Bitcoin miners might face this certain double whammy

- The portion of miner income derived from transaction charges plunged to a 4-month low.

- Bitcoin community’s hashrate hit an all-time excessive, requiring extra funding in mining tools.

The fortune of Bitcoin [BTC] miners has taken a drastic flip in a really brief span. After making a killing throughout the BRC-20 minting frenzy in early Could, most miners have been grappling with decreased earnings on the time of writing.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

In keeping with Glassnode, the portion of miner income derived from transaction charges plunged. It touched a 4-month low as of 9 July.

📉 #Bitcoin $BTC % Miner Income from Charges (7d MA) simply reached a 4-month low of two.247%

View metric:https://t.co/NphJIZNcsL pic.twitter.com/iowHQhQWEI

— glassnode alerts (@glassnodealerts) July 9, 2023

Transactions fall on Bitcoin community

Miners must be incentivized to validate transactions and safe the Bitcoin community. The incentives are available two varieties: block rewards and transaction charges. Whereas the primary is getting much less profitable because the rewards progressively cut back every four years, miners look in direction of charges paid by customers to cowl their expenditures.

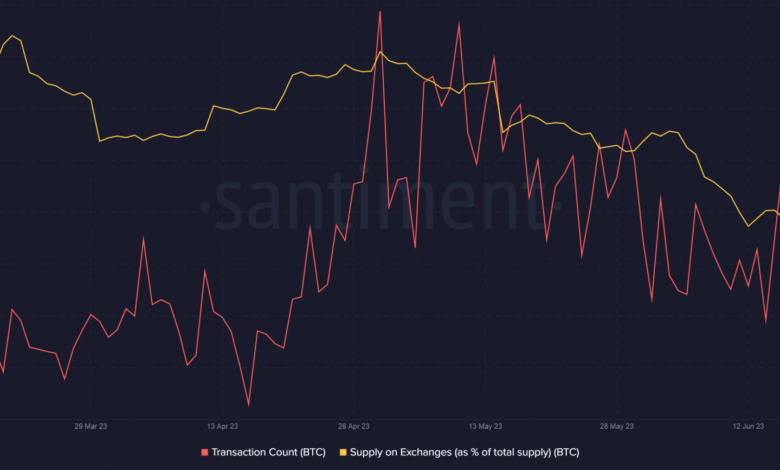

Nonetheless, transaction rely on the community has steadily climbed down from its all-time highs in Could. The protracted low volatility section and traders’ elevated willingness to HODL tokens have confirmed to be a dampener for miners’ spirits.

Alternate provide fell to multi-year lows, suggesting that there was much less BTC to be offered and purchased, and therefore fewer transactions to profit from for miners.

Supply: Santiment

Hashrate ache will increase

Nonetheless, transaction rely surged dramatically over the weekend. Because of this, Bitcoin community’s hashrate hit an all-time excessive, as per a report by Bitcoin mining analysis firm Hashrate Index. Rising hashrate presents a brand new set of challenges for miners. They need to increase their mining infrastructure and buy specialised {hardware}.

However the report highlighted that costs of premium Utility-Particular Built-in Circuits (ASIC) tools have elevated sharply, inflicting extra ache for miners.

Supply: Hashrate Index

Learn Bitcoin’s [BTC] Value Prediction 2023-24

In the meantime, the hashprice trended downwards over the previous week. An indicator of mining profitability, hash worth is positively correlated to BTC’s worth actions. After a rally in June, BTC has stayed sluggish for the reason that begin of July, as per CoinMarketCap, inflicting extra discomfort to miners.

Supply: Hashrate Index