Bitcoin is scarcer than ever! – Why BTC’s $100K mark is only step one

- Bitcoin’s halving schedule reduces mining rewards, enhancing scarcity-driven worth.

- How a lot provide is actually left for the remainder of the market?

Bitcoin’s [BTC] edge over fiat isn’t simply that it’s decentralized, it’s that there’ll solely ever be 21 million cash.

Not like common cash, which governments can print endlessly and watch lose worth, BTC’s provide is locked in, making it extra prone to recognize over time as a result of it’s changing into scarcer.

With the subsequent Bitcoin halving approaching, a lowered provide might influence value motion, probably driving stronger bullish momentum.

The countdown to Bitcoin’s final shortage

Glassnode reported that Bitcoin has now mined 900,000 blocks since its inception. Every mined block releases new Bitcoin, growing the provision.

Nonetheless, attributable to halvings, block rewards are reduce in half each 210,000 blocks. This implies Bitcoin’s issuance slows considerably because it approaches the 21 million provide restrict.

Supply: Glassnode

To place that into perspective: miners course of Bitcoin blocks each 10 minutes, producing about 6 blocks per hour—totaling 144 blocks each day.

Earlier than the halving, every block rewarded 6.25 BTC, leading to 900 new BTC coming into the market per day.

After the halving, rewards dropped to three.125 BTC per block, slicing each day Bitcoin issuance to 450 BTC—practically half.

Since then, BTC has surged 47%, reflecting the influence of lowered provide.

Just one.7 million left, and it’s drying up quick

Notably, miners count on the subsequent halving to hit round block peak 1,050,000 in 2028, slicing the block reward all the way down to 1.5625 BTC.

Run the numbers, and that’s simply 1.5625 BTC × 144 blocks = 225 BTC per day hitting the market, half of at this time’s already-thin issuance.

That’s a serious provide reduce. With just one.7 million Bitcoin left to mine earlier than we hit the 21 million cap, every halving makes Bitcoin even scarcer. And while you take a look at the highest wallets, the provision squeeze feels even tighter.

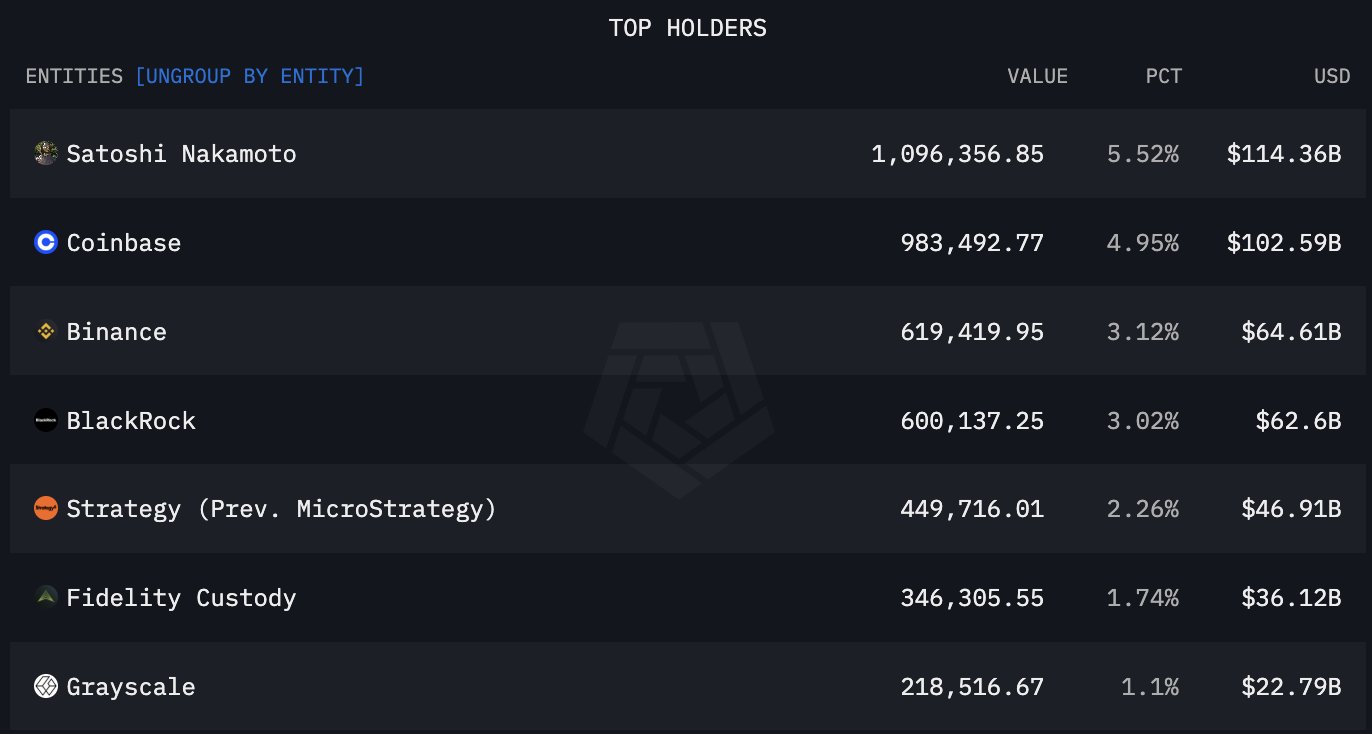

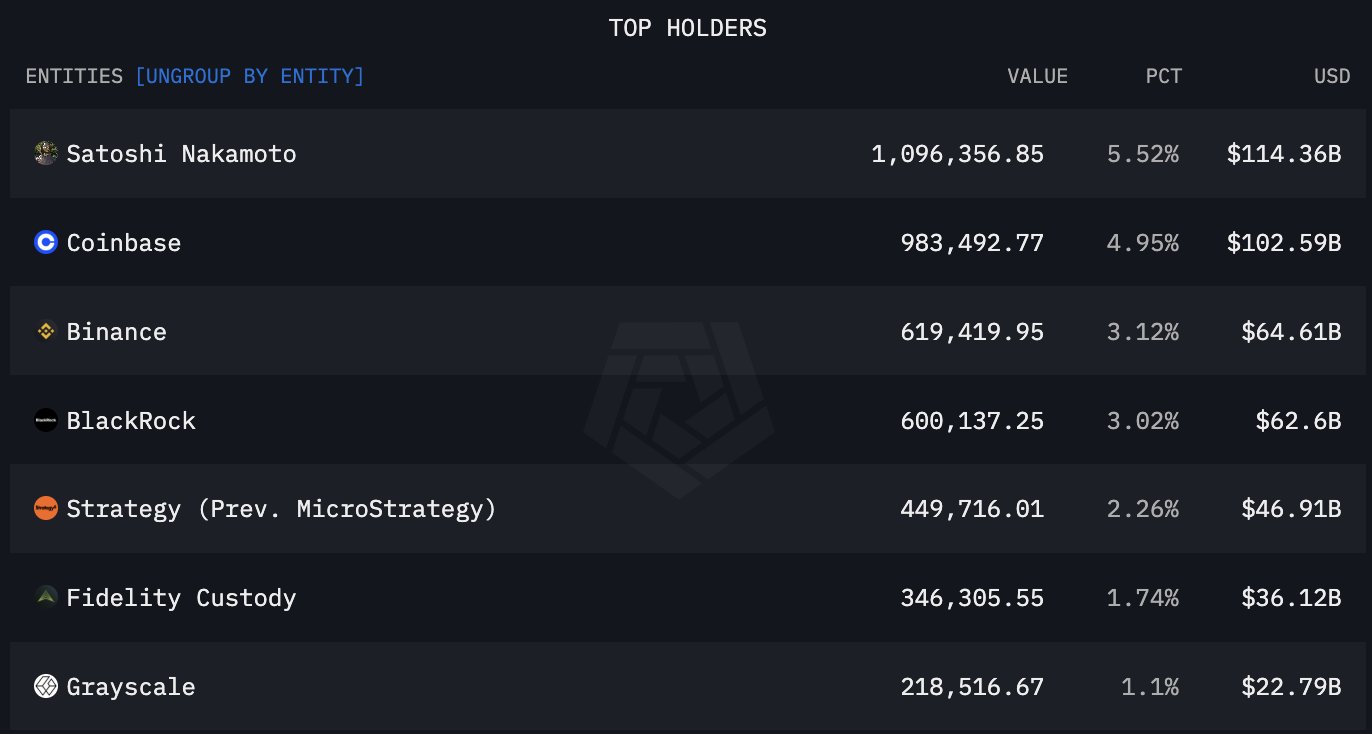

The chart beneath highlights how the highest 8 holders management 4.51 million BTC, holding roughly $471 billion. Which means they lock away over 21% of Bitcoin’s total supply, conserving it off the market.

Supply: X

However that’s solely the opening act. If demand retains ramping up and Bitcoin’s market cap rockets to $3 trillion or $5 trillion, every BTC might simply soar to $143k, $238k, and even past.

After all, these numbers are tough estimates, however that’s the genius of BTC’s design. It’s like a high-stakes public sale with no reserve value: How excessive can the bids go?

Thus, with supply tightening and large gamers holding robust, BTC’s “digital gold” story is simply getting began. The stage is about for some severe features over the lengthy haul.