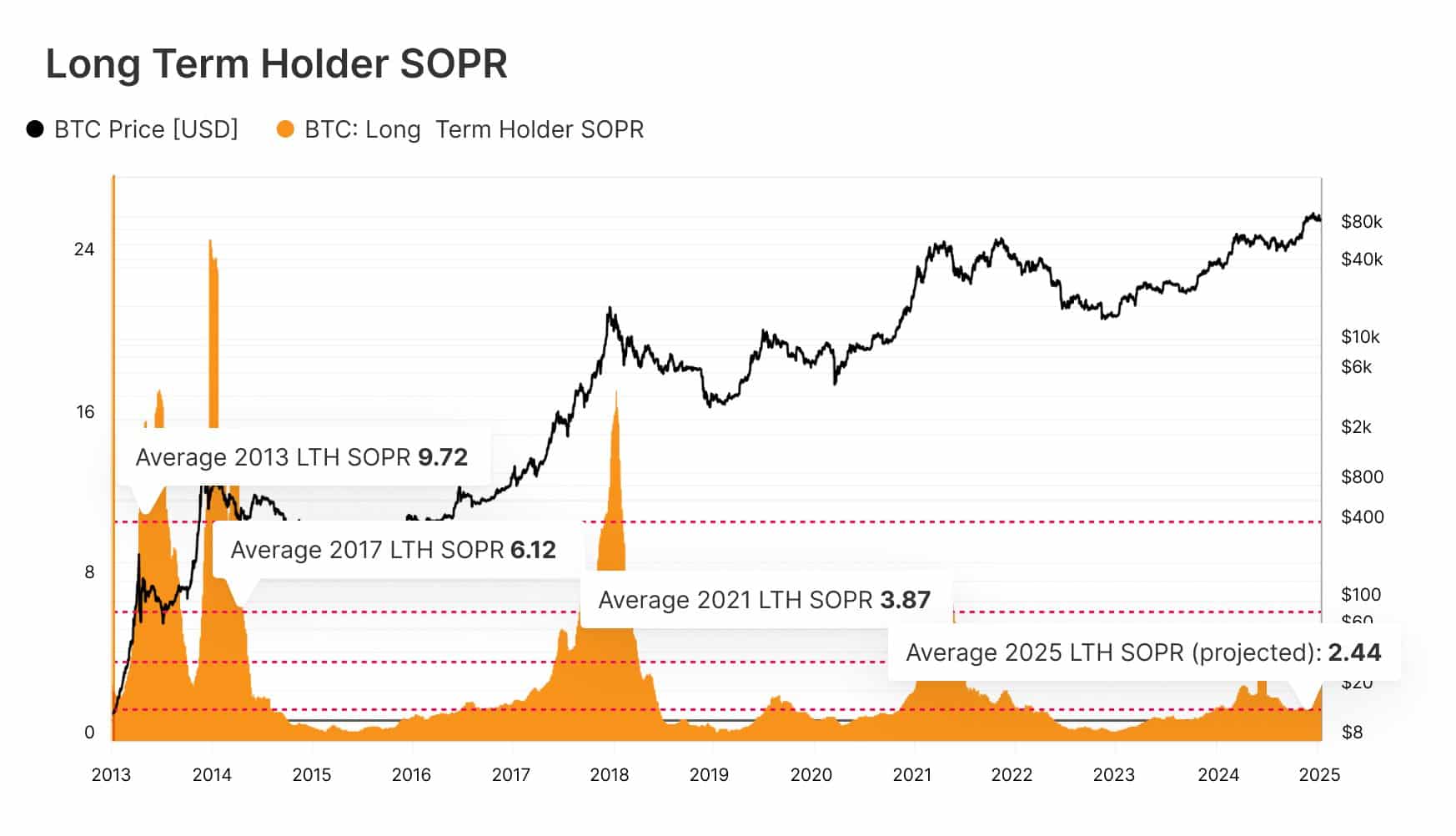

However right here’s the catch – Bitcoin’s Lengthy-Time period Holder (LTH) SOPR has proven a sample of diminishing returns after every halving. As Bitcoin’s provide tightens, LTHs are seeing smaller income.

In 2013, the typical LTH SOPR was 9.72, however by 2021, it had dropped to three.87. If this pattern continues, we might see an extra squeeze to only 2.44 by 2025.

Supply: Glassnode

Technically, on this state of affairs, LTHs face a selection – Accumulate extra BTC to make the identical income, or exit earlier than the squeeze will get tighter. It appears many are selecting to exit.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

Clearly, the stress is constructing. To forestall a large pullback, a provide shock could also be wanted. And proper now, that accountability lies within the arms of those large gamers.