Bitcoin: How a higher-than-expected CPI could affect BTC

- The CPI got here out at 3.1%, triggering a value lower for Bitcoin.

- If rates of interest stay unchanged by March, BTC would possibly fall under $50,000 once more.

The Client Value Index (CPI) studying launched on the thirteenth of February didn’t go down effectively for Bitcoin [BTC]. Earlier than the report was launched, individuals had anticipated the CPI to return out at 2.9%. However AMBCrypto discovered that the Bureau of Labor Statistics set the benchmark at 3.1%.

A better-than-anticipated consequence meant that nominal charges have been greater which made it tough for buyers to contemplate BTC as an pressing retailer of worth. For the unaccustomed, the CPI is a measure of the combination value stage in an financial system.

When it decreases, it means client costs are usually falling, and the market can get extra liquidity.

The shop of worth can wait

Nevertheless, a excessive CPI suggests a rise in costs. Due to this fact, buyers may not take into account shopping for cryptocurrencies as an emergency determination.

Following the report, Bitcoin’s value fell from $50,000. This lower might be linked to the likelihood that some market gamers took earnings since they would want extra funds for “in actual life” actions.

Regardless of the decline, AMBCrypto observed that individuals remained hopeful that BTC’s short-term potential would possibly stay bullish.

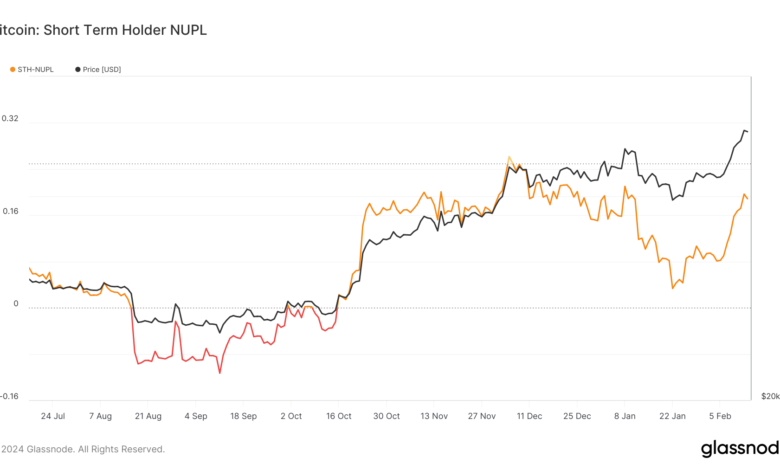

One metric that explains that is the Brief Time period Holder- Web Unrealized Revenue/Loss (STH-NUPL). This metric considers solely UTXOs youthful than 155 days and serves as an indicator to evaluate the conduct of short-term buyers.

From the chart above, Bitcoin holders have moved on from capitulation (pink). Additionally, the hope (orange) that the value would enhance was strong. Ought to this proceed, buyers’ conduct would possibly transfer to optimism (yellow).

March would possibly both make or break BTC

One other main assembly that might have an effect on Bitcoin’s value going ahead is the FOMC. The FOMC stands for Federal Open Market Committee. It’s a division of the U.S. Federal Reserve that focuses on setting financial coverage by managing open market circumstances.

Some weeks again, AMBCrypto reported how the Fed Chair Jerome Powell predicted that the Fed may not minimize rates of interest by March. A more moderen improvement pushed by the CME Group revealed that the chance of retaining rates of interest the identical has elevated to 92%.

The derivatives market additionally noted that the chance of reducing rates of interest was 62.1%. If By March, the FOMC decides to chop charges, Bitcoin’s value would possibly soar greater. But when the charges stay unchanged, the worth would possibly both lower or consolidate.

Within the meantime, on-chain information from Santiment confirmed that BTC was closing in on a return to $50,000. The publish talked about that the disappointing CPI end result put merchants in panic. However now, market individuals have been taking positions for additional climb.

#Bitcoin is nearing one other cross again above $50K, climbing again to $49.8K following the panic drop from yesterday’s disappointing #CPI report. Merchants which are attentively positioning their portfolios with the appropriate mixture of #altcoins are nonetheless profiting as

(Cont)

pic.twitter.com/s6t4UGZ01r

— Santiment (@santimentfeed) February 14, 2024

Is your portfolio inexperienced? Examine the BTC Revenue Calculator

If Bitcoin reclaims $50,000, then main altcoins may also rebound. Ought to this be the case, BTC would possibly attempt to take a look at $55,000 whereas a widespread altcoin rally would possibly start.