Bitcoin is volatile again, but it’s a free fall instead of a rocket launch

- Costs recovered to $26,301 on the time of writing, however the good points made by the mid-June rally have been reversed.

- Analysts equated the promoting stress to the aftermath of the FTX collapse and the U.S. banking disaster.

After weeks of staying frozen, Bitcoin [BTC] lastly got here to life throughout Thursday buying and selling hours. Nevertheless, as a substitute of taking off in the direction of the skies, the king coin crashed right down to the bottom.

How a lot are 1,10,100 BTCs value right this moment?

BTC falls from a cliff

The preferred cryptocurrency witnessed considered one of its sharpest value drops of 2023, falling to as little as $25,000 on 17 August. Though costs recovered to $26,301 on the time of writing, the good points made by the mid-June rally had been successfully erased.

Bitcoin’s implosion led to carnage within the broader crypto market. The worldwide market cap plunged 7.42% within the final 24 hours, per CoinMarketCap knowledge. The entire crypto quantity exploded 81% to $67 billion within the final 24 hours, indicative of the extraordinary wave of promoting.

In truth, a preferred on-chain analyst equated the continued state of affairs to the aftermath of the FTX collapse and the U.S. banking disaster – two of probably the most bearish occasions within the crypto market within the final 12 months.

Wow.

The promoting stress is much like the #FTX collapse and the silicon valley financial institution disaster.

That is loopy

https://t.co/hDbNFuaDEX pic.twitter.com/M1vvsTuRxm

— Maartunn (@JA_Maartun) August 17, 2023

The analyst’s commentary was based mostly on the Internet Taker Quantity indicator, which plunged deeper into the destructive territory. It’s calculated by discovering the distinction between the Taker Purchase Quantity and Taker Promote Quantity. Unfavourable values mirrored that the market was dominated by sellers.

Whales dump, however others purchased the dip

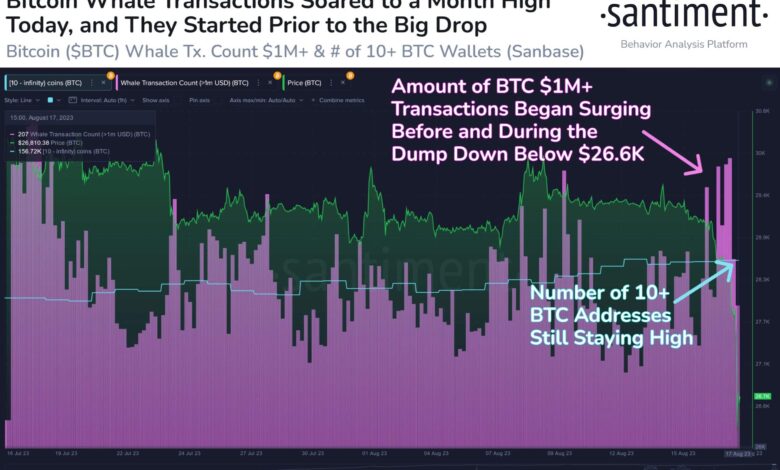

A large chunk of whale buyers contributed to the promoting stress. As per knowledge from on-chain analysis agency Santiment, transactions involving greater than $1 million BTC surged to ranges not seen within the final month.

In actuality, transactions started to pile up even earlier than the meltdown, when BTC fell under $29,000 on 16 August.

Supply: Santiment

Apparently, the variety of wallets storing greater than 10 BTC didn’t witness a big drop. This probably defined that some holders utilized the dump to refill their coffers. Additional examination of consumer cohorts corroborated this assertion.

The variety of addresses holding between 10-100 BTC tokens elevated by 70 over the past 24 hours. Furthermore, at the least 4 extra wallets have been added to the 100-1,000 consumer cohort.

Supply: Santiment

A giant chunk of discussions on crypto-related social media concerned the mentions of “Purchase the Dip.” The phrase-cum-strategy is utilized by buyers, which entails including to an present lengthy place of a essentially robust asset.

After #altcoins spent the previous week bleeding, #Bitcoin lastly had its personal implosion… and took all of #crypto down with it. Costs are rebounding barely, however this dip was sufficient for the group to name for #buythedip on the highest degree since April. https://t.co/SwBU58tnqr pic.twitter.com/O65Hs0w8VM

— Santiment (@santimentfeed) August 17, 2023

Volatility is again

The most recent flip of occasions injected the much-craved volatility into the market, considered as each a USP and a bane, relying on the way you have a look at the crypto panorama.

Based on on-chain monitoring firm Glassnode, the 1-week realized volatility for the king coin soared to a month excessive. Such a bout was final seen after XRP’s win within the authorized tussle with the U.S. Securities and Change Fee.

Supply: Santiment

The surge in volatility led to elevated interplay with centralized exchanges. Inflows to buying and selling platforms, which had reached historic lows previous to the occasion, additionally reached a one-month excessive. In truth, the transfers made to change addresses have been in a gentle uptrend for the reason that starting of the week.

The spinoff markets have been additionally swept up within the twister of maximum volatility. Based on a put up by Coinglass, lengthy positions value greater than $843 million have been liquidated over the past 24 hours. Nevertheless, as folks purchased the dip and costs recovered, bearish leveraged merchants suffered as shorts value $196 million have been worn out.

General, liquidations value greater than a billion have been witnessed available in the market on the time of writing.

Prior to now 24 hours , 174,892 merchants have been liquidated , the whole liquidations is available in at $1.04 billion

Lengthy

$843.83M

Brief

$196.13Mhttps://t.co/C47AgBCcTk#BTC pic.twitter.com/TOL753FteD— CoinGlass (@coinglass_com) August 18, 2023

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

As the costs crashed, the market sentiment shifted to considered one of concern, as per the newest studying from the Bitcoin Concern and Greed Index. This was an indication that buyers have been anxious and will dump extra of their holdings within the days to come back.

The market temper turned to concern after two months of hovering within the impartial zone.

Supply: different.me