Bitcoin: Is this metric enough to assess market sentiment?

- As per on-chain information, the market was in a consolidation section on the time of publication.

- Most holders have been realizing losses since final month’s market crash.

Investor choices, no matter conventional finance or the crypto asset market, are pushed by one thing as fundamental as revenue and loss. Greed for additional positive aspects as markets rise and panic promoting during times of decline are pure reactions from market individuals.

Because of this, it’s hardly stunning that analysts and merchants consider the market by way of monetary motivations.

How a lot are 1,10,100 BTCs price as we speak?

Analyzing Bitcoin’s realized cap

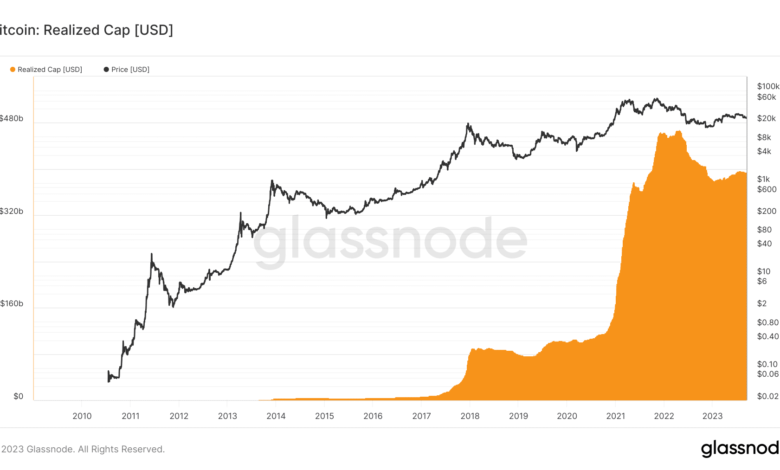

Digital belongings market goes a step additional in introducing ‘Realized Capitalization’ to explain the financial worth which is getting into and exiting the marketplace for an asset, on this case Bitcoin [BTC].

In response to on-chain analytics agency Glassnode, realized cap values an asset primarily based on the worth of every of its cash after they final moved. For instance, when BTC is spent at a worth larger than it was final moved, realized cap will increase and vice versa.

On this means, it differs essentially from the extra typical market cap, which measures the asset primarily based on its present market worth.

Logically, realized cap strikes larger throughout sturdy bull momentum. It’s because long-term holders (LTH) promote holdings, which had been beforehand accrued at discounted charges within the bear market, at very excessive costs.

The above deduction was corroborated by on-chain information as effectively. Discover how realized cap charged to steep highs throughout the historic 2020-21 bull market.

Supply: Glassnode

Furthermore, when costly cash are dumped throughout bear markets, it pulls the realized cap decrease. This era is then adopted by a market consolidation section throughout which cash once more begin shifting in seasoned buyers’ arms.

The above graph additionally captured this habits. Discover how realized cap dropped decrease throughout the peak of crypto winter in 2022. The following restoration in 2023 represented the continuing accumulation section.

Lowering affect of issuance

Within the case of Bitcoin, other than realized revenue and losses, the brand new cash getting into circulation by block mining additionally contributed to the each day realized market cap.

Nevertheless, the quadrennial halving occasions have considerably diminished the dominance of issuance. As indicated under, the thermocap i.e., newly issued provide paled compared to the realized revenue and realized loss parts.

Supply: Glassnode

Infact, Glassnode talked about that since 2016, issuance constituted “at most” 10% of Bitcoin’s each day realized cap. That being stated, miners’ dynamic grew to become a big supply of curiosity for analysts during times of muted buying and selling volumes, as was evident on the time of publication.

Bitcoin holders in a state of loss

Just like realized cap, the Web Realized Revenue/Loss indicator is continuously used to establish market sentiment, capital inflows or outflows, and traits in community profitability.

From the depiction under, it could possibly be clearly seen that almost all holders have been realizing losses since final month’s massacre. This indicated that capital was shifting out of the market and the sentiment has been something however upbeat.

Supply: Glassnode

One other putting side of Bitcoin’s realized cap was that the drawdown was significantly decrease when in comparison with the decline in spot costs. Merely put, if the worth of Bitcoin falls by 75%, the drop in realized cap can be 3x-4x smaller in magnitude.

Supply: Glassnode

As proven above, the realized market cap tended to reverse round cyclical worth lows. This made sense as by this time many of the low-valued cash would have been grabbed by skilled buyers who would await the following bull run to dump them.

Market sentiment nonetheless impartial

The underside line from the evaluation was that Bitcoin market was certainly in a section of consolidation whereas the halving event subsequent yr could possibly be the bull market everybody was ready for.

In response to the newest studying from the Bitcoin Worry and Greed Index, the market was in a state of equilibrium. with no excessive feelings dictating the market.

Bitcoin Worry and Greed Index is 41 — Impartial

Present worth: $26,144 pic.twitter.com/bhrHXEbvce— Bitcoin Worry and Greed Index (@BitcoinFear) September 13, 2023

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Within the final 24 hours, the king coin jumped to breach the $26,000-mark to settle at $26,324.67 on the time of writing, per CoinMarketCap.

In response to Shivam Thakral, CEO of Indian crypto trade BuyUcoin, the regular stream of Bitcoin ETF functions, newest being Franklin Templeton, was retaining the market afloat.