Bitcoin in July: With whales on the move, here’s what BTC will do

- The availability of BTC in revenue surged to 72.3% as of 4 July as per information from Glassnode

- Bitcoin has been regaining its attraction and inflation may not be a significant menace anymore.

Profitability is without doubt one of the greatest components that traders contemplate earlier than shopping for an asset. You would possibly thus discover Glassnode’s newest statistics on Bitcoin [BTC] profitability to be fairly fascinating. Probably even complicated.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

The availability of BTC in revenue lately climbed to 72.3%. However simply what does this imply for merchants? Lower than 50% of the availability in revenue at its lowest level throughout the lowest level in 2022.

Now that the market has been recovering, the extent of BTC profitability additionally improved. However that’s not all.

The Adjusted #Bitcoin % Provide in Revenue has reached a price of 72.3%, equal to 10.8M cash holding a worthwhile place.

When assessing the share of buying and selling days with a larger worth than 72.3%, we observe 49.2% of buying and selling days have recorded a bigger worth. This… pic.twitter.com/yiGX6Hm9MW

— glassnode (@glassnode) July 4, 2023

The BTC provide in revenue is predicated on costs above $30,000. In different phrases, roughly 72% of the BTC acquired beneath the $30,000 worth vary is now in revenue. Whereas that quantity appears excessive, it steered that there was fairly a excessive stage of confidence amongst BTC holders.

Then again, it additionally calls consideration to the possibly heavy promote strain if traders are incentivized to promote.

Will inflation lastly favor BTC?

The market path stays on the mercy of a number of market components. Inflation has been among the many main components which have influenced BTC costs in latest months. It is because the treatment for inflation has largely been elevating rates of interest.

Sadly, high-interest charges are likely to discourage funding, therefore asset costs fall. Current information steered that analysts anticipate decrease core inflation.

Core inflation the fear, anticipated to additionally tick decrease at this month’s print… however not the place it must be. pic.twitter.com/80lv0u02Hl

— tedtalksmacro (@tedtalksmacro) July 4, 2023

BTC costs have been bearish throughout months when inflation escalated. This implies increased than anticipated inflation would possibly yield some promoting strain. Nevertheless, that doesn’t essentially need to be the result since BTC was initially created as a hedge towards inflation. However, closely leveraged BTC positions performed an enormous function in initiating promote strain on account of liquidations.

Current findings additionally revealed that BTC was now now not correlated to the S&P 500. In different phrases, BTC is now not taking part in by the principles of the standard funding market. Some see this as an opportunity for BTC to lastly operate as an inflation hedge. In spite of everything, a lot of the overleveraged liquidity has already been weeded out.

Bitcoin’s correlation to the S&P 500 has gone again to zero.

As blockchain is under no circumstances related to rates of interest, it ought to have a really low correlation to the principle asset courses (shares, bonds, actual property), that are tightly pushed by charges.

Extra: https://t.co/6xoXJhvU04 pic.twitter.com/GZNXJNzZKz

— Dan Morehead (@dan_pantera) July 3, 2023

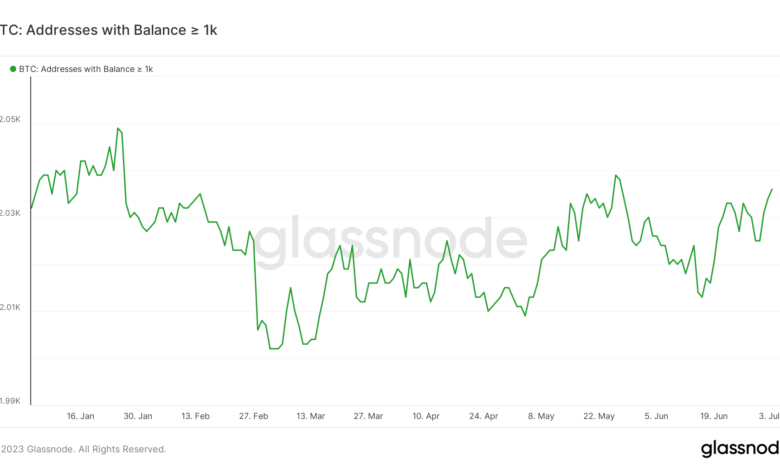

A take a look at tackle exercise revealed that extra whales have been discovering BTC enticing in the previous few months. As an illustration, addresses holding not less than 1,000 BTC have been rising since early March.

Supply: Glassnode

Examine Bitcoin’s [BTC] worth prediction 2023-24

In abstract, BTC has been receiving a number of consideration in the previous few months. Market confidence has improved considerably, particularly after the occasions of 2022 judging by the profitability. A lot that even whales have been getting in on the motion.