Bitcoin: How rising stablecoin supply can put BTC’s $90K at risk

- Stablecoin reserves on derivatives exchanges have surged.

- Till stablecoin quantity flows again into spot buying and selling, volatility is predicted to persist.

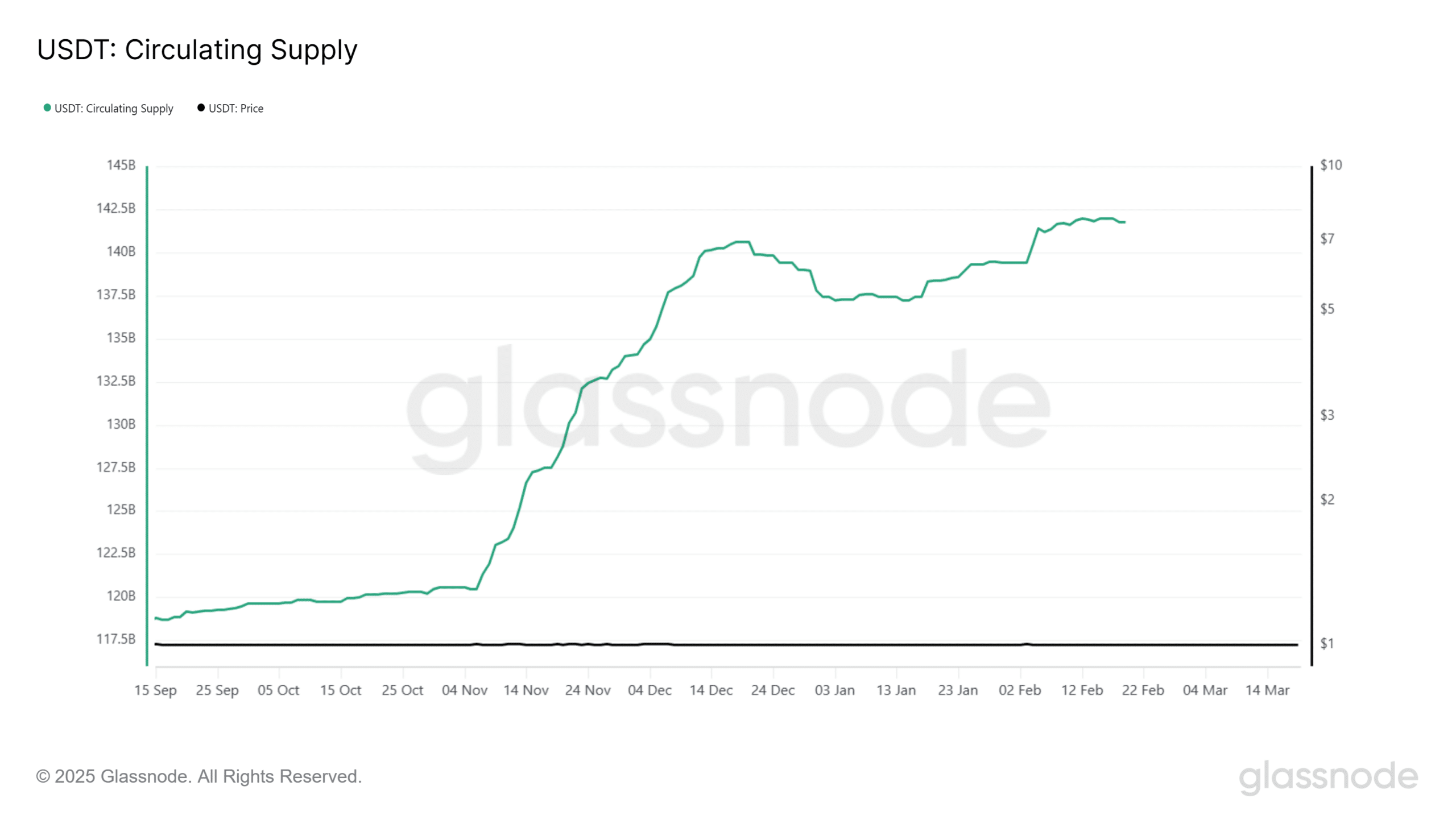

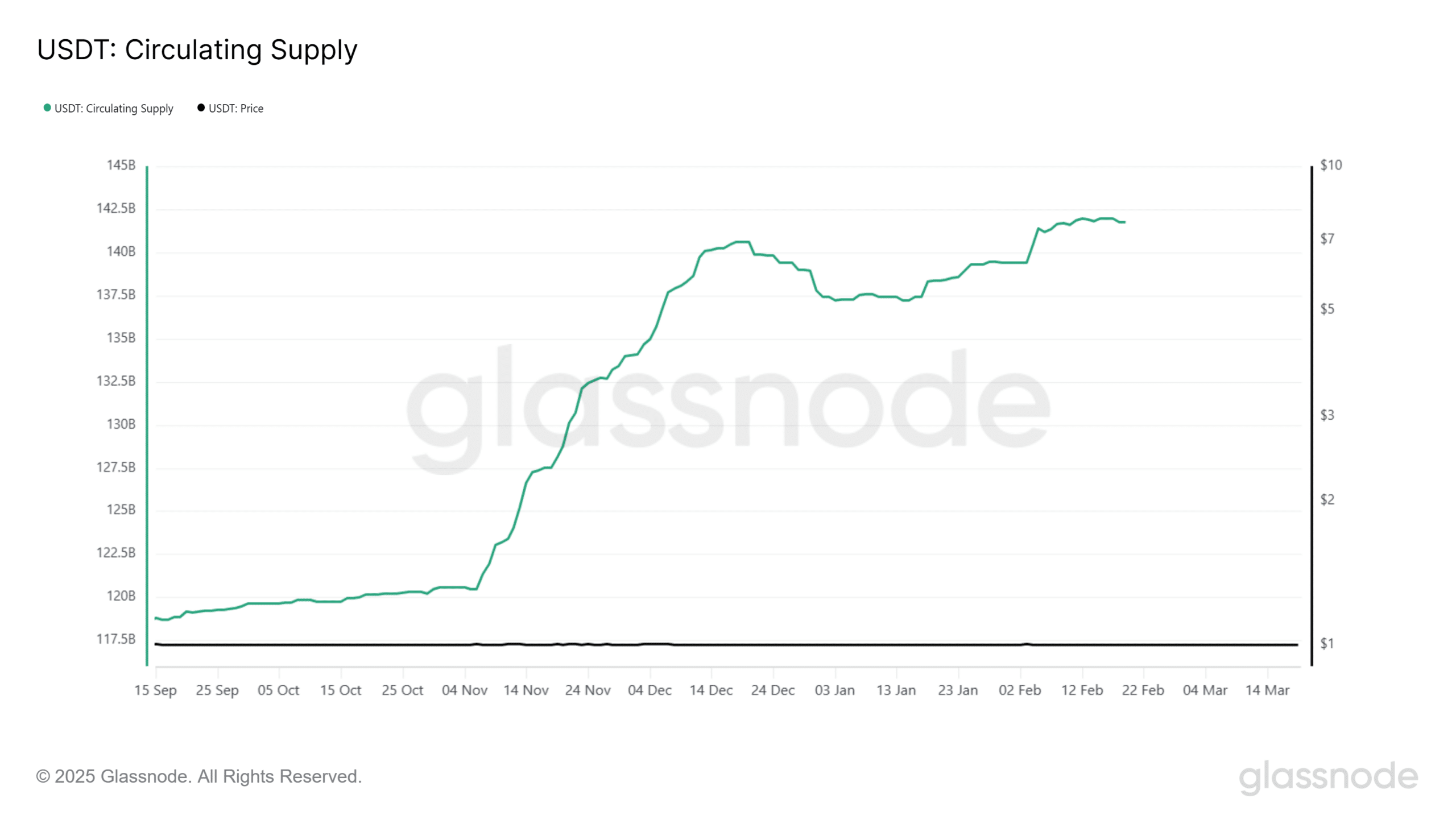

Since November, there was a major improve within the provide of stablecoins, coinciding with Bitcoin’s [BTC] bullish rally.

Nevertheless, this liquidity has predominantly flowed into derivatives markets relatively than spot markets.

This report analyzes the implications of this development. Is the market overleveraged, and will extreme high-leverage buying and selling put Bitcoin’s short-term value motion in danger?

Leveraged bets cleared the path in stablecoin use

A rising stablecoin provide usually signifies elevated shopping for energy. Nevertheless, its diversion into derivatives suggests merchants are favoring leveraged positions over direct BTC accumulation.

Since November, merchants have added round $20 billion in Tether (USDT) to circulation, coinciding with Bitcoin’s climb to its all-time excessive of $109k.

Supply: CryptoQuant

Whereas this surge pointed to heightened USDT liquidity out there, significantly in BTC shopping for stress, data from CryptoQuant revealed a lot of this liquidity was funneled into high-risk leveraged buying and selling.

Because the derivatives market noticed a spike in purchase orders, Open Curiosity (OI) soared to an all-time excessive of $70 billion on the twenty second of January.

At present, it stands at $52 billion. The closure of those positions has exerted intense downward stress on BTC’s value, making it difficult for Bitcoin to reclaim the $90k mark.

Weak spot demand places Bitcoin’s future in danger

The USDT movement on election day exhibits this shift clearly. On the sixth of November, web outflow of stablecoins from spot exchanges signaled heightened shopping for exercise – usually a bearish indicator.

Nevertheless, the derivatives market noticed an explosive influx of 1.2 billion in USDT, pointing to an increase in leveraged buying and selling.

Whereas such liquidity influxes in derivatives can point out bullish sentiment in a robust market, they introduce important threat in a risky surroundings.

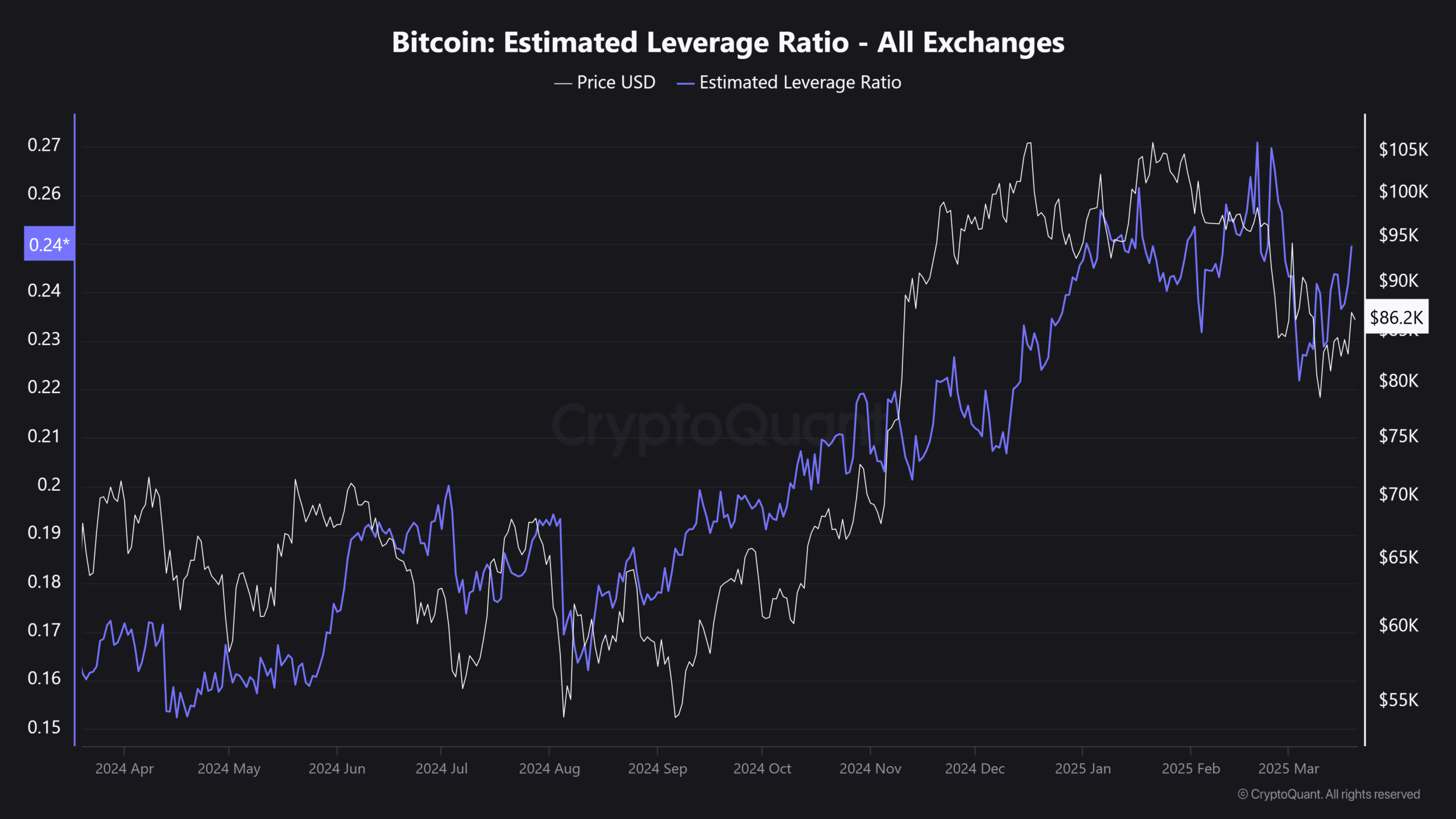

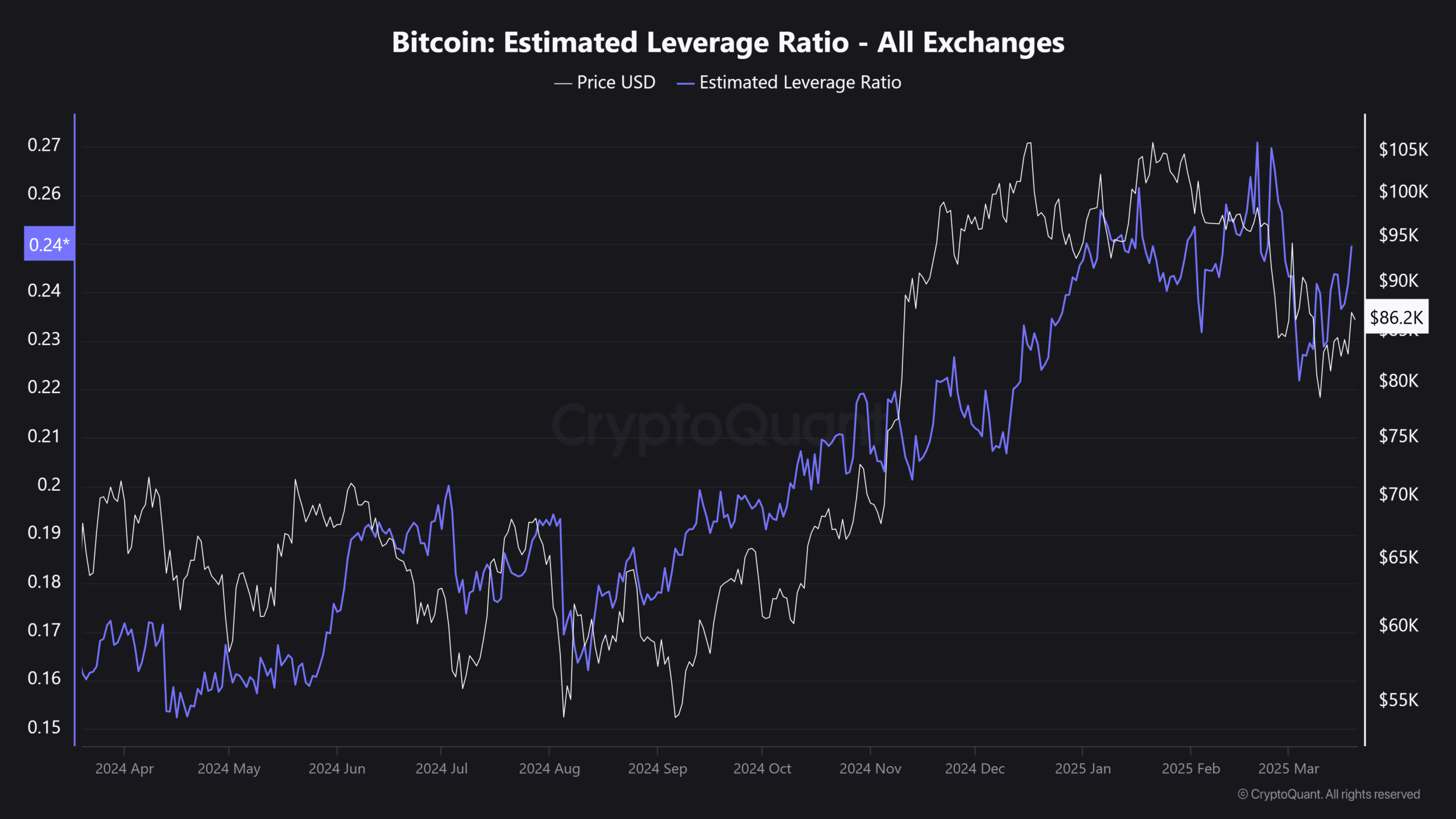

Following the FOMC assembly, which sparked slight optimism for potential price cuts, Bitcoin’s Estimated Leverage Ratio (ELR) noticed a dramatic improve.

Supply: CryptoQuant

As expectations for decrease borrowing prices grew, merchants flocked to high-leverage positions. This development is one to observe intently as Q2 progresses.

Given the weak accumulation within the spot market, these leveraged positions face the next chance of liquidation.