Bitcoin: How THIS metric signals big potential for $85K breakout

- Bitcoin’s Worth Days Destroyed metric has dropped to its lowest stage since mid-2024, signaling a shift to accumulation.

- Historic patterns confirmed that low VDD phases usually precede bullish worth actions, strengthening the long-term outlook.

Bitcoin [BTC] could also be amid one other strategic buildup as seasoned market members shift gears from profit-taking to accumulation.

This evolving pattern is clear within the newest on-chain information, notably the Worth Days Destroyed (VDD) metric, which has now reached a section traditionally related to future worth surges.

Bitcoin long-term holders re-emerge as accumulators

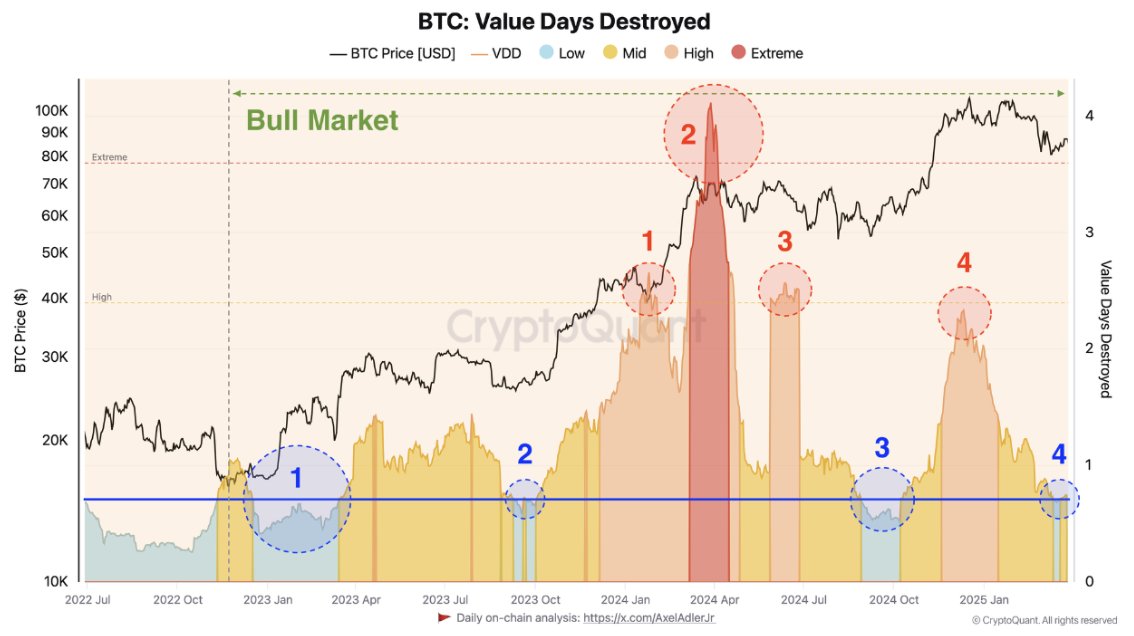

The Bitcoin VDD chart reveals 4 vital accumulation phases: January and October 2023, October 2024, and now March 2025.

Every section is marked by a pointy drop in VDD, signaling lowered coin motion and elevated conviction amongst long-term holders. The present studying, highlighted by the fourth blue circle on the chart, is the bottom since mid-2024.

Traditionally, such low VDD values have preceded sturdy bullish strikes. In every earlier accumulation section, Bitcoin registered a brand new leg up shortly after.

The conduct of those seasoned members, shopping for low and exiting close to native tops, provides a dependable gauge for broader market sentiment. Their present stance suggests they don’t see current worth ranges as opportune for distribution.

No indicators of profit-taking from sensible cash

Purple circles on the Bitcoin VDD chart level to 4 distinct promoting spikes—January, April, July, and March 2025.

Every surge in worth destruction corresponded to native tops, underscoring how strategic these entities are in capturing income. However as of now, there’s no such spike.

The absence of realized worth destruction helps the idea that sensible cash is staying put. Their conviction provides credence to a worth flooring forming close to the $82K stage, discouraging aggressive short-selling within the present construction.

Bitcoin worth motion aligns with on-chain calm

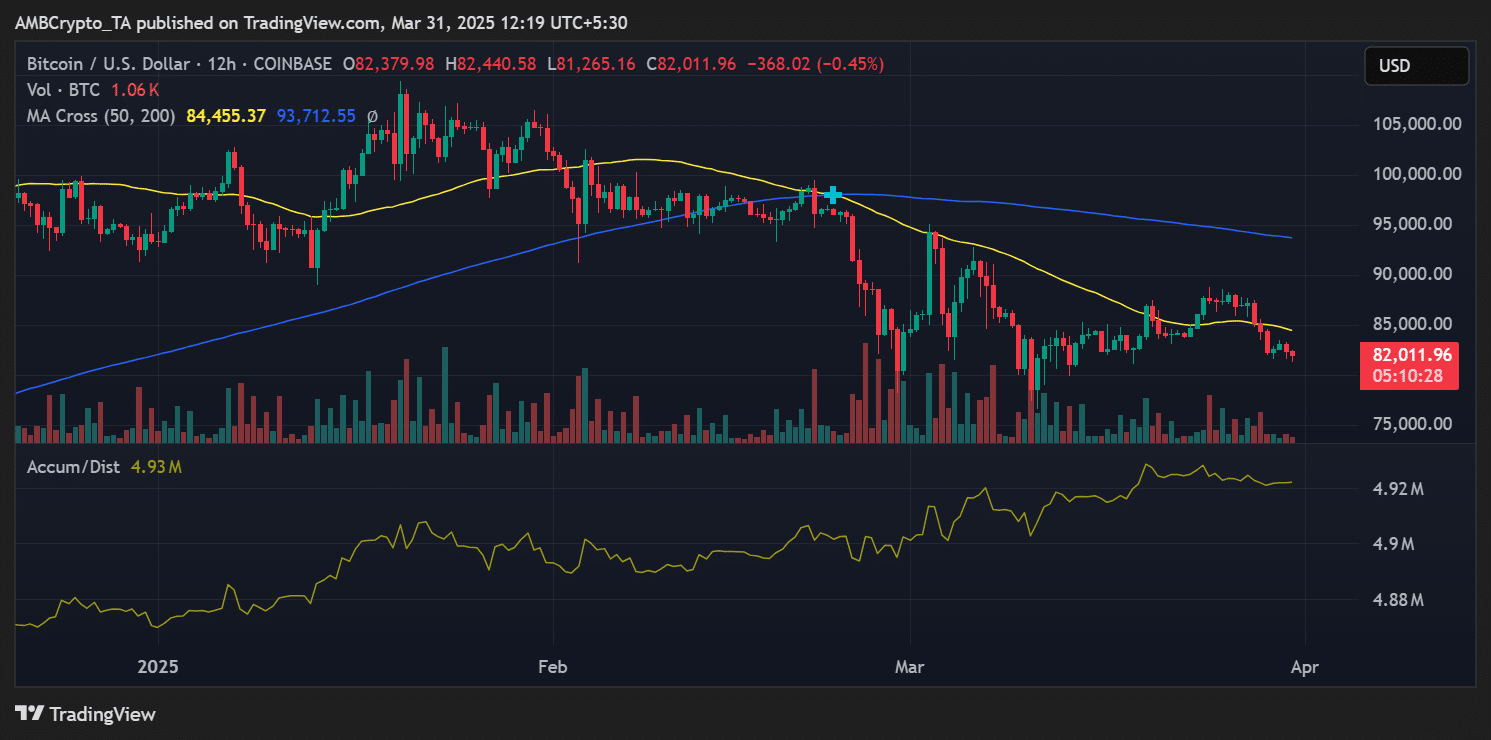

Bitcoin traded at $82,011 at press time, beneath each the 50-day and 200-day Transferring Averages at $84,455 and $93,712, respectively.

Regardless of the bearish short-term construction, the Accumulation/Distribution Line is secure at 4.93M, indicating that distribution strain hasn’t intensified.

Supply: TradingView

This divergence, worth weak spot vs. regular A/D ranges, might level to a hidden bullish divergence forming. It might affirm this thesis if the value stabilizes and breaks above the $ 84K-$ 85K resistance zone.

What subsequent?

Bitcoin’s low VDD surroundings, mixed with the buildup conduct of long-term holders and muted distribution metrics, indicators a possible bottoming section.

If historic patterns repeat, BTC could also be organising for its subsequent bullish impulse.