Bitcoin: Holders of 1 to 100 coins intensify sell-offs because…

- Wallets that maintain between 1 and 100 BTCs have taken to promoting off their belongings.

- Whereas sentiment stays adverse, accumulation continues within the common market.

Holders with 1-100 Bitcoins (BTC) of their custody have elevated coin distribution previously few days as common sentiments stay bitter, pseudonymous CryptoQuant analyst CryptoOnchain, present in a brand new report.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

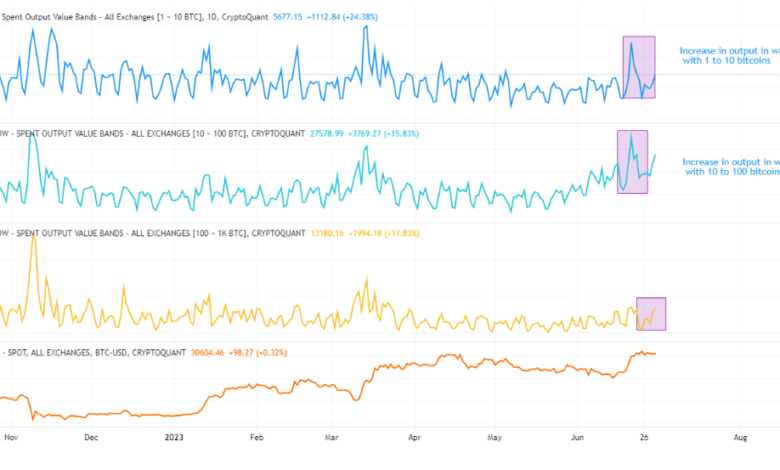

Following an evaluation of BTC’s Spent Output indicator for wallets that maintain between 1 to 100 BTCs, CryptoOnchain discovered that a fantastic share of the main cash has been moved or spent from these wallets previously few days.

Supply: CryptoQuant

Usually, a surge in Spent Output from this cohort of BTC holders usually suggests a possible enhance in promoting exercise by these traders. This might be pushed by numerous elements equivalent to profit-taking, market sentiment, or the assumption that the worth might decline additional.

Nonetheless, it might additionally imply these traders have spent the previous few days transferring their BTC holdings to different entities.

Analyst CryptoOnchain discovered additional that the most important enhance in spent output in the previous few days was noticed in wallets that held between 10 to 100 BTCs. The analyst famous:

“The most important enhance may be seen in wallets with 10 to 100 bitcoins, which after the rise of the previous few days to about 36,170 bitcoins, are at present round 28,000.”

The choice to lower their BTC holdings is perhaps resulting from a persistent decline within the optimistic sentiment. Per Santiment, BTC’s weighted sentiment has been adverse since 9 June. It lingered under the middle line at press time to return a adverse -1.048.

Maintain on to your horses

Whereas weighted sentiment remained within the adverse territory, an evaluation of BTC’s alternate exercise revealed a decline within the main coin’s alternate reserve. This metric tracks the overall variety of BTCs held inside exchanges. When the worth of this metric goes up, this implies a rally in promoting strain, whereas a decline signifies elevated accumulation.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

In keeping with knowledge from CryptoQuant, BTC’s alternate reserves trended downwards between 2 and 25 June, after which it skilled a surge until the tip of Q2. Worth actions throughout that interval revealed extreme volatility. This might have pushed many to exit their commerce positions and ship their BTC to exchanges on the market.

Nonetheless, issues have normalized previously two days because the metric has declined because the starting of July.

Supply: CryptoQuant

Additional, whereas a specific cohort of BTC holders may need taken to promoting, shopping for exercise continued unabated amongst others. A have a look at BTC’s actions on the worth chart confirmed this.

At press time, key momentum indicators RSI and MFI, rested above their impartial positions at 65.57 and 71.16, respectively. At these spots, the king coin was near being overbought.

Whereas the coin inched nearer to overbought highs at press time, its value rested near the higher band of its Bollinger Bands indicator. At this degree, it could encounter resistance, resulting in a pullback or a interval of consolidation.

Supply: BTC/USDT on TradingView