Bitcoin – Identifying whether the range low will hold again

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- BTC struggled to put up sturdy restoration from the range-low

- Lengthy-term holders accrued extra throughout newest value consolidation

Bitcoin [BTC] was at a crossroads because the bears and bulls fought for the $30k value degree. Since Wednesday (19 July), BTC has closed its day by day candlestick classes beneath $30k. The pattern bolstered bears’ growing leverage as they sought to flip $30k to resistance.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

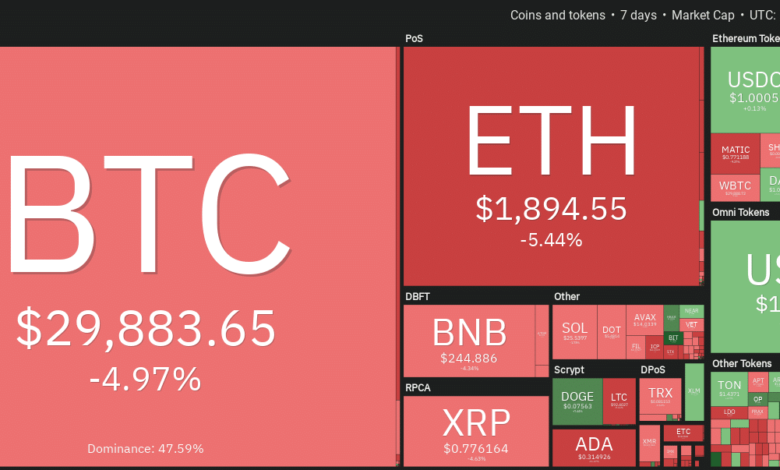

Supply: Coin360 (BTC weekly value efficiency)

Over the identical interval, the US Greenback Index (DXY) edged increased, taking the wrong way to BTC’s value motion. Primarily based on weekly efficiency, BTC suffered about 5% losses.

Will the range-low maintain rescue bulls once more?

Supply: BTC/USDT on TradingView

To this point, the $29.5k-level has been an important rebound degree at any time when BTC fell beneath $30k throughout latest fluctuations. Moreover, the 50-EMA (Exponential Shifting Common) has been an important dynamic help and resistance degree.

So, a drop beneath $29.5k and subsequent breach of the 50-EMA of $29.3k will cement bears’ leverage available in the market. In such a bearish state of affairs, the essential help ranges to observe are $28k and $26.6k, particularly if subsequent week’s (25/26 July) FOMC assembly takes a hawkish stance and unnerves traders.

Conversely, bulls may reinforce their place in the event that they safe the range-low space of $29.3k – $29.5k. Nevertheless, the $31.5k and $32k ranges stay the speedy hurdles to clear earlier than BTC stretches for $34k.

In the meantime, the RSI (Relative Power Index) retreated from the overbought zone and crossed the 50-mark, on the time of writing. Equally, the CMF (Chaikin Cash Circulation) breached beneath zero. Taken collectively, the symptoms underscored growing bears’ leverage.

Lengthy-term holders not nervous

Supply: Glassnode

Regardless of bearish overtures, long-term BTC holders accrued even throughout newest value fluctuations. Notably, the Whole Provide Held by Lengthy-Time period Holders graced a brand new excessive of 14.5 million, regardless of BTC threatening to report a bearish breakout.

How a lot are 1,10,100 BTC price at present?

However, BTC famous over $14 million in total liquidations within the final 24 hours. Out of the $14 million, $12 million accounted for wrecked lengthy positions, additional emphasizing the sturdy bearish grip.

Traders ought to monitor subsequent week’s Fed charge hike determination to substantiate whether or not the bearish stress will fall or not.