Bitcoin: How halving events dictate the behavior of BTC investors

- As BTC was getting scarcer, traders confirmed extra willingness to HODL.

- The quarterly issuance was set to drop to round 40,000 after halving.

Bitcoin [BTC] holders have been ready anxiously for the upcoming halving in 2024, with hopes that the pivotal occasion would kickstart the bull run and drive the most important digital asset’s value to even greater ranges than beforehand seen.

Furthermore, if historical past is something to go by, these occurrences did truly precede durations of excessive returns. Therefore, traders who witnessed a big dent of their portfolios within the bear market had loads at stake.

How traders are making ready for the halving

Contemplating the significance of the occasion, a marked shift in investor conduct and provide began coming to gentle. Customers turned reluctant to let go of their stashes and adopted the HODLing technique.

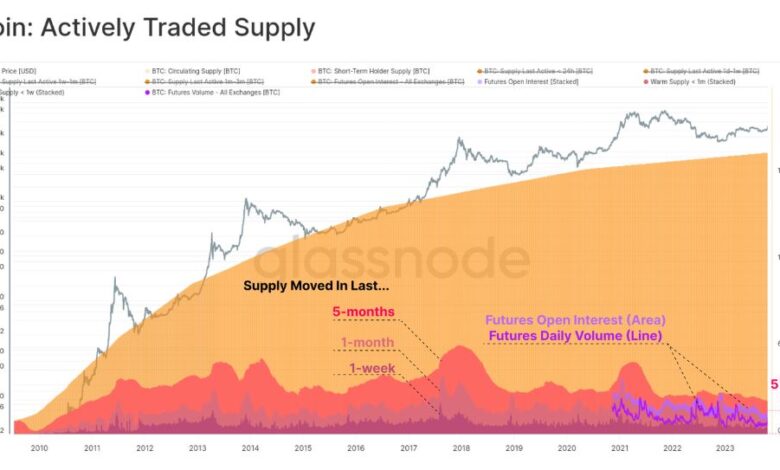

The end result – a pointy dip in BTC provide out there for merchants to purchase and promote. In response to a latest report by on-chain analytics agency Glassnode, the actively traded provide represented simply 5%-10% of the whole circulating provide.

Moreover, the availability of cash transferring into liquid wallets, i.e., those that obtained cash and had a robust monitor report of spending them, was on a multi-year decline.

As an alternative, most cash withdrawn from exchanges have been discovering their solution to illiquid wallets, with little to no monitor report of investing.

An fascinating facet of the rise in illiquid provide was the expansion of institutional custody merchandise such because the Grayscale Bitcoin Belief (GBTC).

Be aware of how the March 2020 turning level highlighted above coincided with a considerable enhance in demand for GBTC.

The evident divergence

In distinction to the decline in actively traded provide of BTC, the long-term holder (LTH) provide confirmed a considerable enhance within the final two years. A evident divergence was noticed between the 2, as evident under.

The divergence implied that increasingly more cash have moved out of change custody to chilly wallets and self-custody of long-term holders.

However how does the bounce in illiquid provide match into the upcoming halving and post-halving situations?

Illiquid provide rising sooner than issuance

As per the report, roughly 81,000 BTC cash have been being mined every quarter. The rely was set to lower to round 40,000 after the halving.

In distinction, the illiquid provide was ramping up at a fee of 180,000 BTCs every quarter. This was practically 2.2 occasions greater than the issuance charges. In actual fact, all earlier halvings witnessed sustained accumulation within the lead-up to the occasion.

The saved provide exceeding the brand new issuance in a pre-halving setting mirrored traders’ sentiment round Bitcoin. With the availability turning into scarcer sooner or later, such a method would possibly change into extra widespread than it was on the time of publication.

Furthermore, LTHs accumulate cash throughout a consolidating market and look forward to a bull run to distribute their holdings. It is a traditionally confirmed narrative that performed out throughout the 2021 bull run.

Combining the aforementioned tendencies, one can see how halving occasions act as one of many major drivers of BTC’s bull cycle.

Market sees correction

In the meantime, the market skilled a correction within the final 24 hours as BTC slipped under $37,000. In response to Coinglass, the whole liquidations on the community hit $174 million, with 70% of them being lengthy liquidations.

The Open interest (OI) in Bitcoin futures was marginally affected by the value dip, reducing by 1.45% within the final 24 hours.

How a lot are 1,10,100 BTCs worth today?

Nonetheless, by and huge, the market was nonetheless optimistic concerning the near-term outlook. Using on the ETF wave, Bitcoin in addition to Ethereum [ETH] regarded properly poised to draw the following wave of liquidity within the coming months.

Shivam Thakral, CEO of Indian cryptocurrency change, opined,

“Open curiosity in BTC choices surpassed $16 billion as patrons are dominating the present market. We could also be witnessing early indicators of the following bull run with the market indicators pointing towards a wholesome come again.”