Bitcoin: Is a local top forming? Why BTC’s pullback looks close

- Bitcoin is exhibiting indicators of a possible native prime, with key momentum indicators suggesting overextension.

- Is one other pullback imminent?

On the 2nd of March, Bitcoin [BTC] surged 9.44% in a single day – the best one-day achieve in three months.

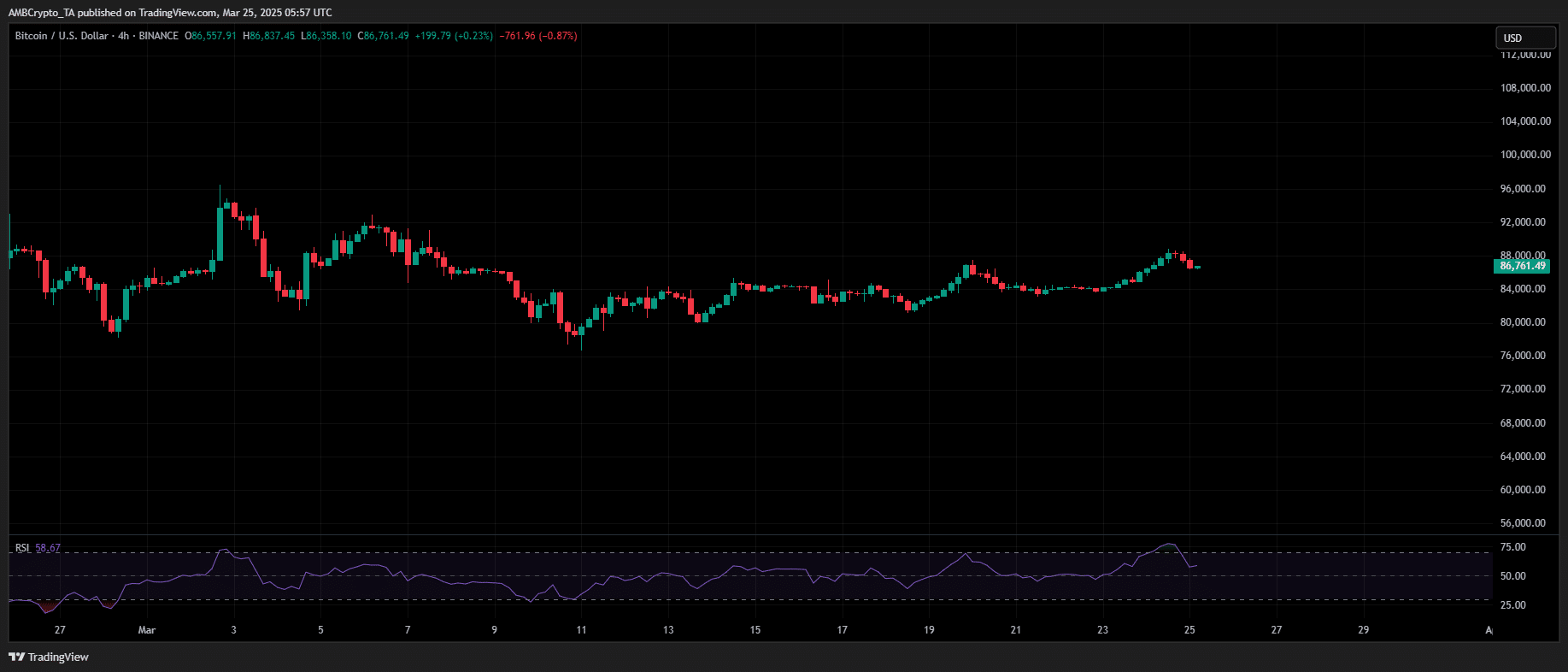

Because the 4-hour RSI peaked at 70, worth motion reversed, resulting in a 14.13% decline to $81,500 inside 10 buying and selling classes.

Supply: TradingView (BTC/USDT)

The final time Bitcoin noticed the same capital inflow was through the election run, when BTC reached its then-all-time excessive of $88,400 on the eleventh of March, pushing the 4-hour RSI into overbought territory.

Regardless of the overbought studying, bulls absorbed sell-side liquidity, flushed out weak fingers, and pushed BTC to a $92,647 peak two days later.

Transferring ahead, the Relative Power Index (RSI) is a momentum oscillator that measures the pace and alter of worth actions on a scale from 0 to 100.

Historically, an RSI above 70 signifies that an asset could also be overbought, suggesting potential for a worth pullback, whereas an RSI beneath 30 suggests it could be oversold, indicating potential for a worth rebound.

Traditionally, when Bitcoin’s 4-hour RSI enters overbought territory, it signifies sturdy bullish momentum however has steadily preceded sharp worth corrections.

Now, three months later, Bitcoin has reclaimed $88k for the primary time in 17 days. Nonetheless, on the 4-hour chart, RSI has once more surged close to 80.

With profit-taking doubtless, can bulls take up the sell-side strain, or is one other March-style correction imminent?

Bitcoin poised for a pullback

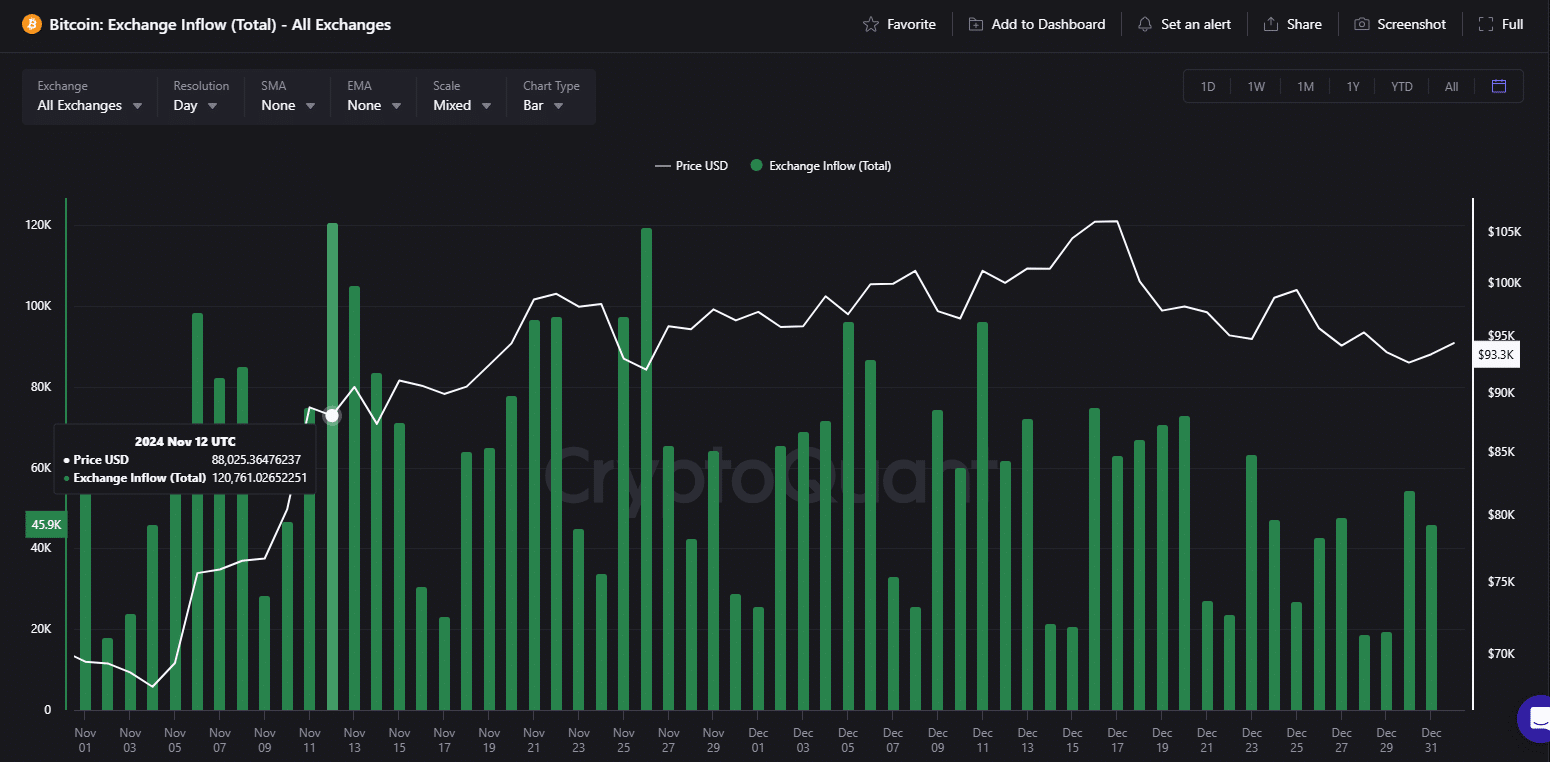

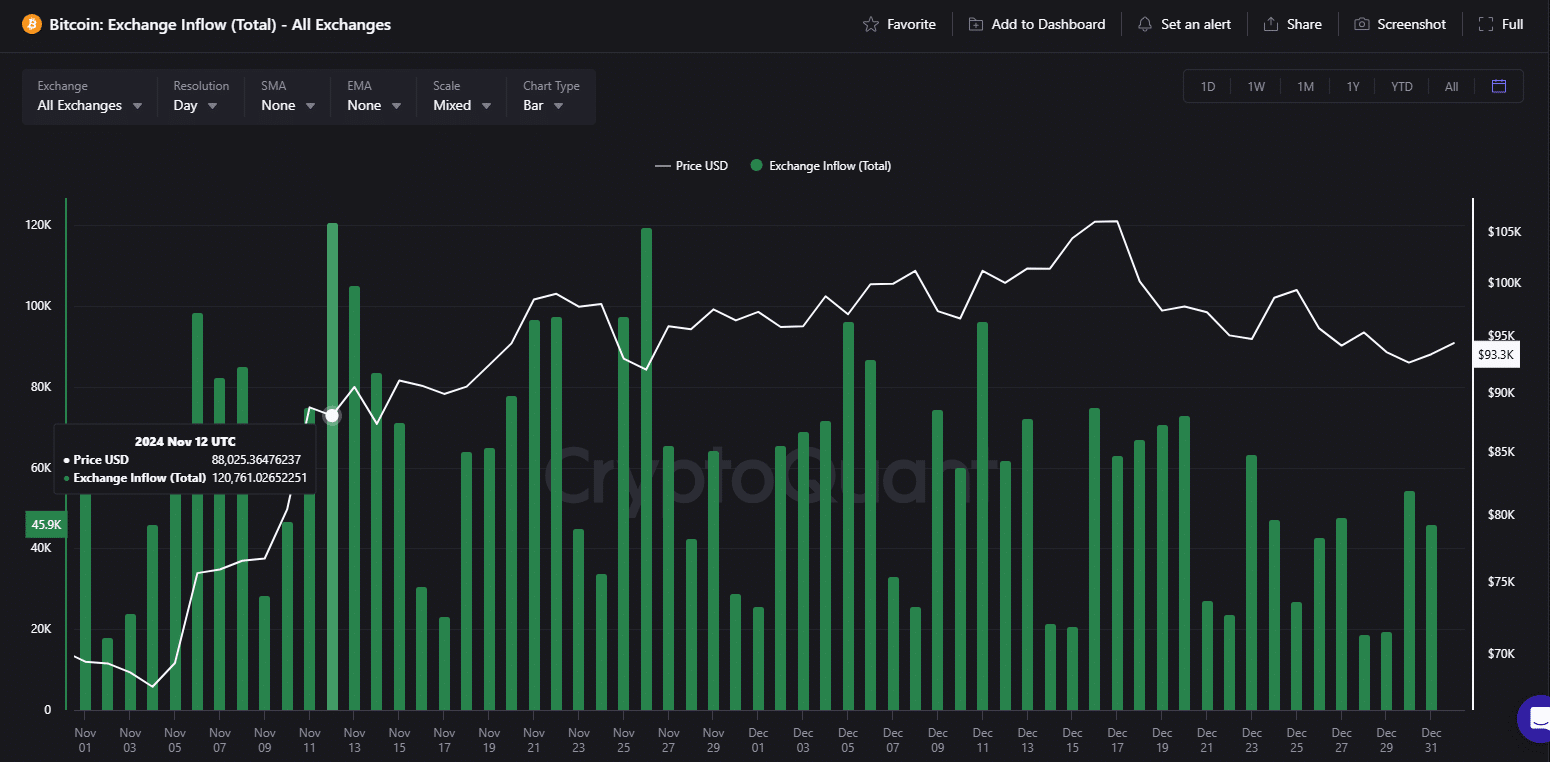

AMBCrypto uncovered a key sample. On the twelfth of March, as Bitcoin’s RSI signaled overextension, Bitcoin ETFs registered their second-highest influx – a report $1.114 billion.

This advised that sustained institutional demand performed an important function in absorbing the impression of 120,761 BTC, value $10.67 billion, that flooded exchanges in a single-day sell-off.

Supply: CryptoQuant

As of this writing, Binance spot demand stays sturdy, with internet outflows suggesting continued Bitcoin accumulation. The derivatives market additionally mirrored bullish positioning.

In the meantime, each long- and short-term SOPR (Spent Output Revenue Ratio) have flipped above 0, confirming that holders are actually in revenue.

Nonetheless, with the Bitcoin’s 4-hour RSI in an overbought territory, profit-taking strain may escalate, doubtlessly triggering short-term volatility. For Bitcoin to push towards $90k, sustained shopping for momentum is essential.

But, with “reciprocal” tariffs set to take impact on the 2nd of April, market uncertainty stays excessive. If resistance holds, a corrective transfer towards the $82k–$83k vary seems doubtless within the close to time period.