Bitcoin: Is 2025 setting the stage for big gains? – THIS metric says yes

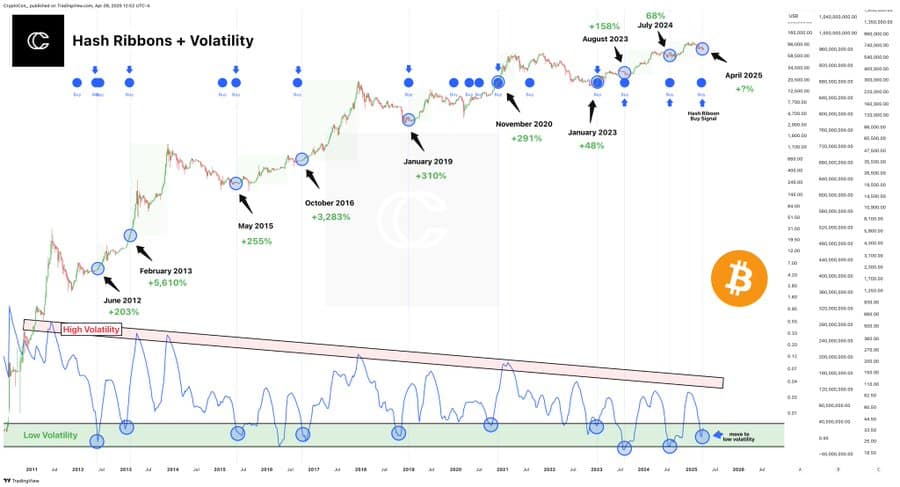

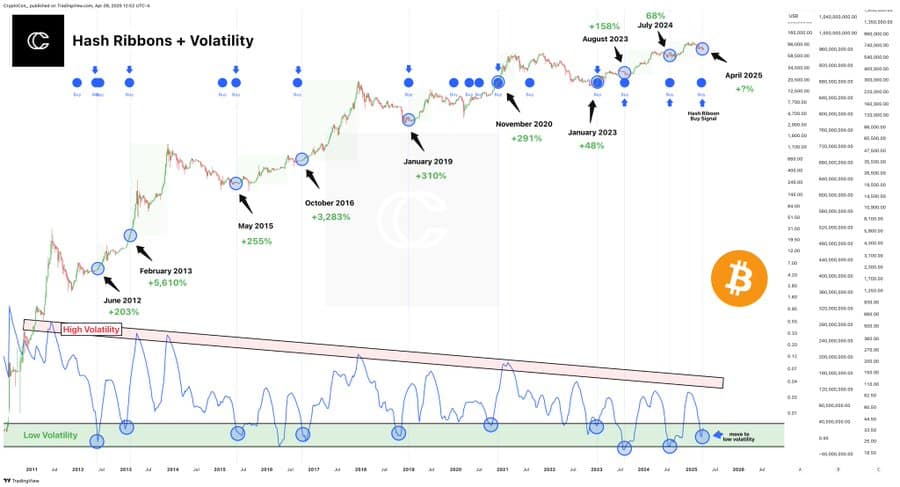

- Bitcoin’s volatility was nearing historic lows — usually a launchpad for main bullish strikes.

- Hash Ribbons purchase sign and low volatility have by no means didn’t precede a BTC rally.

Bitcoin [BTC] has entered an unusually quiet section, with volatility dropping to exceptionally low ranges. Traditionally, such intervals of calm have typically preceded important worth surges.

Including to this anticipation is the Hash Ribbons purchase sign, which is flashing inexperienced—a dependable indicator suggesting a possible market shift.

Might this be the calm earlier than the storm for Bitcoin? It typically is.

Why low volatility isn’t boring – it’s bullish!

When Bitcoin volatility dips into the “low” zone, it often indicators a interval of eerie calm. However don’t mistake it for weak spot!

Traditionally, these intervals of low volatility have typically signaled the buildup of momentum for important worth surges. Previous cycles in 2012, 2015, 2019, and 2023 exhibit that calm markets often precede main upward strikes.

The long-term decline in volatility additionally displays the rising maturity of Bitcoin as an asset class. Nevertheless, every second of calm has persistently been adopted by dramatic worth spikes.

Presently, Bitcoin finds itself again on this low-volatility “inexperienced zone,” suggesting a possible coiled spring second if historical past is any indicator.

Notably, Bitcoin has been more and more transferring in tandem with conventional belongings like shares and gold. This lowered volatility is also seen as an indication of the market’s continued maturation.

The sign with a 100% bullish hit charge

The Hash Ribbons buy signal — marked by these blue circles within the chart – has by no means been triggered throughout a bear market. Not as soon as.

Supply: X

This sign usually fires up when Bitcoin’s mining issue resets after a interval of miner capitulation, signaling renewed energy within the community.

What’s much more convincing? Each time this Hash Ribbon purchase aligns with low volatility, as it’s doing now, it precedes an enormous rally.

Consider the surges in 2013, 2016, and 2020. The newest purchase in August 2023 already introduced a +158% transfer. And but, based on the chart, we haven’t even touched the high-volatility “cycle prime” zone. The primary occasion should still be forward.

Skepticism is wholesome — however the knowledge doesn’t lie

Might Bitcoin faux us out? It’s all the time a risk.

Nevertheless, the proof suggests in any other case. Volatility is at unusually low ranges, a brand new Hash Ribbon purchase sign has appeared, and there are not any indications of a macro prime—Bitcoin has but to enter the high-volatility zone usually seen at bull market peaks.

Traditionally, each occasion of low volatility paired with a Hash Ribbon purchase sign has resulted in substantial returns with out exception.

After all, previous efficiency is just not a assure, however dismissing a 100% historic success charge is perhaps extra wishful pondering than sound technique.

On the time of writing, all indicators pointed upward. This won’t mark the height however moderately the start of a big ascent.