Bitcoin holding hits one-year ATH: ARK Invest

- A current report printed by ARK Make investments make clear institutional Bitcoin holding.

- The sentiment of institutional and huge capital traders has been bullish for months now.

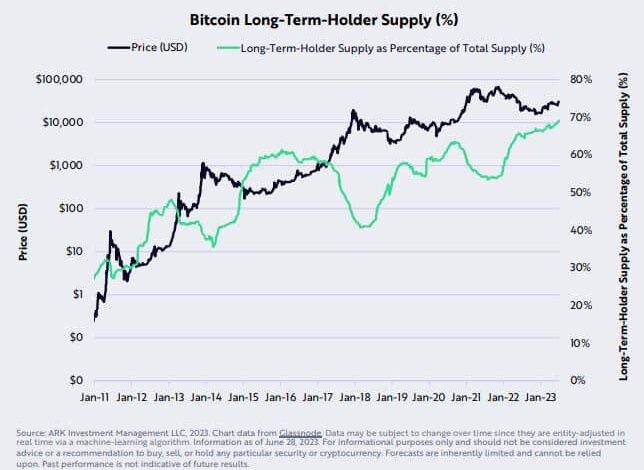

If the most recent figures are to be believed, 70% of the 19 million Bitcoin [BTC] in circulation has not moved in over a yr. The determine represented a one-year all-time excessive (ATH) in each relative and absolute phrases.

The discovering has been revealed in a report printed by ARK Make investments titled, The Bitcoin Monthly- The Dawn of the ETF Era?

In the course of the crypto winter of 2022, traders held on to round 70% of the entire BTC provide.

Supply: ARK Make investments

Practically 8,000 BTC is stay on over-the-counter (OTC) exchanges, registering a formidable rise of 60% this quarter. ARK makes use of OTC as an index to watch institutional funding exercise. The OTC determine corresponds to the Bitcoin holdings of institutional and huge capital traders.

As we will see, the sentiment of institutional and huge capital traders has been bullish for months now. The report, on its half, talked about,

“In our view, elevated balances on OTC desks counsel that establishments and different giant capital allocators are targeted more and more on Bitcoin.”

BTC ETF filings result in low cost to NAV on GBTC

The report inspects the Grayscale Bitcoin Belief (GBTC), one of many largest BTC belief companies catering to giant traders. GBTC’s low cost to internet asset worth (NAV) hit 30% in June 2023.

Supply: ARK Make investments

It signifies that the share worth of GBTC is 30% decrease than the worth of the underlying asset, i.e., BTC. Once more, the low cost is the bottom in practically one yr.

The report attributes the drop in low cost to NAV to the main asset administration agency BlackRock submitting for spot BTC exchange-traded fund (ETF) with the U.S. Securities and Alternate Fee (SEC).

Readers will do not forget that Grayscale has filed a grievance towards the SEC for denying its software to transform GBTC right into a spot Bitcoin ETF.

BlackRock isn’t the one conventional finance (TradFi) firm to file for spot BTC ETF. Different asset administration companies like Constancy, VanEck, 21Shares and WisdomTree have additionally finished so lately.